Last updated: July 28, 2025

Introduction

Levothyroxine sodium, a synthetic form of thyroxine (T4), is the cornerstone treatment for hypothyroidism and other thyroid hormone deficiency conditions. As a well-established therapy, its global market dynamics are influenced by factors including demographic shifts, healthcare policies, technological innovations, and shifts in disease prevalence. This analysis explores the current market landscape, growth drivers, challenges, and projections for levothyroxine sodium over the coming years.

Market Overview

Levothyroxine sodium commands a significant share in the global endocrine therapeutics market, estimated to reach USD 4.5 billion by 2025, expanding at a compound annual growth rate (CAGR) of approximately 3.2% during 2021–2025 [1]. The therapy's broad acceptance stems from its proven efficacy, safety profile, and the increasing global burden of hypothyroidism.

The compound is marketed under various brand and generic names, with a substantial portion of sales attributable to generic manufacturers due to cost-effectiveness. The market's maturity is reflected in high product patent expiry rates, escalating generic competition, and high penetration rates across developed markets.

Market Drivers

Rising Prevalence of Thyroid Disorders

Globally, the prevalence of hypothyroidism is on the rise, driven by aging populations, iodine deficiency, autoimmune diseases like Hashimoto's thyroiditis, and increasing awareness. The WHO estimates that approximately 2% of the world's population suffers from hypothyroidism, with higher prevalence among women—up to 10 times more likely than men [2]. Consequently, demand for levothyroxine nationwide and globally continues to grow.

Aging Population

Older adults are disproportionately affected by thyroid disorders. The global demographic trend toward aging populations—projected to reach 1.5 billion by 2050—amplifies the need for long-term management of thyroid diseases. As elderly patients often require consistent hormone replacement therapy, this demographic shift supports sustained sales.

Advancements in Diagnostic Technologies

Enhanced screening programs and improved diagnostic accuracy through sensitive assays have increased the identification of hypothyroid cases, especially subclinical variants. This early detection expands the treatment pool, fueling demand for levothyroxine sodium.

Political and Healthcare Initiatives

Government-led initiatives encouraging screening and management of thyroid conditions, alongside increasing healthcare infrastructure, especially in emerging markets, contribute to expanding market access and uptake.

Market Challenges

Competition from Generic Products

The expiry of key patents in the late 2000s facilitated widespread generic manufacturing, intensifying price competition. While this broadens access, it pressures profit margins for innovators and branded players, potentially impacting research and innovation in the space.

Manufacturing and Quality Control Challenges

Levothyroxine’s narrow therapeutic index necessitates strict manufacturing standards to ensure batch-to-batch consistency. Variations can lead to therapeutic failure or adverse effects, leading to market withdrawal or reformulation—challenges that can affect supply stability.

Regulatory Scrutiny

Regulatory agencies demand rigorous bioequivalence and manufacturing standards. Changes in regulations or compliance issues can disrupt supply chains or delay market entry for new formulations.

Patient Adherence and Therapy Optimization

Adherence to therapy, especially in chronic disease management, impacts sales. Fluctuations in dosage requirements and bioavailability factors due to formulation differences can impact clinical outcomes and market dynamics.

Regional Market Insights

North America

Leading the market due to high hypothyroidism prevalence, advanced healthcare infrastructure, and widespread screening programs. The U.S. accounts for over 50% of the global levothyroxine sodium sales, with growth driven by aging demographics and chronic disease management.

Europe

Sizable contributions from mature healthcare systems with high diagnosis rates. Variability exists due to regional differences in iodine deficiency and autoimmune disease prevalence.

Asia-Pacific

Projected to witness the fastest growth (CAGR of 4.5%) owing to increasing healthcare expenditure, booming pharmaceutical manufacturing sectors, and improved screening. Countries like China and India offer significant growth opportunities due to large population bases and expanding healthcare access.

Latin America and MEA

Moderate growth driven by increasing awareness, improved healthcare infrastructure, and rising prevalence of thyroid disorders. Market penetration remains variable across countries.

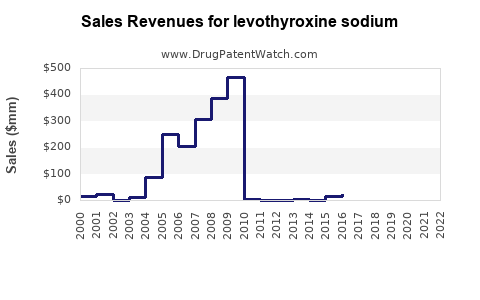

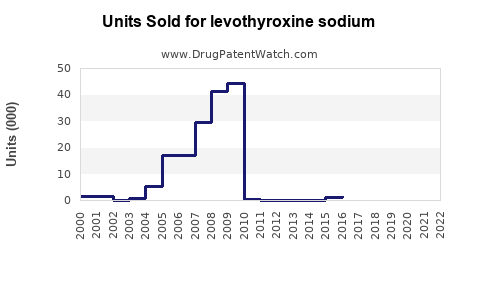

Sales Projections (2021–2030)

Based on current trends, the global levothyroxine sodium market is anticipated to grow from USD 4.5 billion in 2021 to approximately USD 5.9 billion by 2030, registering a CAGR of 3.3%. Key growth segments include:

- Generic Levothyroxine: Dominant, accounting for over 85% of sales, driven by patent expiries and cost-sensitive healthcare systems.

- Innovative Formulations: Slow but steady growth in sustained-release and novel delivery systems aimed at improving adherence.

- Emerging Markets: Contribute over 40% of total sales by 2030, driven by demographic changes and expanding healthcare coverage.

Forecast Period Highlights:

- North America: Continued dominance, with steady growth driven by aging populations and advanced diagnostic protocols.

- Asia-Pacific: Fastest-growing region, with increasing pharmaceutical manufacturing and healthcare expenditure.

- Europe: Stable growth, with regulatory and reimbursement policies influencing market expansion.

Competitor Landscape

Market players include major pharmaceutical corporations like Pfizer, Merck, and Mylan, alongside numerous regional generics manufacturers. Patent expiries incentivize new entrants and generic proliferation, intensifying competition. Companies investing in bioequivalent formulations and patient-centric delivery systems aim to differentiate in a saturated market.

Regulatory and Market Access Considerations

Stringent regulatory environments across the U.S. FDA, EMA, and other agencies necessitate compliance with bioequivalence, manufacturing, and safety standards. Market access strategies involve engaging with payers for formulary inclusion and developing cost-effective manufacturing processes.

Conclusion

The levothyroxine sodium market remains robust, underpinned by the global rise in thyroid disorder prevalence and demographic shifts. While patent expiries and generic competition present challenges, innovations in formulation and expanded healthcare access in emerging economies offer sizable growth opportunities. Strategic positioning, quality assurance, and regulatory compliance are critical for sustaining competitive advantage and maximizing sales growth.

Key Takeaways

-

The global levothyroxine sodium market is projected to expand at a CAGR of approximately 3.2% through 2025, reaching USD 4.5 billion.

-

Increased hypothyroidism prevalence, especially among aging populations, remains the primary driver of demand.

-

Generic manufacturers dominate, intensifying price competition but also expanding market access.

-

Emerging markets in Asia-Pacific present significant growth opportunities due to demographic and healthcare infrastructure advancements.

-

Regulatory compliance and investment in formulation innovations are key to maintaining market share and ensuring continued growth.

FAQs

1. What factors influence the pricing of levothyroxine sodium?

Pricing is influenced primarily by generic competition, manufacturing costs, regulatory compliance expenses, and healthcare reimbursement policies. Patent expiries lead to price reductions due to increased competition.

2. How do regulatory changes affect levothyroxine market dynamics?

Regulatory updates regarding bioequivalence standards and manufacturing quality can impact supply chains, leading to market entry delays or withdrawals, which in turn influence availability and pricing.

3. What opportunities exist for new formulations of levothyroxine?

Innovations such as sustained-release formulations, liquid preparations, and transdermal systems aim to improve patient adherence, reduce absorption variability, and provide competitive advantages.

4. How does the prevalence of hypothyroidism vary geographically?

Prevalence is higher in regions with iodine deficiency and autoimmune disease burdens. Developed countries report prevalence rates up to 10% among women, while developing regions may have underdiagnosed cases.

5. What are the major challenges faced by manufacturers in this market?

Maintaining consistent bioavailability due to narrow therapeutic index, ensuring manufacturing quality, navigating regulatory landscapes, and differentiating products in a highly competitive environment are key challenges.

References

[1] MarketsandMarkets, "Thyroid Disorder Treatment Market," 2021.

[2] World Health Organization, "Thyroid Diseases Fact Sheet," 2020.