Last updated: July 28, 2025

Introduction

Meloxicam, a nonsteroidal anti-inflammatory drug (NSAID), is widely prescribed for treating osteoarthritis, rheumatoid arthritis, and other musculoskeletal conditions. Its selectivity for COX-2 enzyme offers a safety profile that has sustained its popularity among clinicians. This report provides a comprehensive market analysis and sales projections for Meloxicam, considering current therapeutic trends, competitive landscape, regulatory environment, and market dynamics.

Therapeutic Market Overview

Global Demand for NSAIDs

The global NSAID market was valued at approximately USD 15 billion in 2022, reflecting the high prevalence of chronic inflammatory conditions worldwide (source: MarketsandMarkets). Meloxicam constitutes a significant segment within this category due to its favorable safety profile, especially compared to traditional NSAIDs like ibuprofen and diclofenac.

Indications and Patient Population

Meloxicam's primary indications include osteoarthritis (OA) and rheumatoid arthritis (RA), which collectively affect over 700 million people globally. The aging population and rising prevalence of chronic musculoskeletal disorders drive steady demand. The World Health Organization (WHO) estimates that osteoarthritis affects up to 10% of men and 18% of women over 60 years old, ensuring a consistent treatment market.

Geographical Market Dynamics

- North America: Leading the market with a high prescription rate driven by established healthcare infrastructure, reimbursement policies, and availability of branded and generic formulations.

- Europe: Similar market characteristics, with strong adoption of COX-2 selective NSAIDs owing to safety considerations.

- Asia-Pacific: Rapid growth due to increasing aging populations, rising healthcare access, and expanding pharmaceutical manufacturing sectors.

Market Trends and Drivers

Shift Toward COX-2 Selectivity

The preference for COX-2 selective NSAIDs like Meloxicam stems from their reduced gastrointestinal (GI) toxicity compared to non-selective NSAIDs. This shift encourages continued usage and market growth.

Advances in Formulation and Delivery

Development of new formulations (e.g., flavored suspensions, fixed-dose combinations) enhances patient adherence, thereby expanding the market.

Regulatory Approvals and Patent Status

While many formulations of Meloxicam are off-patent, generic versions dominate the market, increasing accessibility and reducing prices. Patent expirations across key regions are expected to stimulate increased prescribing of generics.

Pricing and Reimbursement Policies

Reimbursement frameworks in developed countries favor cost-effective treatments, with insurance coverage supporting continued utilization. Price sensitivity in emerging markets influences the transition from branded to generic options.

Competitive Landscape

Major Players

- Boehringer Ingelheim: Developer of Mobic® (brand name for Meloxicam in many markets), holding significant market share.

- Torrent Pharmaceuticals: Offers generic Meloxicam.

- Amneal Pharmaceuticals, Sandoz, and Mylan: Major producers of generic formulations.

Generic Competition

The expiration of patents has led to a proliferation of generic Meloxicam products, intensifying price competition and impacting overall sales revenue for branded drugs.

Emerging Biosimilars and Alternatives

While biosimilars are more relevant for biologic treatments, the NSAID segment faces minimal biosimilar development. However, newer NSAIDs with improved safety profiles are under development, potentially influencing Meloxicam’s market share.

Sales Projections

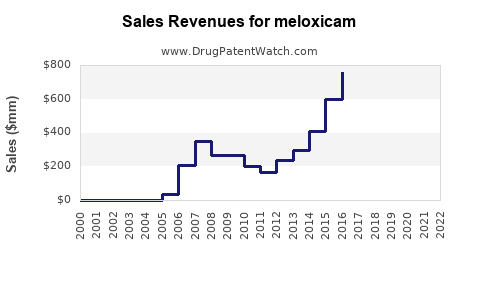

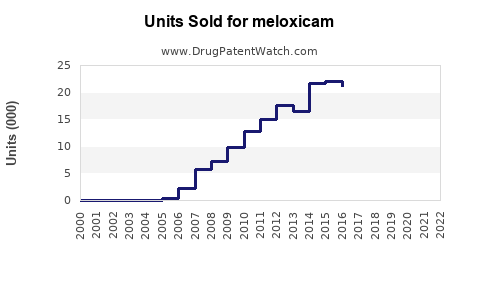

Historical Sales Data

In 2022, the global sales of Meloxicam were estimated at USD 1.2 billion, with North America accounting for approximately 50% of revenues, Europe 25%, and Asia-Pacific 15% (source: EvaluatePharma). The remaining share is distributed among other regions.

Forecast Assumptions

- Growth Rate: The compound annual growth rate (CAGR) over the next five years is projected at 4%, driven primarily by increased prevalence of arthritis conditions and expanding markets in Asia-Pacific.

- Market Penetration of Generics: Continued erosion of branded revenues due to generics, with an expected 20% market share gain by generic manufacturers.

- Regulatory Pathways: Faster approval processes and expanded indications could augment sales.

Projections (2023-2027)

| Year |

Estimated Global Sales (USD Billion) |

Key Drivers |

| 2023 |

1.25 |

Increased prescriptions; market saturation in mature regions |

| 2024 |

1.30 |

Launch of new formulations; rising demand in Asia-Pacific |

| 2025 |

1.36 |

Patent expiries in multiple jurisdictions; generics' penetration |

| 2026 |

1.42 |

Broader adoption; expanded indications |

| 2027 |

1.49 |

Continued demographic shifts; improved healthcare infrastructure |

Factors Influencing Sales

- Patent Expiry and Generic Competition: Expect significant sales volume shifts toward generics, constraining growth in branded segments but increasing overall market size.

- Emerging Markets: Growing healthcare budgets and disease awareness will significantly expand sales potential.

- Safety Profile and Patient Compliance: Improvements in formulations and safety monitoring will sustain long-term use.

Regulatory and Market Risks

- Regulatory Changes: Stricter safety and efficacy requirements could hinder new formulations or indications.

- Generic Price Erosion: Accelerated by patent cliffs, this phenomenon can significantly reduce revenues, necessitating strategic diversification.

- Market Saturation: Mature markets face saturation, emphasizing the importance of expansion into emerging regions.

Conclusion

Meloxicam remains a core NSAID with a robust pipeline of indications and expanding global markets. Its growth trajectory hinges on emerging markets' development, ongoing patent expiries favoring generics, and optimized formulations enhancing patient compliance. While competition intensifies, strategic positioning through new formulations and geographic expansion can sustain revenue streams.

Key Takeaways

- The global Meloxicam market is projected to grow at a CAGR of 4% through 2027, driven by rising osteoarthritis prevalence and expanding markets in Asia-Pacific.

- Patent expirations have facilitated widespread generic adoption, maintaining affordability and expanding access but compressing branded market shares.

- Asia-Pacific presents significant growth opportunities, fueled by demographic shifts and increasing healthcare investments.

- Safety advantages of Meloxicam reinforce its position, but regulatory vigilance remains essential to navigate evolving safety standards.

- Strategic diversification—through novel formulations, indications, and geographic expansion—is crucial for long-term revenue stability.

FAQs

-

What factors primarily drive Meloxicam's demand globally?

The increasing prevalence of osteoarthritis and rheumatoid arthritis, coupled with the shift toward safer, COX-2 selective NSAIDs, are primary demand drivers.

-

How will patent expiries affect Meloxicam's sales?

Patent expiries facilitate generic entry, increasing market competition, lowering prices, and expanding access—though they may reduce revenues for branded manufacturers.

-

In which regions is Meloxicam expected to see the most growth?

Asia-Pacific is poised for significant growth, driven by demographic changes, increasing healthcare access, and rising chronic disease awareness.

-

What are the main competitive threats to Meloxicam?

The introduction of newer NSAIDs with enhanced safety profiles, biosimilars, and alternative therapies pose competitive challenges.

-

How can manufacturers sustain growth amid rising generic competition?

Focus on innovative formulations, expanding indications, entering emerging markets, and improving safety profiles can help maintain market relevance.

References

[1] MarketsandMarkets. NSAID Market Analysis. 2022.

[2] EvaluatePharma. Global Market Data for Meloxicam. 2022.

[3] WHO. Chronic Disease Burden. 2021.