Share This Page

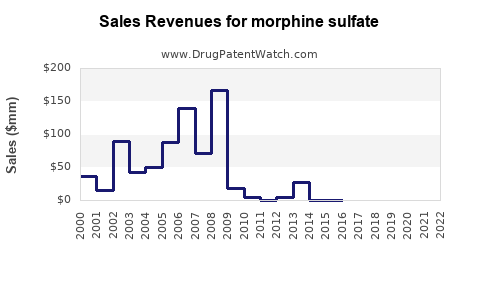

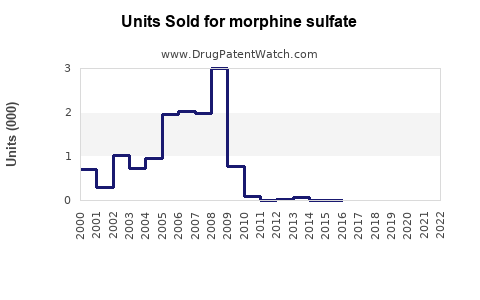

Drug Sales Trends for morphine sulfate

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for morphine sulfate

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| MORPHINE SULFATE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| MORPHINE SULFATE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| MORPHINE SULFATE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| MORPHINE SULFATE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Morphine Sulfate

Introduction

Morphine sulfate, a potent opioid analgesic, remains a cornerstone in managing moderate to severe acute and chronic pain. With global demand driven by expanding healthcare needs, its market landscape is evolving amidst regulatory scrutiny, opioid utilization trends, and advancements in pain management. This analysis delineates the current market environment, competitive dynamics, regulatory factors, and forecasts sales trajectories for morphine sulfate.

Market Overview

Morphine sulfate’s clinical utility spans hospital, outpatient, and home care settings, accounting for the majority of opioid analgesic consumption globally. Its primary indications include cancer pain, post-operative pain, and palliative care. The global opioid analgesics market was valued at approximately USD 20 billion in 2022, with morphine sulfate constituting a significant segment, estimated at around 35% of this figure, driven by high prescription volumes in North America and Europe [1].

Key Market Drivers

- Rising Pain Management Needs: Aging populations and increased prevalence of chronic diseases like cancer amplify demand for effective analgesics.

- Hospital and Surgical Volume Growth: An increase in surgical procedures and hospital admissions sustains consistent needs for pain control.

- Regulatory Approvals and Formulations: Introduction of extended-release formulations and abuse-deterrent versions expand market options.

- Emerging Markets: Increased healthcare infrastructure investment in Asia-Pacific and Latin America introduces new revenue streams.

Market Segmentation

- By Application: Cancer pain management, post-operative pain, chronic non-cancer pain, palliative care.

- By Formulation: Injectable, oral tablets and solutions, extended-release formulations, compounded preparations.

- By End-User: Hospitals (60%), clinics, home care, pain clinics.

Competitive Landscape

Major pharmaceutical players manufacturing morphine sulfate include Purdue Pharma (formerly), Pfizer, Sun Pharmaceutical, and Teva. Market entry barriers involve strict regulatory controls and manufacturing complexities. Generic versions account for approximately 70% of sales, contributing to price competition and accessibility.

Regulatory and Ethical Considerations

The opioid crisis has prompted rigorous regulations globally, especially in the US and Europe, impacting prescribing practices and distribution controls. Upcoming guidelines focus on reducing abuse potential, influencing formulations and marketing strategies [2].

Sales Projections (2023-2030)

Assumptions:

- Moderate growth in developed markets, with annual CAGR around 3-4%.

- Accelerated growth in emerging markets, with CAGR of approximately 6-8%.

- Steady demand in acute care, slightly offset by regulatory restrictions in some regions.

| Year | Estimated Global Sales (USD billion) | Projection Notes |

|---|---|---|

| 2023 | $7.5 | Base year, post-pandemic recovery momentum. |

| 2024 | $7.8 - $8.0 | Slight growth as demand stabilizes. |

| 2025 | $8.2 - $8.4 | Increased adoption in Asia-Pacific. |

| 2026 | $8.5 - $8.8 | Market stabilization with expanded formulations. |

| 2027 | $8.8 - $9.2 | Adoption of abuse-deterrent formulas; regulatory tightening impacts growth. |

| 2028 | $9.2 - $9.6 | Maturation of emerging markets’ demand. |

| 2029 | $9.6 - $10.0 | Continued growth; potential impact of alternative pain therapies. |

| 2030 | $10.0 - $10.5 | Mature market with steady demand; regulatory influences persist. |

Regional Insights

North America is the dominant market, projected to reach USD 4.2 billion by 2030, driven by high utilization in pain management and palliative care. Europe follows, with growth prospects fueled by aging demographics and healthcare reforms. Asia-Pacific’s rapid economic growth and expanding healthcare infrastructure could double its market share, reaching approximately USD 2 billion by 2030. Latin America and Middle East/North Africa are expected to experience moderate upticks amid improving healthcare access.

Market Challenges and Opportunities

- Challenges: Stringent regulations and oversight limit prescribing, especially in North America. The opioid epidemic has increased public and governmental scrutiny, leading to tighter controls, which may suppress growth temporarily.

- Opportunities: Development of abuse-resistant formulations, differentiated delivery systems, and biosimilar entrants offer potential growth avenues. Additionally, expanding pain management protocols in emerging markets presents sizeable opportunities.

Impact of Alternative Therapies

Innovations in non-opioid analgesics, such as nerve blocks, neuromodulation, and novel pharmacologics, pose long-term competitive threats. However, current reliance on opioids like morphine sulfate ensures its continued relevance, especially in terminal and acute care settings.

Regulatory Landscape and Its Influence on Market Dynamics

Regulators worldwide enforce strict manufacturing, distribution, and prescribing standards. The US DEA's scheduling of opioids influences supply and pricing. Emerging policies target minimizing diversion and misuse, impacting market size and growth strategies.

Key Takeaways

- Morphine sulfate remains a dominant analgesic with stable demand but faces regulatory and societal challenges.

- Growth prospects are positive in emerging markets owing to healthcare development, though growth rates are moderated in mature markets by regulatory restrictions.

- Innovations such as abuse-deterrent formulations and novel delivery systems are critical to maintaining market share and addressing public health concerns.

- The rise of non-opioid pain management alternatives presents a strategic challenge requiring ongoing research and product differentiation.

- Companies are advised to monitor regional regulatory nuances and invest in formulations that mitigate misuse potential to sustain competitive advantage.

FAQs

1. What is the primary factor driving global demand for morphine sulfate?

The main drivers include increasing prevalence of chronic and terminal illnesses (notably cancer), expanding surgical procedures, and growing awareness of effective pain management strategies worldwide.

2. How do regulatory restrictions impact the sales of morphine sulfate?

Regulations aimed at curbing misuse and diversion tighten prescribing access, leading to potential sales reductions in certain regions, particularly North America and Europe. Compliance increases costs but also encourages innovation in abuse-deterrent formulations.

3. What are the key growth opportunities for morphine sulfate in coming years?

Emerging markets present high-growth opportunities due to expanding healthcare infrastructure, aging populations, and increased awareness. Additionally, development of abuse-resistant formulations and novel delivery methods offers competitive differentiation.

4. How might the opioid epidemic influence future sales projections?

Heightened societal and regulatory oversight can constrain growth, but ongoing medical necessity in acute and palliative care sustains demand. Strategic adaptation through safer formulations and strict compliance can mitigate adverse impacts.

5. What role do biosimilars and generics play in the morphine sulfate market?

Generics and biosimilars substantially lower prices, making morphine sulfate more accessible. They also intensify price competition, squeezing margins but expanding overall market volume.

References

[1] Market Research Future (MRFR), "Opioid Analgesics Market Growth," 2022.

[2] U.S. Food and Drug Administration (FDA), "Opioids: Regulatory Guidelines and Prescribing Practices," 2023.

More… ↓