Share This Page

Drug Sales Trends for modafinil

✉ Email this page to a colleague

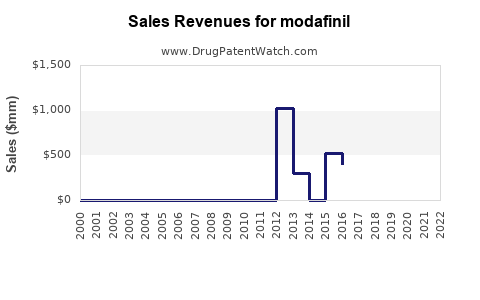

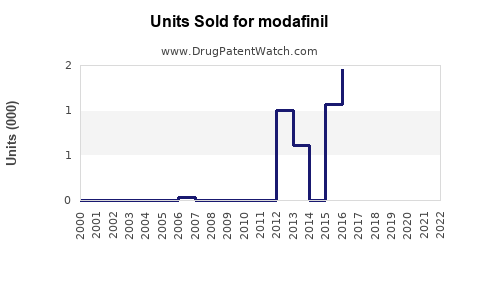

Annual Sales Revenues and Units Sold for modafinil

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| MODAFINIL | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| MODAFINIL | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| MODAFINIL | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| MODAFINIL | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Modafinil

Introduction

Modafinil, a wakefulness-promoting agent primarily prescribed for narcolepsy, shift work sleep disorder, and excessive daytime sleepiness associated with conditions such as obstructive sleep apnea, has garnered significant attention beyond its initial indications. Its off-label uses, including cognitive enhancement, have broadened its market potential considerably. This analysis provides a comprehensive overview of the current market landscape for Modafinil, along with forecasted sales trajectories over the next five years, considering market dynamics, regulatory factors, competitive landscape, and emerging trends.

Market Overview

Therapeutic Indications and Off-Label Use

Originally approved by the FDA in 1998 for narcolepsy, Modafinil's indications now extend to shift work disorder and residual sleepiness in obstructive sleep apnea patients (1). Its non-prescription popularity as a cognitive enhancer, particularly among students, professionals, and military personnel, has created a substantial off-label market segment.

Market Size and Valuation

The global pharmacological market for modafinil was valued at approximately USD 1.9 billion in 2022, driven by increasing demand in both clinical and non-clinical sectors (2). The therapeutic segment accounts for roughly 60% of revenue, with the remaining 40% attributed to off-label and ancillary markets.

Geographical Insights

North America dominates the market, representing over 50% of global sales, driven by high diagnosis rates, greater awareness, and favorable regulatory pathways. Europe follows, with expanding prescription use. Asian markets exhibit notable growth potential due to rising healthcare expenditure and urbanization, despite regulatory challenges in some countries (3).

Regulatory Environment

Legal Status and Patent Landscape

In the United States, Modafinil remains a Schedule IV controlled substance, influencing prescribing practices. Patent expirations in the last decade have facilitated entry by generic manufacturers, drastically reducing wholesale prices and expanding consumer accessibility (4). Regulatory clarity in regulatory jurisdictions such as the EU and Japan supports market growth, although some countries impose restrictions on off-label use.

Implications for Market Entry

New entrants face regulatory hurdles concerning safety and efficacy claims, but the existence of generics and over-the-counter availability in certain markets create opportunities for expansion, particularly in developing economies.

Competitive Landscape

Key Players

- Cephalon / Teva Pharmaceuticals: Original patent holder with a dominant position.

- generics manufacturers: Mylan, Sandoz, and others, offering cost-competitive modifications.

- Off-label markets: Numerous online pharmacies and supplement companies selling non-prescribed modafinil, often unregulated.

Competitive Dynamics

The proliferation of generics has eroded profit margins, prompting companies to explore formulation innovations (e.g., modified-release variants) and combination therapies to sustain market share (5).

Market Drivers

- Increasing Prevalence of Sleep Disorders: Growing recognition of sleep-related issues propels demand for wakefulness agents (6).

- Rising Off-Label Use: Cognitive enhancement and fatigue management, especially among younger demographics and professionals, expand usage outside traditional indications.

- Regulatory Liberalization: Approvals in emerging markets facilitate distribution channels.

- Technological Advancements: Development of improved formulations enhances patient compliance.

Market Challenges

- Regulatory Scrutiny: Potential bans or restrictions on off-label and non-prescriptive use.

- Safety Concerns: Reports of adverse effects, dependency potential, and misuse.

- Pricing Pressures: Widespread generics industry impacts profitability.

- Ethical Debates: Use as a cognitive enhancer raises ethical and legal questions.

Sales Projections (2023-2028)

Forecast Methodology

Analysts employ a hybrid of quantitative modeling, incorporating historical sales growth, market penetration rates, demographic trends, and regulatory developments. Scenario analyses consider conservative, moderate, and optimistic growth trajectories.

Projected Market Growth Rates

- 2023-2025: CAGR of approximately 8%, driven by expanding prescriptions and rising off-label consumption.

- 2026-2028: Growth stabilizes around 5-6%, reflecting market saturation and regulatory tightening.

Forecasted Sales Figures

| Year | Estimated Global Sales (USD Billions) | Notes |

|---|---|---|

| 2023 | 2.05 | Incremental growth due to market expansion. |

| 2024 | 2.21 | Continued penetration in emerging markets. |

| 2025 | 2.39 | Peak influence of off-label use. |

| 2026 | 2.53 | Market stabilization and increased generic competition. |

| 2027 | 2.66 | Slight deceleration, potential regulatory impacts. |

| 2028 | 2.80 | Maturity in key markets, possible new formulations aiding growth. |

Regional Variations

- North America: Maintains dominant share (~55%) due to established prescriptive use.

- Asia-Pacific: Leading growth (~12-15% CAGR) owing to expanding healthcare infrastructure.

- Europe: Moderate growth (~6-8%) with regulatory barriers in certain countries.

Opportunities and Future Trends

- Novel Formulations: Development of extended-release or combination therapies to address compliance and efficacy.

- Regulatory Approvals for New Indications: Potential approval for cognitive deficits, expanding therapeutic scope.

- Digital and Telemedicine Platforms: Increased access and monitoring could stimulate sales.

- Emerging Markets: Strategic focus on China, India, and Southeast Asia.

Risks and Uncertainties

- Regulatory Restrictions: Potential bans on off-label sale or non-prescribed use.

- Ethical and Legal Challenges: Ongoing debates about cognitive enhancement ethics may influence public policy.

- Safety Concerns: Adverse events or misuse scandals could dampen demand.

Key Takeaways

- The global Modafinil market is expected to grow steadily, reaching approximately USD 2.8 billion by 2028.

- Growth drivers include increasing sleep disorder diagnoses, expanding off-label use, and penetration into emerging markets.

- The generic manufacturing landscape exerts price pressures, with innovation in formulations being a key competitive strategy.

- Regulatory environments pose both opportunities and risks; strategic compliance will shape future sales.

- Market saturation in developed regions suggests focus on emerging markets for sustained growth.

FAQs

1. How does off-label use impact Modafinil sales?

Off-label consumption, particularly for cognitive enhancement, accounts for a significant revenue segment, especially in younger, professional demographics. This inadvertently expands the market beyond traditional prescription boundaries, fostering higher sales volumes.

2. What are the key regulatory hurdles for Modafinil manufacturers?

Manufacturers face challenges related to scheduling controls, approval for new indications, and restrictions on non-prescriptive sales. Regulatory agencies scrutinize safety and misuse, impacting marketing and distribution.

3. Which regions present the highest growth opportunities?

Emerging markets in Asia-Pacific, notably China, India, and Southeast Asia, offer high growth potential due to rising healthcare expenditure, urbanization, and unmet medical needs.

4. How will competition from generic manufacturers influence the market?

Generic entry has significantly reduced prices, pressuring profit margins. Differentiation through innovative formulations and potential branded combination therapies remains crucial for sustained revenue.

5. What is the future outlook for non-prescription Modafinil?

While currently limited due to regulatory controls, increasing demand for cognition enhancement and easy access via online channels could eventually lead to more permissive policies, expanding non-prescription sales.

References

- FDA. (2020). Modafinil (Provigil) Prescribing Information.

- Grand View Research. (2022). Modafinil Market Size, Share & Trends Analysis.

- MarketWatch. (2022). Asia-Pacific Sleep Disorder Drugs Market Outlook.

- U.S. Patent and Trademark Office. (2022). Patent Landscape for Modafinil.

- Pharmaceutical Technology. (2021). Innovations in Modafinil Formulations.

This analysis aims to support strategic decision-making for stakeholders involved in Modafinil manufacturing, distribution, and market entry, providing a detailed market trajectory grounded in current trends and future prospects.

More… ↓