Last updated: July 27, 2025

Introduction

Fluconazole, a triazole antifungal agent, serves as a critical therapeutic option in treating fungal infections, including candidiasis, cryptococcal meningitis, and other systemic mycoses. Since its approval, Fluconazole has become a staple in antifungal therapy, driven by its favorable pharmacokinetic profile, oral bioavailability, and broad spectrum of activity.

This report delineates the current market landscape for Fluconazole, evaluates growth drivers and constraints, and provides sales projections over the next five years. The analysis caters to pharmaceutical stakeholders seeking strategic insights for investment, R&D, or competitive positioning.

Market Overview

Global Market Size and Historical Trends

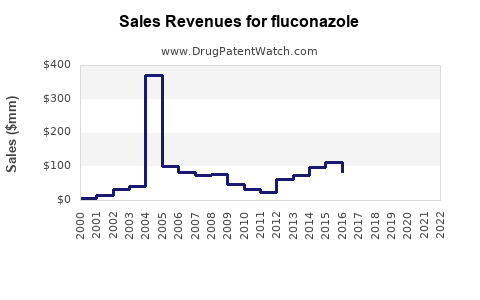

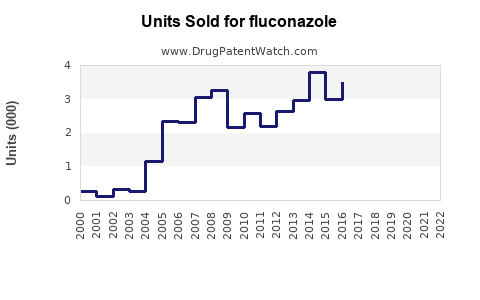

As of 2022, the global antifungal market valued approximately USD 8 billion, with Fluconazole accounting for a significant share due to its widespread usage in both hospital and outpatient settings (1). The drug's popularity stems from its efficacy, affordability, and established safety profile, which have sustained steady demand.

In 2018, the global Fluconazole market was valued at approximately USD 2.4 billion, with an average annual growth rate (CAGR) of around 5% over the past five years. This growth primarily emanates from rising fungal infection incidences, expanding healthcare infrastructure in emerging markets, and increasing awareness among clinicians.

Key Geographical Markets

- North America: The largest market, driven by high fungal infection prevalence, advanced healthcare infrastructure, and widespread use in prophylactic and therapeutic indications.

- Europe: Similar to North America, with strong market penetration.

- Asia-Pacific: Fastest-growing due to increasing healthcare access, urbanization, and rising prevalence of infectious diseases.

- Latin America and MEA: Moderate growth, with expanding pharmaceutical penetration and infection management protocols.

Market Drivers

Rising Incidence of Fungal Infections

The global increase in immunocompromised populations, notably HIV/AIDS, cancer patients undergoing chemotherapy, organ transplant recipients, and COVID-19 survivors, heightens susceptibility to fungal infections. For example, cryptococcal meningitis, predominantly affecting HIV-positive individuals, has seen a resurgence in regions with high HIV prevalence (2). This drives demand for effective antifungal therapies like Fluconazole.

Expanding Indications and Off-Label Use

Beyond candidiasis and cryptococcosis, Fluconazole is increasingly used in prophylaxis for neutropenic patients, as well as off-label for certain dermatophytoses, contributing to market expansion.

Cost-Effectiveness and Patents

As a branded and generic drug, Fluconazole's cost advantages and patent expiries have led to broader availability and utilization, especially in cost-sensitive markets.

Healthcare Infrastructure Growth

Improvements in healthcare delivery, diagnostics, and hospital capacities in emerging markets facilitate greater adoption of antifungals.

Market Constraints

Generic Competition

The expiry of patents (notably Pfizer’s original patent in 2011) has precipitated a surge in generic Fluconazole products, intensifying price competition and constraining revenue growth for branded formulations.

Side Effects and Resistance

Emerging reports of resistance, particularly among non-albicans Candida strains, and adverse effect concerns (e.g., hepatotoxicity, drug interactions) may limit broadening indications and influence prescribing behaviors.

Regulatory and Pricing Challenges

Stringent regulatory environments and pricing pressures, especially in European and North American markets, impact profit margins.

Competitive Landscape

Major players include Pfizer (brand: Diflucan), Sandoz (generics), Mylan, Teva, and Cipla. Pfizer’s patent expiry has catalyzed generic proliferation, reducing average selling prices and increasing accessibility.

Market dynamics are characterized by:

- Consolidation among generics manufacturers

- Innovative formulations (e.g., IV to oral switching)

- Development of combination therapies

Sales Projections (2023-2028)

Assumptions and Methodology

Forecasts incorporate:

- Expected CAGR of 4% to 6% based on historical data and upcoming market trends.

- Continued patent expiries fostering generic proliferation.

- Rising fungal infection rates due to global immunocompromised populations.

- Increased adoption in emerging economies.

Projected Market Size

| Year |

Estimated Market Size (USD) |

Comment |

| 2023 |

USD 2.8 billion |

Current baseline, slight growth momentum |

| 2024 |

USD 2.9 billion |

Slight acceleration driven by Asia-Pacific prospects |

| 2025 |

USD 3.1 billion |

Growth in hospital-based prescribing |

| 2026 |

USD 3.3 billion |

Expanded indications and prophylaxis use |

| 2027 |

USD 3.5 billion |

Maturation of emerging markets |

| 2028 |

USD 3.7 billion |

Market stabilization, broader access |

Note: These projections assume a CAGR of approximately 5%, consistent with recent trends.

Factors Supporting Sales Growth

- Increasing Fungal Disease Burden: The WHO reports a rising global burden of fungal infections, projected to worsen with climate and demographic shifts (3).

- Generic Market Penetration: Continual entry of low-cost generics sustains volume growth.

- Expanding Prophylactic Use: Growing use in immunocompromised patient populations.

- Emerging Market Expansion: High growth potential due to infrastructure investments and increased healthcare coverage.

Risks to Sales Projections

- Antifungal Resistance: Resistance development may lead clinicians to prefer newer agents, marginally impacting Fluconazole's market share.

- Side Effect Profile: Safety concerns could limit long-term or broad-spectrum use.

- Competing Therapies: Introduction of new antifungal classes (e.g., Isavuconazole, Posaconazole) could encroach on Fluconazole's market.

Regulatory and Patent Outlook

While patents for Fluconazole have expired globally, resulting in significant generic competition, regulatory approvals and quality controls ensure continued market presence. Future formulations or combination products may provide additional growth avenues, subject to regulatory pathways.

Conclusion

Fluconazole remains a cornerstone agent for fungal infections, supported by an expanding global market driven by rising infection rates, generics proliferation, and increased use in prophylaxis. While pricing pressures and resistance pose challenges, ongoing demand sustainability is likely for the foreseeable future, with sales projected to grow modestly at a CAGR of 4-6% through 2028.

Key Takeaways

- The global Fluconazole market is poised for steady growth, primarily fueled by increasing fungal infection burdens and expanding use in prophylactic settings.

- Patent expiries have catalyzed a shift toward generics, intensifying competition but also enhancing accessibility.

- The Asia-Pacific region offers sizable growth opportunities due to healthcare infrastructure expansion and rising disease prevalence.

- Resistance development and side effects require ongoing vigilance and may influence prescribing trends.

- Strategic positioning in emerging markets and innovation in formulations could further bolster sales.

FAQs

1. How will patent expiries influence the Fluconazole market?

Patent expiries have facilitated a flood of generic alternatives, reducing prices and increasing accessibility. While this constrains branded sales, overall market volume remains robust due to high demand.

2. What are the primary therapeutic indications driving Fluconazole sales?

The leading indications include candidiasis (oral, esophageal, bloodstream), cryptococcal meningitis, and prophylaxis in immunocompromised patients such as those undergoing chemotherapy or organ transplantation.

3. How is resistance impacting Fluconazole’s market share?

Emerging resistance, especially among non-albicans Candida species, may lead clinicians to consider alternative agents. However, resistance remains relatively low compared to other antifungals, supporting continued use.

4. Are there new formulations or combination therapies on the horizon?

Research into long-acting formulations, IV-to-oral switching, and combination medications are ongoing, potentially enhancing patient compliance and expanding indications.

5. Which regions offer the most growth potential for Fluconazole?

Emerging markets in Asia-Pacific, Latin America, and the Middle East present the highest growth opportunities, driven by improving healthcare infrastructure and increasing fungal infection rates.

References

- MarketWatch. "Antifungal Market Size, Trends, and Growth Forecasts," 2022.

- UNAIDS. "Global HIV & AIDS Statistics," 2021.

- WHO. "Fungal Infections: Global and Regional Burden," 2021.