Last updated: July 27, 2025

Introduction

Pantoprazole, a proton pump inhibitor (PPI), is widely prescribed for the treatment of gastroesophageal reflux disease (GERD), Zollinger-Ellison syndrome, and erosive esophagitis. As a cornerstone in acid suppression therapy, its global market has experienced steady growth driven by rising prevalence of acid-related disorders, expanding indications, and increasing awareness of gastrointestinal health. This analysis explores the current market landscape, competitive dynamics, regulatory factors, and forecasted sales trajectories for pantoprazole.

Market Overview

Global Demand and Usage Trends

The global demand for pantoprazole remains robust, supported by rising incidence rates of GERD and related conditions. The National Institutes of Health estimates that approximately 20% of Americans experience GERD symptoms weekly, underscoring a significant treatment market.[1] Similar trends are observed across Europe and Asia, where lifestyle factors—such as obesity, dietary habits, and aging populations—further drive the need for acid-suppressive therapies.

Market Segmentation and Key Players

The pantoprazole market comprises prescription formulations and over-the-counter (OTC) variants. Major pharmaceutical firms, including Teva Pharmaceuticals, Pfizer (original innovator), and Mylan, dominate manufacturing. Generic versions now capture a significant share, contributing to price competitiveness and market expansion. Also, emerging markets show high growth potential due to increasing healthcare infrastructure and awareness.

Regulatory Environment

Regulatory agencies, such as the FDA and EMA, continue to oversee manufacturing standards for PPIs, affecting market access. While OTC approval has broadened reach in mature markets, ongoing patent expirations and competition intensify price competition, influencing sales dynamics.

Competitive Landscape

Patent Expiry and Generic Competition

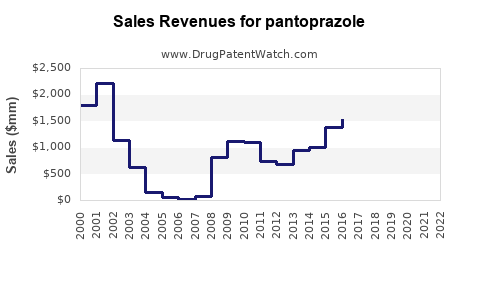

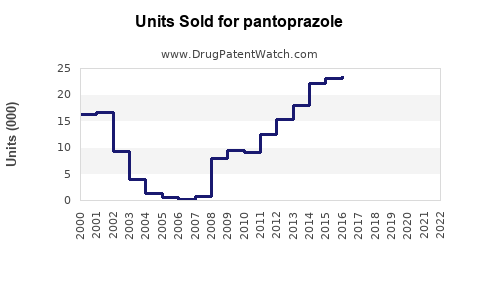

Pfizer’s original patent on pantoprazole expired globally around 2014-2015, prompting a surge in generic entries.[2] Generics typically account for approximately 70-80% of the market volume, exerting downward pressure on prices but expanding overall market size through increased accessibility.

Innovations and New Formulations

While the core molecule remains unchanged, recent developments include formulations with enhanced bioavailability and combination therapies. Such innovations aim to address persistent unmet needs, especially in treatment-resistant cases.

Market Share Dynamics

The competition among generic manufacturers is fierce, with significant price erosions. Brand continuity for Pfizer’s Protonix in certain markets sustains some premium positioning, but the trend favors cost-sensitive prescribing behaviors, especially in price-conscious regions.

Sales Projections

Historical Performance

Between 2018 and 2022, the global pantoprazole market has experienced compound annual growth rates (CAGR) of approximately 4-6%, driven primarily by increasing prevalence of GERD and expanding OTC sales.[3] The market’s valuation was estimated at USD 3.5 billion in 2022, with expected continued growth.

Forecasting Methodology

Using epidemiological data, demographic trends, and medication adoption rates, sales forecasts utilize a combination of bottom-up and top-down approaches, integrating market share analyses, pricing trends, and geographic expansion indicators.

Projected Growth Trajectory (2023-2030)

The pantoprazole market is projected to reach USD 6.2 billion by 2030, reflecting a CAGR of approximately 6%, over the next decade. Key drivers include:

- Increased adoption in emerging markets, such as Asia-Pacific, owing to improved healthcare access.

- Screening programs and early diagnosis augmenting demand for long-term acid suppression.

- The shift toward OTC formulations encourages self-medication, expanding retail channels.

- Patent expirations catalyzing generic proliferation, meeting growing demand at reduced prices.

Regional Outlook

| Region |

2022 Market Size (USD Billion) |

Projected 2030 Market Size (USD Billion) |

CAGR (2023-2030) |

| North America |

1.5 |

2.5 |

7% |

| Europe |

1.0 |

1.7 |

6% |

| Asia-Pacific |

0.7 |

2.0 |

14% |

| Rest of World |

0.3 |

0.75 |

12% |

The Asia-Pacific region's double-digit growth reflects demographic shifts, increasing healthcare expenditure, and regulatory reforms easing market entry.

Key Influencing Factors

Epidemiology and Demographics

Rising obesity rates and aging populations augment the prevalence of acid-related disorders. The World Health Organization reports a 25% increase in GERD prevalence globally over the last decade.[4]

Healthcare Infrastructure and Policy

Expansion of insurance coverage and government healthcare programs facilitates prescription and OTC accessibility. Policies promoting generic substitution further enhance market penetration.

Market Challenges

- Competition from competing PPIs (omeprazole, esomeprazole) and novel agents.

- Safety concerns over long-term use, such as potential osteoporosis and kidney issues, affecting prescribing behaviors.

- Regulatory shifts affecting OTC sales and drug classification.

Strategic Opportunities

- Product Line Extensions: Developing fixed-dose combinations (e.g., pantoprazole with NSAIDs) can capture niche sectors.

- Market Expansion: Entry into emerging markets through strategic partnerships or licensing.

- Differentiation: Investing in bioequivalent improvements or novel delivery systems to sustain competitive advantage.

Risks and Mitigation Strategies

- Patent expirations and price erosion require emphasis on cost efficiencies.

- Regulatory hurdles necessitate robust compliance initiatives.

- Competitive innovation calls for ongoing R&D investments.

Conclusion

The pantoprazole market exhibits sustained growth prospects fueled by demographic trends, expanding indications, and evolving consumer preferences. While generic competition moderates pricing, overall sales are expected to benefit from increased adoption across global markets, especially in emerging economies. Strategic focus on innovation, regulatory compliance, and market expansion will be essential for stakeholders seeking to capitalize on this trend.

Key Takeaways

- The global pantoprazole market is projected to grow at a CAGR of approximately 6%, reaching USD 6.2 billion by 2030.

- Rising GERD prevalence, demographic shifts, and OTC availability underpin sustained demand.

- Generic competition dominates in market share but also catalyzes broader accessibility.

- Asia-Pacific offers significant growth opportunities due to demographic and healthcare infrastructure development.

- Companies should focus on product innovation, regional expansion, and strategic partnerships to maximize sales potential.

FAQs

1. How has patent expiry impacted the pantoprazole market?

Patent expirations around 2014-2015 led to a surge in generic entries, significantly increasing market volume and reducing prices. This transition has expanded accessibility but intensified competition among manufacturers.

2. What are the primary indications for pantoprazole?

Pantoprazole is primarily prescribed for GERD, erosive esophagitis, Zollinger-Ellison syndrome, and Helicobacter pylori eradication regimens.

3. Which regions are expected to see the fastest growth in pantoprazole sales?

The Asia-Pacific region is forecasted to experience the highest CAGR, driven by economic growth, expanding healthcare infrastructure, and increasing prevalence of gastrointestinal disorders.

4. Are there safety concerns affecting pantoprazole sales?

Long-term use of PPIs, including pantoprazole, has been linked to potential risks such as osteoporosis-related fractures and renal impairment, prompting cautious prescribing and monitoring.

5. What strategies can pharmaceutical companies adopt to enhance market share?

Companies should invest in formulation innovations, explore combination therapies, expand into emerging markets, and optimize cost-efficiency to maintain competitiveness.

References

[1] NIH. Gastroesophageal Reflux Disease (GERD). National Institutes of Health, 2022.

[2] Food and Drug Administration (FDA). Patent Status of Proton Pump Inhibitors, 2015.

[3] MarketWatch. Proton Pump Inhibitors Market Report, 2022.

[4] WHO. Global Burden of Gastrointestinal Disorders, 2020.