Share This Page

Drug Sales Trends for desloratadine

✉ Email this page to a colleague

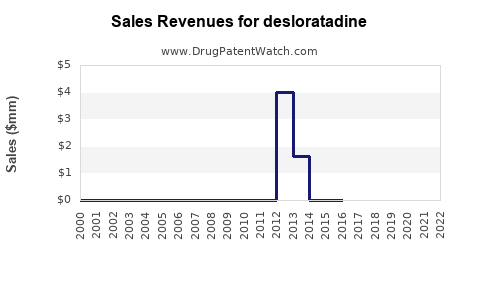

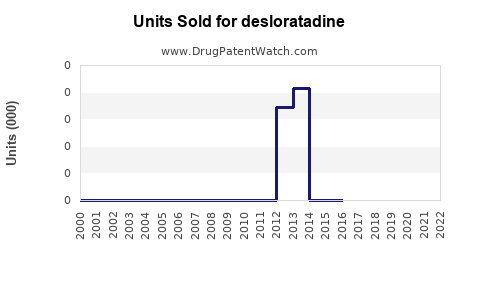

Annual Sales Revenues and Units Sold for desloratadine

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| DESLORATADINE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| DESLORATADINE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| DESLORATADINE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| DESLORATADINE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| DESLORATADINE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Desloratadine

Introduction

Desloratadine, a second-generation antihistamine marketed under brands such as Clarinex, is widely utilized in the management of allergic rhinitis and chronic idiopathic urticaria. Recognized for its non-sedative profile and prolonged efficacy, desloratadine holds a significant position within the global allergy treatment market. This analysis examines the current market landscape, growth drivers, competitive environment, and future sales trajectories of desloratadine, providing strategic insights for stakeholders.

Market Overview

Global Market Size

The global allergy immunology therapeutics market, encompassing antihistamines like desloratadine, was valued at approximately USD 19 billion in 2022. Anticipated CAGR stands at around 7% from 2023 to 2030, driven primarily by rising allergy prevalence, expanding aging populations, and increased awareness of allergic conditions. Within this sector, second-generation antihistamines such as desloratadine account for a significant share owing to their improved safety and tolerability profiles.

Segment-Specific Dynamics

Desloratadine occupies a niche within the second-generation antihistamines segment, which also includes loratadine, cetirizine, and levocetirizine. The segment is distinguished by superior safety profiles, minimal sedation, and longer duration of action, making it preferable in both pediatric and adult populations.

Geographic Market Distribution

- North America: Largest market, driven by high allergy prevalence and established healthcare infrastructure.

- Europe: Significant growth potential due to increasing allergy awareness.

- Asia-Pacific: Fastest-growing region, attributed to rising allergen exposure, urbanization, and expanding pharmaceutical markets.

Market Drivers

Rising Prevalence of Allergic Diseases

With recent epidemiological studies indicating that up to 30-40% of adults and children suffer from allergic rhinitis globally, demand for effective antihistamines like desloratadine is escalating. Urban lifestyle, pollution, and climate change further contribute to increasing allergy incidence.

Shift Towards Non-Sedative Antihistamines

Clinicians and patients favor second-generation antihistamines over first-generation counterparts due to their minimal sedation and non-sedative profiles. Desloratadine’s proven safety makes it a preferred choice, supporting persistent demand.

Expanding Indications and Off-label Use

Recent clinical trials suggest potential off-label benefits of desloratadine in other allergic conditions, which could expand its therapeutic use and consequently, its market size.

Regulatory Trends

Regulatory bodies across many jurisdictions have approved desloratadine for both adult and pediatric use, facilitating widespread market access. Patent expirations and generic entry, notably after 2020, have also increased affordability and accessibility.

Competitive Landscape

Key Players

- Merck & Co. (Clarinex): Proprietary brand dominance but faced generic competition.

- Sandoz (generic formulations): Increased market penetration post-patent expiry.

- Mitsubishi Tanabe Pharma: Alternative formulations and regional presence.

Market Share Dynamics

Post-patent expiry, generics dominate sales volumes in many markets, although branded versions continue to command premium pricing in developed regions owing to brand loyalty and perceived quality.

Innovation and Formulations

Emerging formulations include fast-dissolving tablets, combination therapies, and pediatric-friendly formulations, aiming to expand usage and improve patient compliance.

Sales Projections

Methodology and Assumptions

Forecasts utilize CAGR estimates based on historical sales data, demographic trends, and upcoming regulatory approvals. Consideration is given to potential market saturation, generic competition, and regional expansion.

Projected Market Growth

-

2023-2028: The global desloratadine market is projected to grow from USD 0.9 billion in 2022 to approximately USD 1.4 billion by 2028, reflecting a CAGR of around 8%. The growth leverages increased allergy prevalence, generic proliferation, and expanded indications.

-

Regional Expansion: Notably, Asia-Pacific is expected to see highest growth rates (~10-12%), propelled by rising allergy incidences and healthcare reforms.

Segment-Specific Sales

-

Branded vs. Generic: While branded sales are declining due to generics, high-volume regional markets such as India and China will account for substantial growth, especially through local manufacturing and distribution.

-

Pediatric and Adult Markets: Pediatric formulations and over-the-counter (OTC) availability in various countries will continue to drive sales across demographics.

Impact of Potential Developments

- New Formulations: Introduction of novel, combination, or extended-release formulations could disrupt current sales.

- Regulatory Changes: Approvals for new indications or formulation routes can substantially expand market footprint.

Challenges and Risks

- Patent Expiry and Generics: Price erosion due to generic competition may suppress margins.

- Regulatory Barriers: Variations in regulatory approvals across regions may delay market entry.

- Market Saturation: Mature markets may experience stagnation, limiting growth potential.

- Emerging Alternatives: Biologics and novel therapeutics targeting allergic diseases could impact antihistamine demand.

Strategic Recommendations

- Focus on Regional Expansion: Prioritize emerging markets with rising allergy prevalence.

- Invest in Formulation Innovation: Develop pediatric-friendly, long-acting, or combination therapy formulations.

- Leverage Patent Strategies: Secure supplementary patents and exclusivities to extend market life.

- Enhance Clinical Evidence: Support research on broader indications and combination uses to diversify revenue streams.

Key Takeaways

- The desloratadine market is poised for sustained growth, driven by rising allergy prevalence and preferences for non-sedative antihistamines.

- Generics dominate volumes post-patent expiry, but branded formulations maintain a premium segment in developed markets.

- Asia-Pacific represents an attractive region for expansion, with projected double-digit growth rates.

- Innovation in formulations and expanding indications will be critical for maintaining competitive advantage.

- Strategic focus on emerging markets and product differentiation will unlock future sales potential.

FAQs

1. What are the main factors influencing desloratadine sales globally?

The primary factors include rising prevalence of allergic conditions, patient preference for non-sedative antihistamines, patent expirations leading to generic competition, and regional healthcare infrastructure development.

2. How does patent expiry impact desloratadine market sales?

Patent expiry facilitates generic entry, decreasing prices and potentially lowering brand sales. However, it also broadens market access and increases overall consumption through affordability.

3. What future market opportunities exist for desloratadine?

Opportunities include expanding indications (e.g., chronic cough or other allergic disorders), formulation innovations for pediatric or fast-acting relief, and regional expansion into emerging markets.

4. Which regions are expected to drive the most growth for desloratadine?

Asia-Pacific is forecasted to experience the highest growth, owing to increasing allergy awareness and expanding pharmaceutical infrastructure. North America and Europe will sustain steady demand due to established markets and advanced healthcare systems.

5. What competitive strategies can companies adopt to increase desloratadine sales?

Investments in novel formulations, geographic expansion, clinical research for additional indications, aggressive marketing, and strategic partnerships to improve distribution channels can enhance market position and sales.

Sources

[1] MarketWatch, "Global Allergy Immunology Therapeutics Market Size, Share & Trends," 2022.

[2] Allied Market Research, "Second-Generation Antihistamines Market Forecast," 2022-2030.

[3] FDA and EMA pharmaceutical approval databases, 2022.

[4] IQVIA, "Pharmaceutical Market Analysis," 2022.

More… ↓