Share This Page

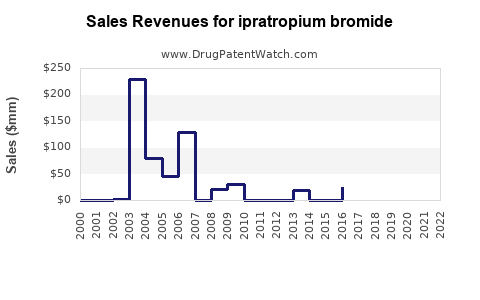

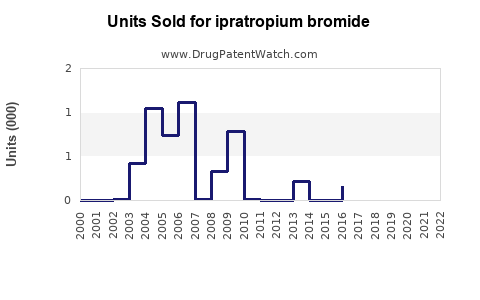

Drug Sales Trends for ipratropium bromide

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for ipratropium bromide

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| IPRATROPIUM BROMIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| IPRATROPIUM BROMIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| IPRATROPIUM BROMIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| IPRATROPIUM BROMIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| IPRATROPIUM BROMIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Ipratropium Bromide

Introduction

Ipratropium bromide, a well-established inhaled anticholinergic agent, has been a cornerstone in the management of chronic obstructive pulmonary disease (COPD) and asthma since its introduction in the 1980s. As a bronchodilator, it’s prescribed globally, holding a significant share of the respiratory therapeutic market. This analysis explores the current market landscape, key drivers, competitive environment, and future sales forecasts for ipratropium bromide, providing stakeholders with actionable insights for strategic planning.

Overview of Ipratropium Bromide

Ipratropium bromide is primarily marketed as an inhaler (metered-dose inhaler - MDI) and nebulizer solution. Its mechanism involves antagonizing muscarinic receptors in airway smooth muscle, reducing bronchoconstriction. Offering rapid onset and favorable safety profile, it remains a preferred option for acute and chronic respiratory conditions.

Despite the advent of newer long-acting agents like tiotropium and glycopyrrolate, ipratropium retains relevance due to its cost-effectiveness and established efficacy. Its versatility extends to combination therapies, notably as part of inhalers combined with beta-agonists, broadening its market scope.

Market Size and Trends

Global Market Valuation

As of 2022, the global respiratory drugs market was valued at approximately $45 billion (source: Grand View Research [1]). Ipratropium bromide commands a significant segment within this, estimated at $800 million to $1.2 billion, driven by large volume sales in developed countries and ongoing demand in developing regions.

Market Segmentation

- By Formulation:

- MDI (most common)

- Nebulizer solutions

- By Application:

- COPD (largest segment)

- Asthma

- By Distribution Channel:

- Hospitals (major buyers)

- Retail pharmacies

Market Dynamics

- Increasing COPD prevalence: According to WHO, COPD affects over 200 million globally, with an annual rise, particularly in Asia-Pacific. This expanding patient base sustains demand for inhaled bronchodilators like ipratropium.

- Pricing and reimbursement policies: In markets like the U.S. and EU, reimbursement frameworks support continued utilization of cost-effective medications.

- Generic dominance: The patent of ipratropium bromide expired in multiple territories, leading to a proliferation of generics, which has driven down prices but increased volume sales.

Competitive Landscape

Major manufacturers include Boehringer Ingelheim (original developer), Teva, Mylan, Cipla, and Sun Pharma. Market share is largely dictated by manufacturing scale, distribution networks, and pricing strategies. The liquid and inhaler formulations are often commoditized, with branded products competing primarily on reputation and trust.

Emerging competitors focus on fixed-dose combination therapies, enhancing convenience and adherence, especially in COPD management.

Regulatory and Patent Outlook

While some patents on ipratropium bromide have expired or are near expiry, incremental patents on specific formulations or delivery devices may provide temporary exclusivity advantages. Regulatory pathways for generic approvals remain accessible, intensifying price competition and pressuring margins.

Sales Projections (2023-2030)

Methodology

Projections incorporate epidemiological data, current market sizes, competitive dynamics, and macroeconomic factors. Scenario analyses account for potential regulatory shifts, technological innovations, and market penetration of newer therapies.

Base Case Projection

- 2023: Approximately $1 billion global sales

- 2024-2026: Compound annual growth rate (CAGR) of 3%, driven by growing COPD prevalence and continued utilization, especially in Asia-Pacific.

- 2027-2030: Anticipated slowdown to a CAGR of 1-2%, as newer long-acting agents and combination inhalers gain market share at the expense of short-acting formulations.

By 2030, global sales are forecasted to reach $1.2 billion to $1.4 billion. This plateau anticipates market saturation, especially in developed countries, where generic competition and patent expiries have already maximized volume.

Regional Variations

- North America: Stable, mature market with moderated growth (~2%) due to high penetration and availability of alternative therapies.

- Europe: Similar trends with stable demand and slight declines in some countries due to increased use of long-acting agents.

- Asia-Pacific: The fastest growth segment (~5-6% CAGR), driven by rising COPD prevalence, expanding healthcare access, and generic availability.

- Latin America and Africa: Emerging markets with significant growth potential but constrained by affordability and infrastructure challenges.

Key Market Drivers and Constraints

Drivers:

- Growing global COPD and asthma burdens.

- Cost-effectiveness of generic formulations.

- Integration into combination inhalers.

- Increasing awareness and diagnosis rates.

Constraints:

- Competition from long-acting bronchodilators and inhaled corticosteroid combinations.

- Shift toward newer, once-daily formulations improving adherence.

- Pricing pressures in highly regulated markets.

- Saturation in mature regions.

Emerging Trends and Opportunities

- Innovative Delivery Devices: Development of smart inhalers and breath-actuated devices enhances patient adherence and monitoring, potentially enabling premium pricing for such formulations.

- Combination Therapies: Partnerships and co-formulations with long-acting beta-agonists or corticosteroids augment therapeutic efficacy, capturing further market share.

- Market Expansion: Focused efforts in rural and underserved regions in Asia and Africa present growth avenues, especially with tiered pricing strategies.

- Regulatory Adaptation: Navigating approvals for new indications or novel formulations can extend product lifecycle.

Conclusion

Ipratropium bromide remains a critical component within respiratory therapeutics, especially for patients with moderate COPD and asthma. Despite the emergence of advanced therapies, its cost-efficiency, established efficacy, and broad availability sustain its sales. The global market is projected to experience gentle growth, primarily propelled by emerging markets, while mature regions observe stabilization or decline.

Strategic focus on innovation, competitive pricing, and expanding access will be vital for stakeholders aiming to maximize commercial potential over the coming decade.

Key Takeaways

- Market Size & Trends: The global ipratropium bromide market is valued at approximately $1 billion with a projected CAGR of 2-3% until 2030.

- Growth Drivers: Increasing COPD prevalence, cost advantages of generics, and integration into combination therapies.

- Challenges: Competition from newer agents, patent expiries, and pricing pressures.

- Opportunities: Adoption of advanced inhaler devices, emerging markets expansion, and novel formulations.

- Strategic Outlook: Stability in mature markets, sustained growth in developing regions, with innovation and market access expansion as critical success factors.

FAQs

1. What factors influence the market demand for ipratropium bromide?

Demand is primarily driven by COPD prevalence, treatment guidelines endorsing inhaled bronchodilators, patient adherence strategies, and the availability of cost-effective generics.

2. How does patent expiration impact the sales of ipratropium bromide?

Patent expiries facilitate generic entry, reducing prices and enabling higher volume sales but limit branded market share and profit margins.

3. Are there upcoming innovations that may threaten ipratropium bromide’s market position?

Yes, once-daily long-acting bronchodilators and combination inhalers offer improved adherence, potentially shifting prescriptions away from short-acting agents like ipratropium.

4. Which regions present the most growth opportunities?

Asia-Pacific, Latin America, and Africa represent high-growth opportunities due to rising disease burden, improving healthcare infrastructure, and cost-sensitive markets favoring generics.

5. What strategies should manufacturers adopt to sustain sales?

Invest in innovative delivery devices, develop combination therapies, expand access in emerging markets, and optimize manufacturing costs to maintain competitiveness.

References

[1] Grand View Research. “Respiratory Drugs Market Size, Share & Trends Analysis Report” (2022).

More… ↓