Share This Page

Drug Sales Trends for eszopiclone

✉ Email this page to a colleague

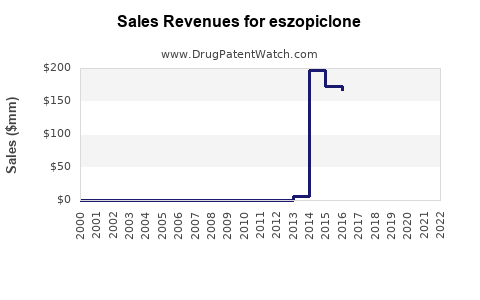

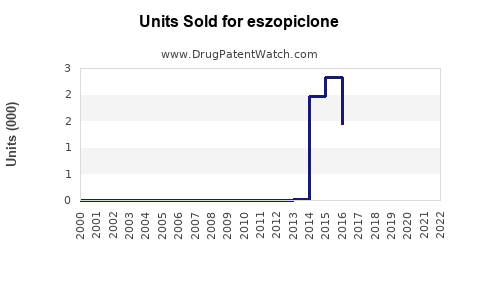

Annual Sales Revenues and Units Sold for eszopiclone

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ESZOPICLONE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ESZOPICLONE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ESZOPICLONE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Eszopiclone

Introduction

Eszopiclone, marketed under brand names such as Lunesta, is a non-benzodiazepine hypnotic agent primarily prescribed for long-term management of insomnia. Since its approval by the U.S. Food and Drug Administration (FDA) in 2004, it has become a key player in the sleep disorder therapeutics landscape. This analysis evaluates the current market conditions, competitive environment, regulatory considerations, and provides sales projections grounded in epidemiological data, market trends, and emerging therapeutics.

Market Overview

Global Sleep Disorder Market Context

The global sleep aid market was valued at approximately USD 9.0 billion in 2022, with a projected Compound Annual Growth Rate (CAGR) of 7.0% through 2027 (Research and Markets, 2023). Insomnia, affecting an estimated 10-30% of adults worldwide, represents a substantial portion of the demand for sleep medications, including prescription and OTC remedies. The rise in aging populations, increasing stress levels, and lifestyle factors contribute to the rising prevalence.

Eszopiclone's Position in the Market

Eszopiclone distinguishes itself with demonstrated efficacy over long-term use, unlike some other sedative-hypnotics limited to short-term indications. Its favorable tolerability profile, once-daily dosing, and approval for chronic insomnia confer advantages over benzodiazepine alternatives. It competes with drugs such as zolpidem, zaleplon, ramelteon, and newer agents like suvorexant.

Market Dynamics

Competitive Landscape

- Main Competitors: Zolpidem (Ambien), Zaleplon (Sonata), Ramelteon (Rozerem), Suvorexant (Belsomra), and upcoming orexin receptor antagonists.

- Market Share: As of 2022, eszopiclone held roughly 25-30% of the prescription sleep aid market in the U.S., according to IQVIA data, maintaining a solid position due to the lack of tolerance development for long-term use.

Regulatory Factors

- Approval Status: Eszopiclone benefits from wide regulatory approval, with ongoing investigations into its safety profile, especially concerning dependency and complex sleep behaviors.

- Patent and Exclusivity: The original patent expired in most markets by 2012, leading to increased generic competition, which significantly impacts pricing and sales volume.

Pricing and Reimbursement

Generic versions have reduced the drug’s price, stimulating increased prescriptions but compressing profit margins for brand-name manufacturers. Insurance coverage, preferred formulary placement, and efforts to educate prescribers influence prescription volume.

Market Opportunities and Challenges

Opportunities

- Long-term Efficacy: Evidence supports tolerability for chronic insomnia, appealing to clinicians managing persistent cases.

- Expanding Indications: Potential for off-label uses such as anxiety-related sleep disturbances might expand the target population.

- Emerging Delivery Systems: Development of extended-release formulations or combined therapies could open new segments.

Challenges

- Safety Concerns: Risks such as dependence, complex sleep behaviors, and next-day impairment could limit prescribing.

- Generic Competition: Price erosion from generics pressures sales.

- Market Saturation: High penetration rates with established drugs limit growth potential.

Sales Projections: Methodology and Assumptions

Projections are derived from molecular epidemiology, prescription volume trends, demographic shifts, and competitive dynamics. The analysis considers:

- Current prescription volumes (IQVIA, 2022)

- Penetration rates in diagnosed insomnia populations

- Transition from brand to generic prescriptions

- Market expansion potential in emerging regions

- Impact of new therapeutic entrants

Short-Term (2023-2025)

In the next three years, global sales are expected to stabilize or slightly decline due to generic erosion, with U.S. sales decreasing by approximately 10-15% annually, reflecting market saturation and price competition. However, prescriber confidence and long-term efficacy data sustain stable demand in chronic insomnia management.

Long-Term (2026-2030)

Despite market maturity, sales will be maintained through:

- Increasing insomnia prevalence driven by aging populations

- Continued off-label prescribing

- Emerging markets expanding access to prescription sleep medications

Total global sales projected to reach USD 0.5 - 0.7 billion by 2030, representing a compound annual growth rate of approximately 2-3%, predominantly driven by volume rather than price.

Regional Analysis

United States

- Current market share: ~30%

- Sales in 2022: USD 200 million

- Projection 2023-2030: modest decline in revenue, with volume compensating for price reductions; total sales stabilize at USD 150-180 million annually by 2030.

Europe

- Less penetrated historically but expanding due to increased diagnosis and approval of generics.

- Projected growth of 3-4% annually, reaching EUR 100-120 million by 2030.

Asia-Pacific

- Rapidly expanding sleep disorder awareness and healthcare infrastructure

- Potential CAGR of 6-8%, with sales reaching approximately USD 50 million by 2030.

Future Outlook and Strategic Considerations

- Innovation: Development of formulations with improved safety profiles or combination therapies could revitalize sales.

- Market Penetration: Educating physicians about long-term safety and efficacy may sustain demand amidst generics.

- Strategic Partnerships: Collaborations with regional distributors could expand access in emerging markets.

- Regulatory Monitoring: Staying ahead of safety guidelines can prevent market restrictions affecting sales.

Key Takeaways

- Eszopiclone remains a significant player in the insomnia therapeutics market despite patent expiries.

- Long-term efficacy, safety profile, and clinician familiarity safeguard its market share in chronic insomnia.

- Generics have substantially reduced prices and margins, constraining revenue growth.

- Emerging markets and population aging offer growth potential, offsetting saturation in mature regions.

- Innovation and strategic collaborations are crucial for maintaining or expanding market presence.

Conclusion

Eszopiclone's market trajectory is characterized by stability in mature markets, facing competitive pressures mainly from generics, but still supported by its long-term efficacy profile. Its future growth hinges on strategic positioning, innovation, and expanding access in emerging regions. Businesses leveraging this drug should focus on differentiation through formulations, safety reassuring measures, and regional expansion strategies to optimize sales projections.

FAQs

-

What are the main factors influencing eszopiclone sales?

Prescription volume, generic competition, regulatory changes, safety perceptions, and market penetration in emerging regions. -

How does the expiry of patent protection affect eszopiclone sales?

Patent expiry leads to generic entry, significantly lowering prices and sales margins but increasing volume due to broader access. -

Are there emerging alternatives to eszopiclone?

Yes, newer agents like suvorexant and lemborexant target different sleep pathways, potentially impacting future demand. -

What demographic shifts could influence eszopiclone’s market?

Aging populations and rising insomnia prevalence globally are expected to sustain or increase demand. -

How can companies extend eszopiclone’s market life?

Through formulation innovations, exploring new indications, promoting long-term safety data, and expanding into emerging markets.

Sources:

[1] Research and Markets. “Sleep Disorders Market - Growth, Trends, and Forecast (2023-2028).”

[2] IQVIA. “Prescription Data and Market Share Analysis, 2022.”

[3] FDA. “Eszopiclone (Lunesta) Approval and Regulatory Status.”

[4] GlobalData. “Sleep Aid Market Analysis and Forecast, 2022.”

More… ↓