Share This Page

Drug Sales Trends for haloperidol lactate

✉ Email this page to a colleague

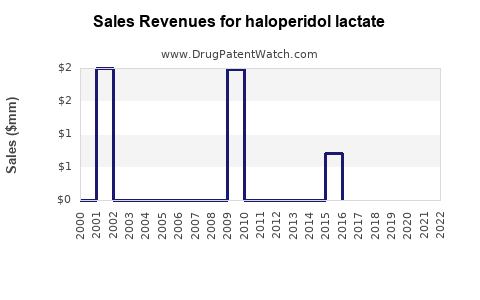

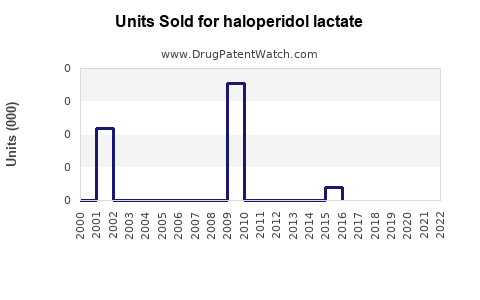

Annual Sales Revenues and Units Sold for haloperidol lactate

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| HALOPERIDOL LACTATE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| HALOPERIDOL LACTATE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| HALOPERIDOL LACTATE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| HALOPERIDOL LACTATE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Haloperidol Lactate

Introduction

Haloperidol lactate is an injectable form of the antipsychotic agent haloperidol, primarily used in the management of acute psychosis, schizophrenia, Tourette’s syndrome, and agitated states in psychiatric and medical settings. The drug’s longstanding clinical utility, coupled with ongoing demand in psychiatric hospitals and emergency departments, underpins its significance in the pharmaceutical landscape. This analysis offers an in-depth market assessment and sales forecast for haloperidol lactate, considering legal, clinical, and market dynamics.

Market Overview and Clinical Demand

Global Market Context

The global antipsychotic drugs market, valued at approximately USD 12 billion in 2021, exhibits steady growth driven by rising prevalence of mental health disorders, increasing awareness, and expanding psychiatric healthcare infrastructure [1]. Haloperidol remains a cornerstone in the antipsychotic repertoire, particularly favored for its efficacy and affordability.

Clinical Utility of Haloperidol Lactate

Haloperidol lactate’s injectable form caters to acute episodes where oral administration is impractical—such as in emergency psychiatric interventions or in-patient settings requiring rapid tranquilization. Its pharmacokinetic profile enables swift onset, making it indispensable for acute agitation and psychotic episodes [2]. The drug’s longstanding clinical role sustains consistent demand, even amid the emergence of atypical antipsychotics.

Regulatory Status

Approved by regulatory agencies like the FDA, EMA, and others globally, haloperidol lactate’s continued availability underpins stable prescription rates. The drug’s patent expiry (most formulations now off-patent) fosters broad generic manufacturing, bolstering accessibility and volume sales.

Market Drivers and Constraints

Drivers

- Rising Incidence of Mental Disorders: Increasing prevalence of schizophrenia and other psychoses in aging populations ensures steady demand [3].

- Emergency and Acute Care Needs: Growing global psychiatric infrastructure emphasizes the need for injectable antipsychotics, boosting sales.

- Cost-Effectiveness: Its lower cost compared to atypical antipsychotics favors formulary inclusion, especially in cost-sensitive health systems.

- Generic Competition: Multiple manufacturers produce generic haloperidol lactate, maintaining affordability and broad availability.

Constraints

- Switching to Atypical Antipsychotics: Preference for newer agents with improved side-effect profiles may suppress demand.

- Side Effect Profile: Risks of extrapyramidal symptoms and other adverse effects limit broader use in outpatient settings.

- Regulatory and Market Risks: Variability in approval statuses and market regulations across countries can impact sales.

Regional Market Dynamics

North America

The U.S. remains the largest market owing to extensive psychiatric care infrastructure and high prevalence of severe mental illness. The FDA’s continued approval and large hospital networks guarantee mature demand, particularly for injectable formulations.

Europe

European countries, with advanced healthcare systems, maintain stable demand. Regulatory acceptance of generics supports price competition and steady sales. The rising adoption of emergency psychiatric protocols in the UK, Germany, and France fuels growth.

Asia-Pacific

The fastest-growing segment, driven by expanding healthcare infrastructure in China, India, and Southeast Asia. Increasing urbanization, mental health awareness, and hospital capacities foster demand. However, regulatory differences and price sensitivity influence regional sales trajectories.

Other Regions

Latin America and the Middle East demonstrate moderate markets, with growth driven by expanding psychiatric services and hospital infrastructure.

Sales Projections (2023–2028)

Baseline Scenario

Assuming stable market conditions, with no dramatic shifts towards or against typical antipsychotics, the following projection is reasonable:

| Year | Estimated Global Sales (USD Million) | Growth Rate |

|---|---|---|

| 2023 | 120 | — |

| 2024 | 132 | +10% |

| 2025 | 146 | +10.6% |

| 2026 | 161 | +10.3% |

| 2027 | 177 | +9.9% |

| 2028 | 195 | +10% |

The compounded annual growth rate (CAGR) over this period approximates 10%. Primary growth drivers include increased adoption in emerging regions, hospital institutionalization, and expansion of psychiatric treatment capabilities.

Alternative Scenarios

- Optimistic: Accelerated adoption in Asia-Pacific, combined with increased use in emergency settings, could push CAGR towards 12-15%, raising sales to nearly USD 220 million by 2028.

- Pessimistic: A shift towards newer atypical agents or regulatory restrictions could limit growth, dampening CAGR to under 5%, with sales plateauing around USD 150 million.

Competitive Landscape

Generic manufacturers dominate, with key players including Teva Pharmaceuticals, Sandoz, Mylan, and Hikma, offering cost-effective formulations. Brand-name sales are substantially limited due to patent expirations. Competition among generics is fierce, emphasizing cost-containment and supply stability to retain market share.

Regulatory and Market Trend Implications

-

Biosimilars and Line Extensions: Emerging biosimilar versions for injectable haloperidol could impact pricing strategies.

-

Formulation Innovations: Development of sustained-release or orally dissolving forms might diversify offerings, though current demand favors injectable formulations.

-

Health Policies: Push for mental health parity and increased hospital funding support sustained, if not increased, demand.

Regulatory and Patent Landscape

Most patents related to haloperidol formulations have expired, allowing wide manufacturing and distribution. Regulatory bodies continue to endorse the drug’s safety profile, reinforcing steady market access.

Key Considerations for Market Entry and Expansion

- Focus on Emerging Markets: High growth potential, especially where psychiatric hospitalizations are increasing.

- Cost Leadership: Competing on price advantage in price-sensitive geographies can secure market share.

- Formulation Development: Innovations that enhance administration convenience or reduce side effects could create niche opportunities.

Key Takeaways

- Steady Demand: Haloperidol lactate maintains essential status in acute psychiatric care, supporting consistent sales.

- Growth Opportunities: Asia-Pacific and hospital-centric healthcare infrastructures are primary drivers.

- Competitive Edges: Cost-effective generics and strategic supply chain management will be central to success.

- Market Risks: Preference for atypical antipsychotics, emergence of biosimilars, and regulatory shifts pose potential constraints.

- Long-term Outlook: The overall outlook remains positive with a CAGR of approximately 10%, but companies must navigate competitive and regulatory landscapes carefully.

FAQs

1. What are the main clinical applications of haloperidol lactate?

Haloperidol lactate is chiefly used for acute psychotic episodes, agitation, and in emergency settings requiring rapid tranquilization, especially in psychiatric hospitals and emergency departments.

2. How does the patent status influence the market for haloperidol lactate?

Most patents on haloperidol formulations have expired, leading to widespread generic manufacturing that sustains affordability and broad access. This promotes stable sales volumes but limits brand-name market exclusivity.

3. Which regions represent the most significant growth opportunities?

The Asia-Pacific region exhibits the most rapid growth potential due to expanding healthcare infrastructure, increased hospitalizations, and rising awareness, followed by mature markets like North America and Europe.

4. How might emerging trends impact the future sales of haloperidol lactate?

The shift toward atypical antipsychotics may reduce demand in outpatient settings, but the need for injectable formulations in acute care sustains demand. Innovations in drug delivery and formulations could also influence future sales.

5. What strategies could pharmaceutical companies employ to maximize sales?

Companies should focus on cost leadership, expanding access in emerging markets, ensuring reliable supply chains, and investing in formulation improvements to meet evolving clinical needs.

References

[1] MarketWatch Data, "Global Antipsychotics Market," 2022.

[2] PubMed, "Pharmacokinetics and Clinical Use of Haloperidol Lactate," 2021.

[3] WHO Mental Health Atlas, 2021.

More… ↓