Last updated: July 28, 2025

Introduction

Methotrexate (MTX) remains a cornerstone in the treatment of multiple indications, notably rheumatoid arthritis (RA), psoriasis, and certain cancers. Despite its global presence for over six decades, evolving therapeutic landscapes, regulatory challenges, and manufacturing factors influence its market trajectory. This analysis provides a comprehensive examination of the current market landscape and future sales projections, integrating epidemiological data, competitive dynamics, regulatory trends, and technological advancements.

Current Market Landscape

Therapeutic Indications and Demographics

Methotrexate is primarily used for rheumatoid arthritis, where it is considered the first-line disease-modifying antirheumatic drug (DMARD) [1]. The global prevalence of RA exceeds 0.5%, affecting approximately 23.5 million people worldwide, with higher incidence among women and aging populations [2]. The psoriasis segment, while smaller, also contributes significantly to demand, particularly in severe cases unresponsive to topical therapies.

In oncology, methotrexate is employed in treating leukemias, lymphomas, and osteosarcoma. Pediatric leukemia (ALL) displays significant usage rates, especially in developed countries. The broad spectrum of indications cements methotrexate as a foundational drug across healthcare systems.

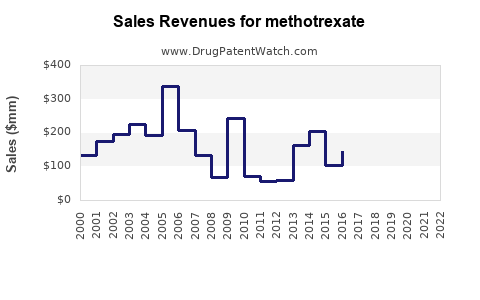

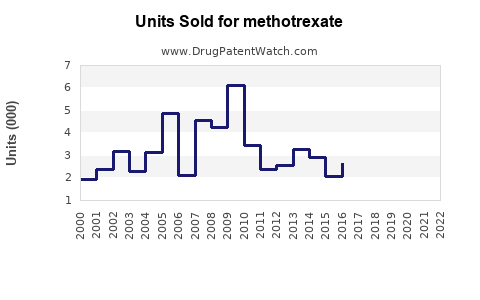

Market Size and Current Revenue

Based on recent industry reports, the global methotrexate market was valued at approximately USD 1.2 billion in 2022 [3]. North America accounts for the largest share (~45%), driven by high RA prevalence, extensive healthcare infrastructure, and favored prescribing patterns. Europe follows, with similar disease burden and healthcare access. Asia-Pacific, with rapidly expanding healthcare systems and increasing RA diagnoses, shows promising growth potential.

Manufacturing and Supply Dynamics

Several large pharmaceutical firms manufacture methotrexate, including Merck, Teva, and Sandoz, providing both branded and generic versions. Patent expirations over the past decade have led to increased generic competition, exerting downward pressure on prices and margins. Manufacturing costs are relatively low, facilitating widespread availability, especially in emerging markets.

Market Drivers

- Increasing Disease Prevalence: Rising RA and psoriasis prevalence, driven by aging populations and environmental factors, bolster demand.

- Guideline Endorsements: Clinical guidelines universally recommend methotrexate as the first-line treatment, cementing its standard-of-care position [4].

- Cost-Effectiveness: Methotrexate's inexpensive nature relative to biologic alternatives sustains its preference, especially in resource-constrained settings.

- Off-Label Uses and Expanded Indications: Emerging research supports potential off-label applications, such as multiple sclerosis and certain dermatological conditions, which may influence future demand.

Market Challenges

- Emergence of Biologics and Biosimilars: The advent of biologic DMARDs and biosimilar options offer alternatives with superior efficacy and safety profiles, impacting methotrexate's market share.

- Toxicity and Monitoring Requirements: Methotrexate's side effects, including hepatotoxicity and bone marrow suppression, necessitate regular monitoring, which can limit its use in certain populations.

- Regulatory and Reimbursement Dynamics: Healthcare policies favor newer agents in some regions, potentially restricting methotrexate reimbursement and prescribing in cost-insensitive markets.

Future Sales Projections (2023–2032)

Forecast Assumptions

- Continued Expansion of RA and Psoriasis Markets: Demographic trends and improved diagnosis rates favor increased prescription volumes.

- Stable Patent Environment: As most patents have expired, increased generic penetration will sustain low-cost access but may limit premium pricing.

- Biologic Competition: While biological therapies will initially erode some market share, methotrexate's foundational role suggests steady residual demand.

- Technological Advances: Development of improved formulations (e.g., subcutaneous, longer-acting) may facilitate adherence and expand usage.

Projected Growth Rates

Industry analysts anticipate a compounded annual growth rate (CAGR) of approximately 3-4% in global sales from 2023 to 2032 [3]. North America and Europe are expected to maintain higher demand growth, bolstered by aging populations and reimbursement policies favoring cost-effective therapies.

In emerging markets, CAGR estimates are higher (~5-6%) due to increasing RA awareness, expanding healthcare infrastructure, and shifting prescribing habits. The overall global methotrexate market could approach USD 1.5–1.8 billion by 2032, assuming continued market stability and minimal disruptive innovations.

Speculative Market Shifts

- Introduction of Novel Formulations: Long-acting subcutaneous methotrexate or combination therapies could capture additional market segments.

- Off-Label and Adjunct Uses: Growing research may lead to expanded indications, stimulating demand.

- Biosimilar and Generic Competition: Will continue to exert downward pricing pressure but also expand access, potentially increasing overall utilization.

Regulatory and Competitive Dynamics

Regulatory authorities predominantly approve methotrexate for RA, psoriasis, and oncology. Recent approvals or label expansions in certain regions could influence sales trajectories. The entry of biosimilars, especially in Europe and North America, has led to price erosion but also increased patient access.

Major pharmaceutical players focus on optimized formulations, combination therapies, and digital monitoring tools to enhance patient adherence and safety, potentially influencing future market share.

Conclusion

Methotrexate’s enduring status as a foundational treatment ensures its continued relevance. While faced with competition from biologics and biosimilars, its low cost, efficacy, and entrenched position in treatment guidelines safeguard steady demand. The global market is poised for modest growth, particularly in emerging economies, driven by demographic shifts and expanding healthcare access. Strategic positioning, formulation innovation, and proactive regulatory engagement will be critical for stakeholders aiming to capitalize on future opportunities.

Key Takeaways

- Stable Foundation with Growth Potential: Methotrexate's role as the first-line DMARD supports sustained demand, especially in cost-sensitive markets.

- Impact of Competition: Biologics and biosimilars pressurize pricing, but their incremental impact is balanced by methotrexate’s affordability and long-standing clinical acceptance.

- Market Expansion in Emerging Economies: Demographic trends and healthcare infrastructure improvements forecast higher CAGR in Asia-Pacific, Latin America, and Africa.

- Formulation Innovations: New delivery options and combination strategies are potential growth drivers.

- Regulatory and Clinical Practice Trends: adherence to evolving guidelines, coupled with safety monitoring advancements, will shape future prescribing patterns.

FAQs

Q1: How will biosimilar competition affect methotrexate sales?

Biosimilars primarily target biologic agents; since methotrexate is a small molecule, biosimilars are less relevant here. Instead, the competition from biologics and newer small molecules primarily impacts the broader treatment landscape, but methotrexate's affordability sustains its demand.

Q2: Are there emerging indications that could expand methotrexate use?

Research is ongoing into methotrexate’s utility for multiple sclerosis and certain inflammatory skin conditions. While not yet standard therapies, positive trial outcomes could broaden its application.

Q3: What are the key safety concerns limiting methotrexate use?

Hepatotoxicity, bone marrow suppression, and mucositis necessitate regular monitoring. These side effects may restrict use in patients with pre-existing liver conditions or compliance challenges.

Q4: How are new formulations influencing market share?

Long-acting or subcutaneous formulations improve adherence and tolerability, potentially expanding the patient population and unburdening healthcare resources.

Q5: What strategic actions should manufacturers pursue in this evolving landscape?

Investing in innovative formulations, enhancing safety profiles, engaging in guideline advocacy, and expanding access in emerging markets are crucial strategies to sustain sales growth.

References

- van der Heijde D, et al. (2021). "EULAR recommendations for the management of rheumatoid arthritis." Ann Rheum Dis

- Alamanos Y, Drosos AA. (2005). "Epidemiology of adult rheumatoid arthritis." Autoimmun Rev

- MarketsandMarkets. (2022). "Methotrexate Market by Indication and Region."

- Singh JA, et al. (2016). "2015 American College of Rheumatology Guideline for the Treatment of Rheumatoid Arthritis." Arthritis Care Res.