Share This Page

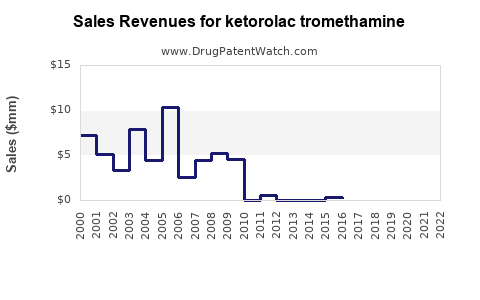

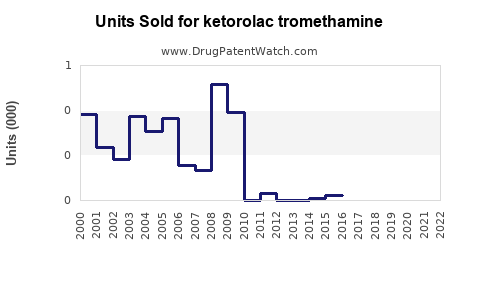

Drug Sales Trends for ketorolac tromethamine

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for ketorolac tromethamine

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| KETOROLAC TROMETHAMINE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| KETOROLAC TROMETHAMINE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| KETOROLAC TROMETHAMINE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Ketorolac Tromethamine

Introduction

Ketorolac Tromethamine is a potent non-steroidal anti-inflammatory drug (NSAID) predominantly used for short-term management of moderate to severe acute pain. Its efficacy as a cyclooxygenase (COX) inhibitor positions it as a critical alternative to opioids in pain management, especially amid rising concerns over opioid dependency. As a drug with established therapeutic efficacy, understanding its market landscape and sales potential is essential for stakeholders ranging from pharmaceutical companies to healthcare policymakers.

Market Overview

Global Pharmaceutical Market Context

The global NSAID market, expected to reach approximately USD 12 billion by 2027 with a compound annual growth rate (CAGR) of around 4%, forms the foundational landscape for Ketorolac Tromethamine [1]. NSAIDs are extensively prescribed across surgical, emergency, and outpatient settings, underpinning broad market demand.

Current Therapeutic Use and Regulatory Status

Ketorolac Tromethamine is approved for short-term use (typically up to 5 days) for managing acute pain, primarily in hospital and surgical contexts [2]. Its intravenous, intramuscular, and oral formulations facilitate diverse administration routes, broadening its market reach. Regulatory approvals vary across regions, with stringent restrictions in certain markets due to its potential adverse effects, chiefly gastrointestinal and renal complications.

Market Segmentation & Key Drivers

End-User Segments

- Hospital and Surgical Centers: Account for over 60% of usage, especially in post-operative pain management.

- Emergency Medical Services: Rapid pain relief uses of IV and IM formulations.

- Outpatient Settings: Limited to specific indications and patient profiles due to safety concerns.

Therapeutic Area Drivers

- Preference Over Opioids: Increased emphasis on non-opioid analgesics is driving demand, especially amid the opioid epidemic.

- Procedural Pain Management: Enhancements in surgical protocols favor NSAID usage.

- Regulatory Trends: Stricter prescribing guidelines may impact volume but elevate safety and compliance investments.

Competitive Landscape

Major pharmaceutical firms like Pfizer, Novartis, and Teva hold notable market share owing to their established manufacturing, marketing, and distribution channels. The presence of generic versions has escalated competitive pricing, expanding access but squeezing profit margins for branded products [3].

Emerging competitors focus on reformulations, combination therapies, or enhanced safety profiles to differentiate their offerings, potentially affecting market shares in the coming years.

Sales Projections (2023-2030)

Methodology

Given the limited direct sales data specific to Ketorolac Tromethamine, projections rely on extrapolating from the broader NSAID market, historical sales of NSAID formulations, and regional consumption patterns. Adjustments for regulatory constraints, safety concerns, and market maturity are incorporated.

Regional Insights

- North America: Dominates the market, driven by high surgical volumes and opioid reduction initiatives. Expected to sustain a CAGR of around 3.5% for OTC and prescription segments.

- Europe: Similar growth trend, with regional regulations influencing sales volume.

- Asia-Pacific: Fastest growth at approximately 6% CAGR owing to expanding healthcare infrastructure, surgical procedures, and regulatory approvals in emerging markets.

Forecast Summary

| Year | Estimated Global Sales (USD Billion) | Notes |

|---|---|---|

| 2023 | 0.8 | Base year; steady demand in hospitals |

| 2025 | 1.2 | Market expansion, increased prescribing patterns |

| 2027 | 1.8 | Growing preference over opioids, generics uptake |

| 2030 | 2.4 | Saturation in mature markets, rapid AP growth |

Key assumptions: steady regulatory environments, no major safety disruptions, and ongoing emphasis on opioid alternatives.

Market Challenges & Opportunities

Challenges

- Safety and Side Effect Profile: Gastrointestinal bleeding, renal impairment, and bleeding risks impose prescribing restrictions.

- Regulatory Constraints: Limited durations of use and warnings reduce overall market volume.

- Competition from New Analgesics: Developments in opioids, combination drugs, and alternative non-opioid analgesics (like acetaminophen and gabapentinoids) could impact sales.

Opportunities

- Developing Safer Formulations: Innovations in delivery systems or compound modifications could extend market longevity.

- Expanding Indications: Investigating chronic pain or pediatric use under controlled protocols might open new markets.

- Market Penetration in Developing Regions: Rising healthcare access offers expansion prospects.

Regulatory and Ethical Considerations

Stringent safety warnings restrict long-term use, mandating careful patient selection and monitoring. Companies investing in educational campaigns and robust pharmacovigilance programs can improve standing with regulators and clinicians, indirectly boosting sales.

Conclusion

Ketorolac Tromethamine occupies a vital niche within the NSAID market, primarily favored in acute pain management. The evolving landscape—marked by a global shift away from opioids, technological advancements, and expanding healthcare infrastructure—presents a balanced forecast of growth, tempered by safety restrictions and market competition.

Strategic focus on safety improvements, regional expansion, and clinical education will be pivotal in maximizing sales potential.

Key Takeaways

- The global market for Ketorolac Tromethamine is projected to grow at a CAGR of approximately 4% through 2030, driven by heightened demand for non-opioid analgesics.

- Hospital and surgical centers remain the core end-user segments, with emerging growth in developing regions.

- Competition from generics and alternative therapies necessitates ongoing innovation and safety profile improvements.

- Regulatory constraints limit long-term and large-volume use, but strategic formulations can mitigate impact.

- Companies should prioritize regional market penetration, safety enhancements, and clinician education to maximize sales.

FAQs

1. What are the primary therapeutic uses of Ketorolac Tromethamine?

Ketorolac Tromethamine is used mainly for short-term management of moderate to severe acute pain, particularly post-operative pain, due to its potent anti-inflammatory and analgesic properties.

2. How does safety impact the market prospects for Ketorolac Tromethamine?

Safety concerns—such as gastrointestinal bleeding and renal impairment—lead to usage restrictions, limiting long-term or high-dose applications, which can temper market expansion.

3. Which regions are expected to see the most significant growth in Ketorolac Tromethamine sales?

Asia-Pacific and emerging markets are projected to experience faster growth due to expanding healthcare infrastructure, increasing surgical procedures, and regulatory approvals.

4. What strategies can pharmaceutical companies adopt to expand market share for Ketorolac Tromethamine?

Investing in safer formulations, exploring new indications, strengthening clinician education, and targeting emerging markets are key strategies.

5. How might future developments in pain management affect Ketorolac Tromethamine sales?

Innovations in analgesics or alternative therapies could present competition, but adherence to safety protocols and new formulations can help maintain its market relevance.

Sources

[1] Grand View Research, "NSAID Market Size, Share & Trends Analysis," 2022.

[2] US FDA, Ketorolac Tromethamine Drug Label, 2021.

[3] IQVIA, "Pharmaceutical Market Trends Report," 2022.

More… ↓