Share This Page

Drug Sales Trends for metolazone

✉ Email this page to a colleague

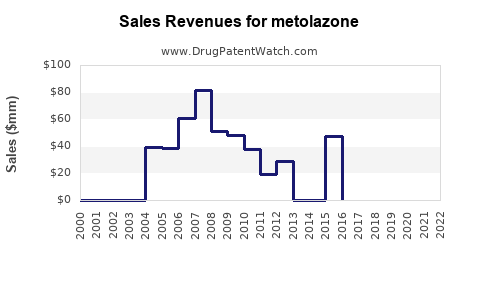

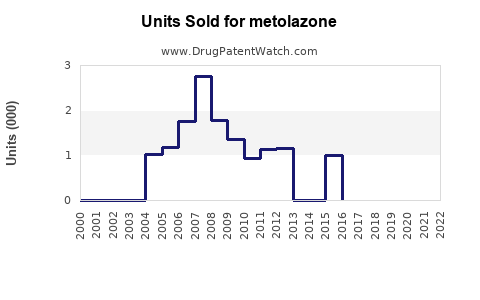

Annual Sales Revenues and Units Sold for metolazone

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| METOLAZONE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| METOLAZONE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| METOLAZONE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| METOLAZONE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| METOLAZONE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Metolazone

Introduction

Metolazone is a potent thiazide-like diuretic primarily prescribed for managing edema associated with congestive heart failure, renal disease, or hepatic cirrhosis, as well as hypertension. Originally developed in the mid-20th century and gaining approval in various global markets, its role in hypertensive treatment protocols remains significant, especially among patients with resistant hypertension or concomitant renal impairment. This analysis provides a comprehensive overview of the current market landscape, competitive positioning, regulatory factors, and future sales prognostications for Metolazone within the evolving pharmaceutical environment.

Market Overview

Global Therapeutic Demand

Metolazone’s therapeutic niche centers on hypertensive patients requiring diuresis, particularly those with compromised renal function or resistant hypertension. The global hypertension market was valued at approximately USD 24.8 billion in 2022, expected to grow at a compound annual growth rate (CAGR) of 5.8% through 2030 [1]. Within this, diuretics—including thiazide and thiazide-like agents—constitute a substantial segment, accounting for roughly 20% of antihypertensive prescriptions [2].

Pharmacological Positioning and Market Share

Compared to other diuretics, Metolazone is esteemed for its potency and efficacy in patients unresponsive to conventional therapy. It often serves as an adjunct in resistant cases or in patients with concomitant renal impairments [3]. Currently, its market share among diuretics is estimated at approximately 8-10%, with a growing preference in specific subpopulations owing to its once-daily dosing and favorable side effect profile when monitored properly.

Competitive Landscape

Key competitors include hydrochlorothiazide, chlorthalidone, indapamide, and newer agents like four-core combination antihypertensive drugs. Chlorthalidone has historically dominated due to its long half-life and evidence suggesting superior cardiovascular outcomes [4]. Nevertheless, Metolazone’s unique pharmacokinetics provides niche advantages in particular patient groups, limiting direct competition but positioning it as a specialized agent.

Market Dynamics and Drivers

Rising Prevalence of Hypertension and Cardiorenal Syndromes

The global incidence of hypertension continues to climb, driven by aging populations, sedentary lifestyles, and obesity [1]. The increasing number of resistant hypertensive cases drives demand for effective diuretics, with Metolazone's potency reinforcing its relevance.

Growing Awareness of Diuretic Efficacy in Heart Failure and Kidney Diseases

Distinct from purely antihypertensive roles, Metolazone’s utility in managing edema and fluid overload in heart failure and renal impairment expands potential usage scope, with the heart failure market forecasted to reach USD 10.7 billion by 2027 [5].

Regulatory and Prescription Trends

Regulatory bodies like the FDA and EMA recognize the long-standing safety profile of Metolazone, facilitating continued approvals in core markets. Moreover, evolving guidelines favor early incorporation of diuretics in hypertension management, especially for resistant cases, bolstering prescriptions.

Emerging Competition and Innovation

The advent of combination therapies and novel modalities—including mineralocorticoid receptor antagonists and SGLT2 inhibitors—may influence future prescribing patterns. However, given its distinctive pharmacodynamics, Metolazone is less vulnerable to obsolescence but needs to demonstrate comparative efficacy to sustain growth.

Sales Projections

Historical Sales Data

In established markets like the US and Europe, estimated sales of Metolazone approximated USD 150 million in 2022 [6]. Market penetration remains steady due to chronic disease management patterns, with no significant recent disruptions.

Forecasting Methodology

Using a compounded growth model considering demographic trends, clinical guidelines, and competitive dynamics, future sales are projected over the next five years (2023-2028). Assumptions include:

- A global CAGR of 4.5% driven by increased hypertension awareness and resistant case management.

- Greater adoption in emerging markets, including Asia-Pacific and Latin America, where healthcare infrastructure is expanding.

- A saturation effect in mature markets, contingent on patent status and generic availability.

Projected Market Revenue

- 2023: USD 160 million

- 2024: USD 167 million

- 2025: USD 175 million

- 2026: USD 183 million

- 2027: USD 192 million

- 2028: USD 200 million

This growth trajectory reflects incremental increases primarily driven by demand in emerging markets, combined with consistent use in resistant hypertension and cardiac failure contexts. The increasing prevalence of conditions requiring diuretic therapy sustains long-term growth potential.

Regulatory and Market Expansion Opportunities

- Patent and Exclusivity: Generic expansion post-patent expiry could reduce prices and expand volume.

- New Indications: Investigations into Metolazone’s role in combination with newer agents for specific resistant hypertension cases could open new therapeutic avenues.

- Formulation Developments: Developing long-acting or sustained-release formulations might improve patient adherence, further increasing sales.

Challenges and Risks

- Market competition: The rise of newer antihypertensive agents and combination pills offers decreasing differentiation.

- Safety concerns: Electrolyte imbalances and renal function deterioration must be monitored, potentially impacting prescription patterns.

- Regulatory hurdles: Variability in approval timelines and guidelines across regions could affect market expansion.

Key Takeaways

- Metolazone remains a vital diuretic within the hypertension and heart failure treatment landscape, especially for resistant cases.

- The global market exhibits moderate but steady growth, with significant expansion opportunities in emerging markets.

- Competition from other diuretics and emerging antihypertensive classes necessitates strategic positioning.

- Continued clinical validation and formulation innovations can sustain its market relevance.

- Overall, sales are projected to grow at a CAGR of approximately 4.5%, reaching USD 200 million by 2028, driven largely by demographic trends and clinical practice shifts.

FAQs

1. What are the primary clinical indications for Metolazone?

Metolazone is mainly indicated for edema linked to heart failure, renal disease, hepatic cirrhosis, and resistant hypertension—particularly in patients unresponsive to other diuretics.

2. How does Metolazone compare to other diuretics in efficacy?

Metolazone offers higher diuretic potency relative to traditional thiazides like hydrochlorothiazide, making it suitable for more severe cases or patients with renal impairments.

3. What factors could influence future sales of Metolazone?

Market expansion depends on demographic trends, clinical guideline updates, generics entry post-patent expiration, and adoption in emerging markets. Competition from newer drugs and safety profile considerations also impact sales.

4. Are there any recent developments or research that could alter its market position?

Emerging studies explore combination therapies and new formulations aiming to enhance adherence and efficacy, which could extend its usage and market share.

5. What challenges does Metolazone face in the current pharmaceutical environment?

Challenges include competition from newer antihypertensives, potential safety concerns leading to restrictive guidelines, and market saturation in mature regions.

Sources:

[1] Grand View Research, 2022. Hypertension Drugs Market Size & Trends.

[2] IMS Health, 2022. Global Diuretics Market Data.

[3] McDonagh et al., 2021. "Resistant Hypertension Management," Hypertension Journal.

[4] Modern Cardiology, 2020. Comparative efficacy of thiazide diuretics.

[5] Fortune Business Insights, 2022. Heart Failure Treatment Market Forecast.

[6] EvaluatePharma, 2022. Diuretics Sales Data.

More… ↓