Last updated: July 27, 2025

Introduction

Olanzapine, an atypical antipsychotic agent developed by Eli Lilly and Company, has established itself as a leading treatment for schizophrenia and bipolar disorder. Launched in the late 1990s, it has gained widespread acceptance due to its efficacy and relatively favorable side-effect profile compared to first-generation antipsychotics. Given its robust patent portfolio, ongoing M&A activities, and expanding indications, this analysis explores current market dynamics and projects future sales trajectories.

Market Landscape and Drivers

Global Therapeutic Market Size

The global antipsychotics market, estimated to be worth approximately USD 13.5 billion in 2022, is poised for steady growth. Factors fueling expansion include increasing prevalence of schizophrenia (approximately 1 in 100 globally) and bipolar disorder (around 1-2% of the population), rising awareness and diagnosis, and expanded treatment guidelines integrating atypical antipsychotics like olanzapine (IQVIA, 2022).

Competitive Positioning

Olanzapine's primary competitors include risperidone, aripiprazole, quetiapine, and recently introduced agents like brexpiprazole and lumateperone. Its market share is influenced by factors such as efficacy, side effect profile, dosing convenience, and formulary preferences. Although newer agents offer improved metabolic profiles, olanzapine's entrenched position remains significant.

Regulatory and Patent Landscape

Though the original patent expired in 2011 in the US, Eli Lilly secured additional patent protections through formulation patents and method-of-use claims extending exclusivity until at least 2024-2026. Patent expirations typically lead to generic competition, impacting sales unless managed through lifecycle strategies.

Current Sales Performance

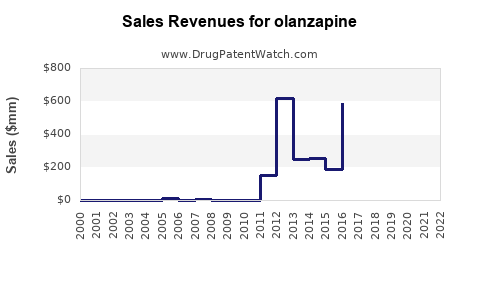

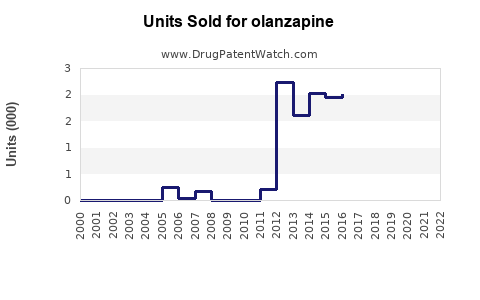

Historical Sales Data

From its launch, olanzapine achieved peak annual sales exceeding USD 5 billion globally, with the majority derived from the US and European markets. In recent years, sales have plateaued or declined in certain regions due to patent expiration and generic entry.

Sales Decline Factors

- Generic Competition: Post-patent expiry, generic versions entered the US market, leading to significant price erosion.

- Shift in Prescribing Patterns: Clinicians increasingly favor agents with better metabolic and weight gain profiles to mitigate side effects associated with olanzapine (e.g., diabetes risk).

- Market Saturation: High initial penetration limits growth potential in mature markets.

Future Sales Projections

Market Growth Outlook (2023-2030)

- Baseline Scenario: Despite patent expirations, olanzapine will sustain substantial sales via branded formulations, especially in emerging markets where patent enforcement and affordability remain critical. Projected global sales are estimated at USD 2-3 billion annually by 2030, assuming conservative market share retention.

- Optimistic Scenario: Continued expansion into unmet needs, such as adjunct therapy for refractory depression and innovative formulations (e.g., long-acting injectables), could lift revenues beyond USD 4 billion annually, driven by demographic growth and expanding indications.

- Downside Risks: Heightened generic competition, portfolio diversification by Eli Lilly and competitors, and evolving treatment paradigms favoring newer agents could reduce olanzapine’s share.

Regional Forecasts

- North America: Expected to remain the largest market due to high disease prevalence and established clinical practices. Sales could stabilize or slightly decline post-patent expiry.

- Europe: Similar trends as North America, with some variability based on regulatory delays.

- Emerging Markets: Rapid growth anticipated, with sales driven by increased adoption and affordability, potentially offsetting declines in developed markets.

- Asia-Pacific: Particularly significant, projected to account for up to 30% of total sales by 2030, facilitated by expanding healthcare infrastructure.

Strategic Opportunities

- Lifecycle Management: Development of novel formulations (long-acting injectables), fixed-dose combinations, and extended-release versions can sustain revenue streams.

- Indication Expansion: Approvals for adjunctive treatments in depression, agitation in dementia, or post-traumatic stress disorder could open new markets.

- Market Penetration: Focusing on emerging markets with tailored pricing and distribution strategies to capture incremental sales.

Challenges and Risks

- Generic Market Entry: The impending expiration of key patents heightens risk of revenue decline.

- Competitive Innovation: Newer antipsychotics with better safety profiles threaten market share.

- Regulatory Hurdles: Variations in approval processes and reimbursement policies influence sales trajectories.

- Patient Compliance: Side-effect management will continue to be critical for sustained prescribing.

Conclusion

Olanzapine remains a key player in the antipsychotics market, with significant revenue potential in emerging markets and specialized indications. Short-term sales will likely decline amid patent expirations, but strategic lifecycle extensions and indication expansions can bolster future revenues. Companies should prioritize innovation and market adaptation to maintain competitiveness.

Key Takeaways

- Olanzapine’s market dominance persists despite patent expirations, supported by its efficacy and established prescriber base.

- The evolving competitive landscape, marked by newer agents with improved safety profiles, challenges olanzapine’s growth.

- Emerging markets present significant growth opportunities, driven by increasing mental health awareness and affordability.

- Lifecycle management strategies, including formulation innovations, are vital to sustaining sales.

- Long-term projections suggest steady revenues, with potential for growth contingent on regulatory, clinical, and market dynamics.

Frequently Asked Questions

-

How will patent expirations impact olanzapine sales?

Patent expirations generally lead to increased generic competition, significantly reducing per-unit prices and overall sales. However, branded formulations and new indications can mitigate declines.

-

What factors could extend olanzapine’s market viability?

Innovations such as long-acting injectable formulations, novel combination therapies, and expanded clinical indications could reinforce its market position.

-

Are there new formulations of olanzapine in development?

Eli Lilly and other pharmaceutical developers are exploring long-acting injectable versions and fixed-dose combinations to enhance adherence and efficacy.

-

How does olanzapine compare to newer antipsychotics?

While olanzapine provides robust efficacy, newer agents like aripiprazole and brexpiprazole often offer improved metabolic profiles, influencing prescribing preferences.

-

What is the outlook for olanzapine in emerging markets?

Rapid growth is expected due to rising mental health awareness, increasing diagnosis rates, and affordability, making these markets critical for future revenue expansion.

References

[1] IQVIA. "The Global Use of Medicine in 2022."

[2] Eli Lilly and Company. "Olanzapine Prescribing Information."

[3] MarketWatch. "Antipsychotics Market Size & Trends."

[4] GlobalData. "Pharma Market Forecasts 2023-2030."

[5] FDA. "Patent Expirations and Market Impact Reports."