Last updated: July 29, 2025

Introduction

Levofloxacin, a fluoroquinolone antibiotic developed by Sanofi-Aventis, is widely prescribed for treating bacterial infections, including respiratory, urinary tract, skin, and soft tissue infections. Since its approval in the early 2000s, levofloxacin has established itself as a cornerstone in antimicrobial therapy. This analysis evaluates current market conditions, competitive landscape, and future sales projections, drawing insights for pharmaceutical stakeholders, healthcare providers, and investors.

Global Market Landscape

Market Size and Growth Trends

The global antibiotic market is projected to reach approximately $50 billion by 2030, expanding at a compound annual growth rate (CAGR) of about 3-4% [1]. Levofloxacin occupies a significant segment within this market, primarily driven by its broad-spectrum efficacy, convenient once-daily dosing, and extensive clinical use.

Between 2021 and 2025, the levofloxacin market demonstrated a steady CAGR of approximately 4-5%, driven by increased incidence of respiratory and urinary tract infections, and expanding geriatric populations with higher infection susceptibility [2].

Regional Market Dynamics

-

North America: The largest market, accounting for roughly 40% of global sales, owing to high antibiotic consumption, advanced healthcare infrastructure, and regulatory approvals. The U.S. represents a substantial market share, with annual sales exceeding $1.2 billion [3].

-

Europe: The second-largest market, driven by strong hospital prescription practices and regulatory approvals. Countries like Germany, France, and the UK lead regional sales.

-

Asia-Pacific: Exhibiting rapid growth, projected to grow at a CAGR of 6-7%, fueled by emerging economies like China and India, where antibiotics are widely accessible, and infectious disease prevalence is high.

-

Latin America and Middle East: Growing markets with moderate penetration, driven by improving healthcare infrastructure.

Key Drivers and Barriers

Drivers:

- Increasing prevalence of bacterial infections.

- Rising antibiotic resistance issues, reinforcing the need for effective agents.

- Clinical guidelines endorsing levofloxacin for various multi-drug resistant infections.

- Expanding outpatient and home-based therapy settings.

Barriers:

- Concerns over fluoroquinolone-associated adverse events such as tendinopathy and QT prolongation [4].

- Regulatory challenges and usage restrictions, especially in Europe, where some countries have imposed prescribing limits.

- Competition from newer antibiotics with improved safety profiles.

Competitive Landscape

Levofloxacin faces competitive pressures from both generic and branded formulations.

Major Competitors

- Other Fluoroquinolones: Ciprofloxacin, moxifloxacin, and gemifloxacin. Moxifloxacin, with enhanced activity against atypical pathogens, is a notable alternative.

- Non-fluoroquinolone antibiotics: Amoxicillin-clavulanate, doxycycline, and third-generation cephalosporins.

- Emerging Agents: Liposomal antibiotics and newer classes such as oxazolidinones, targeting resistant strains.

Patent and Regulatory Status

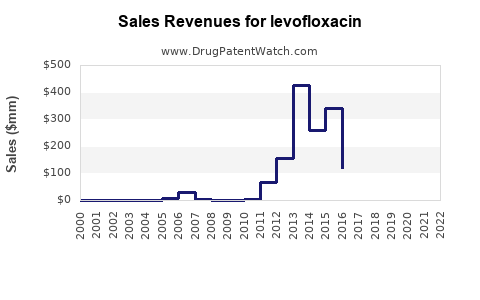

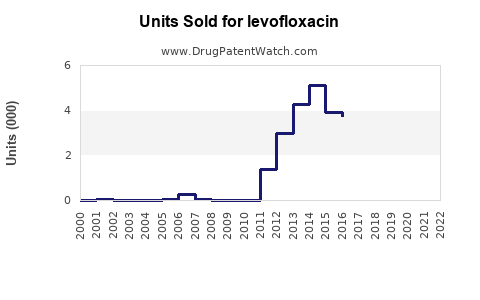

Most patents expired in the late 2010s, leading to a surge in generic sales. Market share now predominantly rests with generic manufacturers, which have driven down prices but increased volume-based sales.

Sales Projections (2023-2030)

Current Sales Overview

In 2022, global levofloxacin sales are estimated around $2.3 billion, with North America holding roughly 50% of this, followed by Europe (20%), and Asia-Pacific (25%). The rest is distributed among smaller regions.

Future Sales Forecast

Assuming a CAGR of 4% to 5%, driven by regional adoption, expanding indications, and increased diagnostics, global sales could reach approximately $3.2 billion to $3.5 billion by 2030.

Market Segment Evolution

- Generic dominance: Generics will maintain high sales volumes, with price reductions offsetting volume increases.

- Formulation innovations: Development of combination therapies or formulations with improved pharmacokinetics may generate incremental revenues.

- Regulatory impacts: Potential restrictions or safety warnings may temper growth in certain regions.

Impact of Antimicrobial Stewardship

Enhanced stewardship programs and updated clinical guidelines emphasizing judicious antibiotic use will influence prescribing patterns. This could potentially slow growth but also promote targeted, higher-value use, ensuring steady demand.

Pricing and Reimbursement Trends

Pricing strategies vary globally, with significant discounts in developing markets. Reimbursement policies in mature markets support continued utilization, albeit with increased scrutiny over safety concerns. The balance between affordability and profit margins will shape future sales.

Conclusion

Levofloxacin remains a vital antibiotic within the global infectious disease market. Its broad-spectrum activity, clinical versatility, and established brand presence underpin stable demand. However, navigating safety concerns, regulatory restrictions, and shifting prescribing practices will be critical in maintaining and expanding its market share. Strategic focus on safety, formulation enhancements, and targeted use will be essential to optimize future sales trajectories.

Key Takeaways

- The global levofloxacin market is poised for continued moderate growth, projecting sales of approximately $3.2–3.5 billion by 2030.

- Market expansion is driven by increasing bacterial infection incidence, especially in Asia-Pacific regions, with growth moderated by safety concerns and antibiotic stewardship.

- Price reductions due to generic proliferation support volume-driven sales, while safety restrictions may limit broad-spectrum use.

- Competitive pressures from other fluoroquinolones and newer agents necessitate ongoing innovation and targeted applications.

- Strategic positioning around safety, formulation, and compliance with evolving regulations will be vital for sustained market relevance.

FAQs

Q1: How will antibiotic resistance affect levofloxacin sales?

A1: Rising resistance diminishes levofloxacin’s efficacy, prompting prescribing restrictions, and potentially reducing sales unless new formulations or combination therapies address resistance issues.

Q2: Are there plans for new formulations of levofloxacin?

A2: Current R&D focuses on developing combination products or extended-release formulations to improve safety and compliance, which could bolster future sales.

Q3: What role will regulatory agencies play in the future of levofloxacin?

A3: Agencies like the FDA and EMA may impose stricter prescribing guidelines or safety warnings, influencing demand patterns and prescribing behaviors.

Q4: How significant is the impact of COVID-19 on levofloxacin sales?

A4: While COVID-19 reduced some elective procedures, bacterial co-infections increased antibiotic use, temporarily stabilizing or boosting levofloxacin demand in certain regions.

Q5: Which markets represent the best growth opportunities moving forward?

A5: Asia-Pacific and Latin America are poised for robust growth due to expanding healthcare access, increasing infection rates, and emerging markets' rising antibiotic consumption.

Sources:

- Grand View Research, "Antibiotic Market Size and Forecast," 2022.

- MarketWatch, "Global Antibiotics Market Analysis," 2022.

- IQVIA, "Pharmaceutical Sales Data," 2022.

- FDA, "Safety Alerts for Fluoroquinolones," 2018.