Last updated: July 29, 2025

Introduction

Lidocaine, a widely used local anesthetic and antiarrhythmic agent, has maintained a prominent position in the healthcare market for over seven decades. Its versatility spans across dental procedures, minor surgeries, cardiac arrhythmia management, and topical applications for pain relief. The global demand for lidocaine persists due to its efficacy, safety profile, and expanding therapeutic indications, prompting comprehensive market analysis and sales projections.

This report evaluates the current market landscape, factors influencing demand, regulatory environments, competitive dynamics, and future sales forecasts. It aims to inform stakeholders, including pharmaceutical companies, investors, and healthcare providers, about the growth potential and strategic considerations associated with lidocaine.

Market Overview

Global Market Size and Growth Trends

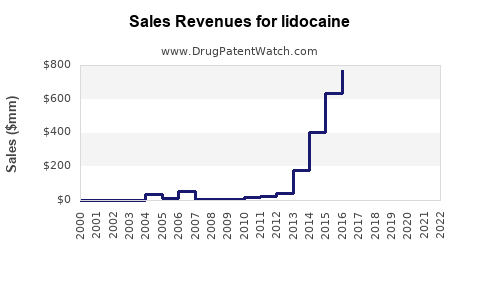

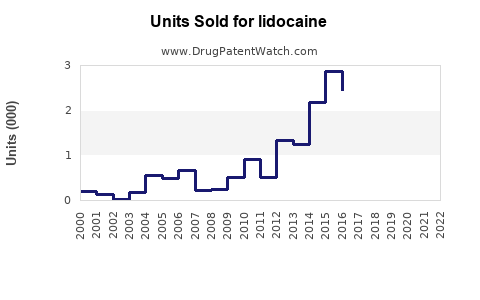

The global lidocaine market was valued at approximately USD 1.2 billion in 2022, with steady annual growth estimated at 4-6% over the next five years. Its robust compound annual growth rate (CAGR) is driven by rising procedural volumes, expanding indications, and technological advancements in delivery methods.

Key Market Segments

- Formulation Types: Injectable, topical, transdermal patches, gels, creams.

- Applications: Dental anesthesia, surgical anesthesia, cardiology, dermatology, pain management.

- Geographical Distribution: North America remains dominant, accounting for nearly 40% of sales, influenced by high procedural volume and advanced healthcare infrastructure. Asia-Pacific is the fastest-growing regional market due to increasing healthcare access, rising procedural rates, and expanding pharmaceutical manufacturing capacity.

Market Drivers

1. Expansion of Indications

Lidocaine's versatility fuels demand. Originally used primarily as a local anesthetic, its role has expanded to include:

- Epidural and nerve block anesthesia in surgical settings.

- Management of cardiac arrhythmias through intravenous formulations.

- Topical applications for localized pain, including post-herpetic neuralgia.

- Emerging uses in drug delivery systems and combination therapies.

2. Increasing Procedural Volumes

Global procedural volumes for dental surgeries, minor surgeries, and cardiac interventions have risen, particularly post-pandemic, following delays in elective procedures. This increases the utilization of anesthetics like lidocaine.

3. Technological Innovations

Advancements in drug delivery, such as controlled-release patches, liposomal formulations, and combination products, enhance therapeutic efficacy and patient compliance, fueling sales growth.

4. Growing Awareness and Expanding Healthcare Infrastructure

Rising healthcare expenditure and acceptance of minimally invasive procedures bolster demand in emerging markets.

Regulatory and Competitive Landscape

Regulatory Environment

Lidocaine is approved globally, with stringent regulations ensuring safety and efficacy. Regulatory agencies, such as the U.S. FDA and EMA, continually review formulations for safety updates, affecting product availability and market entry timelines.

Competitive Dynamics

The market features major pharmaceutical companies like AstraZeneca, Hospira (part of Pfizer), and Teva Pharmaceuticals. The entry of generic formulations has increased affordability and accessibility, intensifying price competition.

Emerging entrants focus on novel delivery systems and combination products, aiming to differentiate from existing offerings.

Sales Projections (2023–2028)

Based on current trends, market analyses from sources such as Global Market Insights and IQVIA forecast sustained growth. The following projections assume a CAGR of approximately 5% over this period:

| Year |

Estimated Market Size (USD billion) |

Growth Driver Highlights |

| 2023 |

USD 1.26 billion |

Continued procedural growth, FDA approvals for new formulations, and expansion in emerging markets. |

| 2024 |

USD 1.32 billion |

Increased adoption of topical patches, new combination therapies. |

| 2025 |

USD 1.39 billion |

Further technological innovations, pipeline approvals. |

| 2026 |

USD 1.47 billion |

Market saturation in developed regions, expansion into new indications. |

| 2027 |

USD 1.55 billion |

Healthcare infrastructure growth, especially in Asia-Pacific. |

| 2028 |

USD 1.63 billion |

Adoption of advanced delivery systems, record procedural volumes. |

Potential Growth Catalysts:

- Innovation in sustained-release and transdermal formulations.

- Approvals for lidocaine in novel indications such as neuropathic pain.

- Expansion of sales channels in underserved markets.

Challenges and Risks

- Regulatory hurdles: Extended approval timelines for new formulations.

- Price pressures: Increasing generic competition impacting margins.

- Safety concerns: Rare adverse events necessitate continuous monitoring, potentially affecting market perception.

- Market saturation: Mature markets may experience slower growth rates.

Strategic Opportunities

- Product Diversification: Developing advanced delivery systems, combination products, and topical formulations.

- Emerging Markets Penetration: Tailored pricing and supply chain strategies for growth in Asia, Africa, and Latin America.

- Collaborations and Licensing: Partnering with biotech firms for innovation in lidocaine-based therapeutics.

- Regulatory Engagement: Proactive regulatory strategies to expedite approvals for new indications.

Key Takeaways

- The global lidocaine market is poised for steady growth, driven by procedural volume expansion, innovation, and geographical expansion.

- Technological advancements in drug delivery and new therapeutic indications are critical for capturing value.

- Competitive landscape favors differentiation through formulation innovation and strategic regional penetration.

- Price competition and regulatory dynamics require vigilant monitoring to maintain market share.

- Emerging markets in Asia-Pacific and Latin America represent significant growth opportunities owing to expanding healthcare infrastructure and procedural adoption.

FAQs

1. What are the primary drivers of lidocaine market growth?

Procedural volume increases, expanded therapeutic indications, technological innovations, and healthcare infrastructure expansion are key growth drivers.

2. How does the regulatory environment impact lidocaine sales?

Regulatory agencies' approvals and ongoing safety reviews influence product availability, formulations, and market entry, directly affecting sales trajectories.

3. What are the main markets for lidocaine?

North America remains the largest, with Europe and Asia-Pacific experiencing rapid growth due to expanding healthcare services and infrastructure.

4. How does generic competition influence the lidocaine market?

Generics lower prices, increase access, and boost volume sales but may compress profit margins for branded products.

5. What future innovations could impact lidocaine sales?

Advanced transdermal patches, liposomal formulations, and combination therapies integrating lidocaine with other agents are poised to significantly influence future market growth.

References

[1] Global Market Insights, "Lidocaine Market Size and Forecast," 2022.

[2] IQVIA Insights, "Pharmaceutical Market Trends," 2022.

[3] U.S. Food and Drug Administration, "Lidocaine Approval and Safety Updates," 2022.