Share This Page

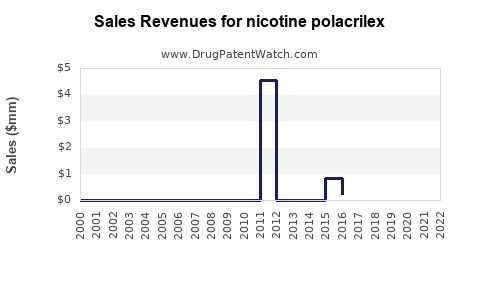

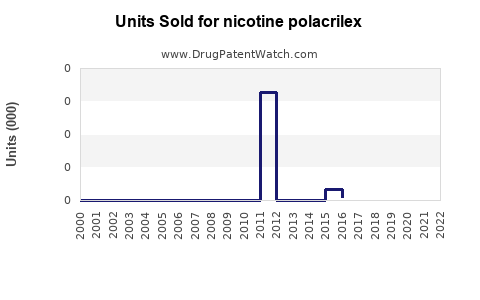

Drug Sales Trends for nicotine polacrilex

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for nicotine polacrilex

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| NICOTINE POLACRILEX | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| NICOTINE POLACRILEX | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| NICOTINE POLACRILEX | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| NICOTINE POLACRILEX | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| NICOTINE POLACRILEX | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| NICOTINE POLACRILEX | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Nicotine Polacrilex

Introduction

Nicotine polacrilex, a form of nicotine gum, is a widely accepted smoking cessation aid. It functions as an over-the-counter (OTC) product designed to reduce withdrawal symptoms and curb nicotine cravings, supporting smokers’ efforts to quit. Understanding the evolving market landscape, competitive environment, regulatory setting, and forecasted sales trends of nicotine polacrilex is essential for pharmaceutical companies, investors, and healthcare stakeholders aiming to capitalize on or understand the growth potential of this therapeutic segment.

Market Overview

The global market for smoking cessation aids is projected to expand from USD 10.2 billion in 2022 to approximately USD 14.8 billion by 2030, at a compound annual growth rate (CAGR) of 4.8% (CAGR from reports by Grand View Research). Nicotine polacrilex remains a prominent OTC product within this market, attributed to its proven efficacy, affordability, and accessibility—key factors influencing consumer choice.

Key Drivers

-

Rising Smoking Prevalence & Public Health Campaigns: Despite declines in smoking rates, approximately 1.1 billion smokers globally persist, with high prevalence in low- and middle-income countries. Governments and health authorities increasingly promote tobacco cessation programs, elevating demand for effective cessation tools like nicotine polacrilex.

-

Regulatory Approval & OTC Availability: Regulations in North America and Europe have facilitated OTC sales of nicotine replacement therapy (NRT) products, including nicotine polacrilex, broadening consumer access and bolstering sales.

-

Increased Awareness & Consumer Demand: Enhanced education around smoking health risks encourages smokers to seek accessible cessation options. The product’s familiar format and non-prescriptive nature support its popularity.

-

Innovation & Product Diversification: Development of improved formulations and flavors enhances user compliance, expanding the market reach.

Competitive Landscape

Major players in nicotine polacrilex include:

- GlaxoSmithKline (Nicorette)

- Johnson & Johnson (Nicorette)

- Novartis (NicoDerm CQ, though more a patch)

- Other regional brands & generic manufacturers

Market leaders have leveraged extensive distribution networks, marketing campaigns, and product diversification to maintain dominance. Moreover, emerging players in generic formulations are intensifying competition, often offering lower prices which influence market share and sales.

Regulatory Environment

Regulatory bodies such as the FDA (U.S.) and EMA (European Union) maintain strict standards for NRT products. The classification of nicotine polacrilex as a Category III OTC drug in the U.S. simplifies sales but necessitates compliance with labeling, safety, and efficacy standards. Increasing regulatory scrutiny on novel nicotine delivery systems could impact the traditional NRT landscape, but presently, nicotine polacrilex remains a stable, approved OTC product.

Market Segmentation

-

Geography: North America and Europe currently dominate sales, driven by mature markets with established OTC access. Emerging markets in Asia-Pacific and Latin America are expected to see robust growth due to increasing smoking prevalence and improving healthcare infrastructure.

-

Consumer Demographics: Adult smokers aged 25-45 are primary consumers, especially those attempting to quit or reduce cigarette consumption. Gender-wise, males constitute a higher share due to higher smoking prevalence, but female-oriented marketing is gaining traction.

Sales Projections

Based on historical data, market trends, and demographic shifts, nicotine polacrilex sales are projected to grow at a CAGR of approximately 4.0%-5.0% from 2023 to 2030. The following elements influence these projections:

-

Market Penetration: While the product's OTC status allows for broad access, consumer preferences are shifting towards alternative NRT forms like lozenges and inhalers, which slightly diversify the market.

-

Innovation & Differentiation: Introducing new flavors, all-natural ingredients, or combination therapies may expand the market, increasing sales.

-

Policy Changes: Stricter regulations or taxes on tobacco products could propel smokers toward OTC NRT options, including nicotine polacrilex.

-

Digital & Telehealth Integration: Enhanced marketing via digital platforms and remote clinical support facilitates increased consumer engagement.

Quantitative Forecast

- 2023: USD 2.2 billion in global sales.

- 2025: Approximately USD 2.9 billion.

- 2028: Approximately USD 3.8 billion.

- 2030: Approximately USD 4.8 billion.

These figures are based on extrapolated CAGR and market dynamics, with regional variances expected.

Challenges & Opportunities

Challenges

- Competition from alternative therapies (e.g., combination therapy, e-cigarettes).

- Regulatory uncertainties concerning nicotine replacement products.

- Consumer preference shifts towards novel nicotine delivery systems.

Opportunities

- Expansion into emerging markets with increasing smoking prevalence.

- Product innovation tailor-made for specific demographics.

- Strategic alliances with healthcare providers for integrated cessation programs.

Conclusion

The nicotine polacrilex segment exhibits steady growth driven by increased global smoking cessation efforts, regulatory support, and consumer awareness. Continuous innovation, market expansion in developing economies, and strategic marketing will be essential for capturing future value. Market players should also closely monitor regulatory developments and evolving consumer preferences to mitigate risks and capitalize on emerging opportunities.

Key Takeaways

- The global demand for nicotine polacrilex is projected to grow at a CAGR of 4.0-5.0% through 2030, driven by tobacco control initiatives and OTC accessibility.

- Major markets remain North America and Europe, but emerging economies present significant growth opportunities.

- Competition from alternative nicotine delivery systems requires product differentiation and targeted marketing.

- Regulatory stability favors sustained sales, but ongoing policy shifts could impact market dynamics.

- Innovation in flavors, formulations, and integration with digital tools will influence future sales trajectories.

FAQs

Q1: How does nicotine polacrilex compare with other nicotine replacement therapies?

A1: Nicotine polacrilex offers an effective, accessible oral form of NRT, primarily used as gum. Compared to patches, it allows for flexible dosing and rapid relief of cravings but requires proper chewing technique. Its non-invasive, OTC status makes it widely accessible, whereas other forms like lozenges or inhalers provide alternative delivery options tailored to consumer preferences.

Q2: What regulatory changes could impact the nicotine polacrilex market?

A2: Stricter regulations on nicotine content, flavor restrictions, and advertising curbs could reduce market accessibility. Conversely, positive regulatory classifications and approvals could expand sales. Monitoring regulatory developments in key markets is essential for strategic planning.

Q3: Which regions are expected to show the highest growth in nicotine polacrilex sales?

A3: The Asia-Pacific and Latin America regions are anticipated to experience the highest growth, driven by rising smoking prevalence, increasing healthcare infrastructure, and improving product availability.

Q4: How has consumer preference shifted concerning NRT products?

A4: Consumers are increasingly seeking variety in NRT options, favoring flavors, natural ingredients, and discreet delivery systems. There is also a rising preference for combination therapies and digital support tools to enhance cessation success.

Q5: What role does product innovation play in the future of nicotine polacrilex?

A5: Innovation in flavors, formulations, and delivery mechanisms can attract new users, improve adherence, and differentiate products in a competitive market. Incorporating digital support and customization can further enhance user experience and market share.

References

[1] Grand View Research. "Smoking Cessation Market Analysis & Forecasts." 2022.

[2] U.S. Food & Drug Administration. “Guidance for Industry: Tobacco Products.” 2022.

[3] World Health Organization. "WHO Report on the Global Tobacco Epidemic." 2021.

More… ↓