Last updated: July 27, 2025

Introduction

Clonidine, a centrally acting alpha-2 adrenergic agonist, has established its role in managing hypertension, ADHD, opioid withdrawal, and certain pain conditions. Since its FDA approval in 1974, clonidine's therapeutic applications have expanded, reflecting evolving clinical needs and patent landscape. Given this context, a comprehensive market analysis and sales projection outline the current dynamics shaping clonidine's commercial trajectory, factoring in competitive forces, regulatory environment, and emerging therapeutic uses.

Market Overview and Key Drivers

Therapeutic Uses and Market Demand

Clonidine's primary indications include treatment of hypertension, ADHD, opioid withdrawal symptoms, and off-label uses like sleep disorders and vasomotor symptoms. Hypertension remains the largest driver, representing a significant share of the clonidine market, especially among elderly populations and those unable to tolerate first-line antihypertensives. The ADHD segment, increasingly prevalent among pediatric and adult populations, also presents growth potential, notably with the introduction of extended-release formulations.

Opioid dependence treatment has gained prominence amidst ongoing opioid crises, fueling demand for clonidine as an adjunct therapy. Moreover, the off-label use for opioid withdrawal management and anxiety disorders, although less regulated, continues to contribute to sales.

Competitive Landscape

Clonidine faces competition from multiple drug classes wherever it is indicated. In hypertension, ACE inhibitors, calcium channel blockers, and beta-blockers dominate, while in ADHD, stimulant medications (e.g., methylphenidate, amphetamines) hold market supremacy. The emergence of newer non-stimulant therapies (e.g., guanfacine) has intensified competition in ADHD management. Additionally, the development pipeline includes novel alpha-2 agonists like dexmedetomidine, which serve specific niches such as sedation and anesthesia, indirectly affecting clonidine's adult market.

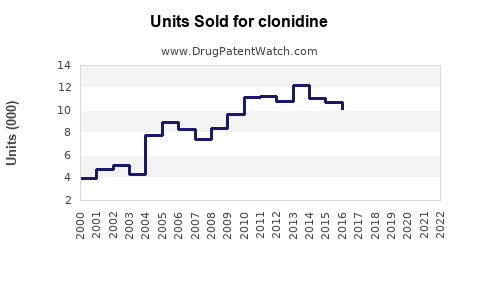

Patent expirations of immediate-release formulations have ushered in generic competition, exerting downward pressure on prices but broadening access, which sustains volume sales.

Regulatory Environment and Patent Status

Clonidine's patent expiration has facilitated widespread generic manufacturing, reducing costs and expanding accessibility but limiting brand-specific growth. The approval of sustained-release formulations and combination therapies offers incremental market opportunities, especially in ADHD and hypertension management.

Regulatory agencies oversee off-label use prescriptions, influencing formulations' markets. Recent guidelines emphasizing personalized medicine and combination therapies may introduce new utilization frameworks, impacting sales.

Market Size and Segmentation

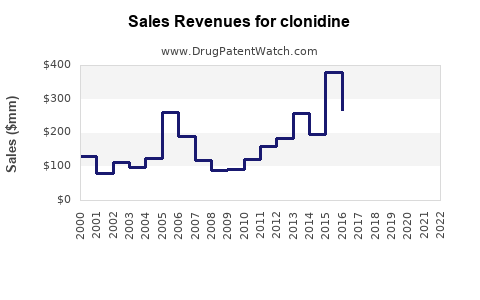

Global Market Valuation

The global clonidine market was valued at approximately US$600 million in 2022, with a compound annual growth rate (CAGR) forecasted around 3-4% through 2028. North America remains the dominant region, reflecting the high prevalence of hypertension and ADHD, along with robust healthcare infrastructure.

Regional Insights

- North America: Accounts for over 50% of sales, driven by large patient populations, increased awareness, and insurance coverage. The focus on managing opioid withdrawal adds to demand.

- Europe: Growing market due to rising hypertension prevalence and adoption of combination therapies.

- Asia-Pacific: Expected to witness the fastest growth (CAGR >5%) owing to expanding healthcare infrastructure, increasing hypertension rates, and off-label use expansion.

Sales Projection Methodology

Forecasts incorporate historical sales data, market penetration rates, demographic trends, regulatory developments, and competitive dynamics. Assumptions include:

- Continued generic competition maintaining price pressures.

- Incremental adoption of extended-release formulations in ADHD and hypertension.

- Off-label use trends influenced by evolving clinical guidelines.

- Potential disruptions or innovations from alternative therapies.

Future Sales Projections (2023–2028)

| Year |

Estimated Global Sales (US$ million) |

Key Drivers |

| 2023 |

600 |

Stable base, generic competition, steady demand in hypertension |

| 2024 |

620 |

Slight growth in ADHD segment, increased off-label use |

| 2025 |

650 |

Expanded use in opioid withdrawal, new formulations |

| 2026 |

680 |

Growing adoption in Asia-Pacific, strategic marketing |

| 2027 |

710 |

Penetration into emerging markets, increased prescribing |

| 2028 |

740 |

Market maturation, additional indications |

This projection demonstrates a gradual upward trajectory, primarily driven by emerging markets, formulations innovation, and off-label use extensions.

Key Challenges and Opportunities

Challenges

- Pricing and reimbursement pressures: Governments and insurers seek cost-effective replacements, constraining price growth.

- Generic erosion: Widespread patent expirations and biosimilar entries limit brand differentiation.

- Competition from newer agents: Dexmedetomidine and other alpha-2 agonists offer alternative options with different safety profiles.

- Off-label use regulation: Increasing scrutiny may influence prescribing patterns.

Opportunities

- Formulation innovations: Development of extended-release and combination pills can boost adherence and market share.

- Expanding indications: Research into novel therapeutic applications (e.g., PTSD, anxiety) presents potential growth avenues.

- Strategic partnerships: Collaborations with specialty clinics and mental health providers can enhance market penetration.

- Emerging markets' expansion: Rapid growth in healthcare infrastructure provides access to previously underserved populations.

Conclusion

Clonidine remains a vital pharmacological agent with a resilient market base, primarily driven by hypertension and ADHD therapeutics. Market growth will be moderate but steady, supported by demographic factors, formulation innovations, and expansion into emerging markets. However, the commercial landscape faces challenges from generic competition and evolving treatment paradigms. Companies leveraging formulation developments and strategic market positioning can optimize clonidine’s sales potential over the coming years.

Key Takeaways

- Steady Market Demand: Clonidine’s applications in hypertension and ADHD ensure consistent global demand, especially with supplementary formulations.

- Regional Growth Opportunities: Asia-Pacific and emerging markets offer significant growth potential due to healthcare expansion and increasing disease prevalence.

- Formulation Innovation as a Catalyst: Extended-release and combination drugs can drive adherence and capture new segments.

- Competitive Dynamics: Generic competition exerts downward pressure on prices; innovation and brand differentiation remain crucial.

- Regulatory and Off-label Trends: Monitoring policy developments and off-label prescribing patterns is essential to anticipate market shifts.

FAQs

1. How will patent expiration affect clonidine sales?

Patent expirations have led to widespread generic availability, reducing prices and pressure on brand-name sales. While this can diminish per-unit revenue, it broadens access and maintains volume sales, especially in cost-sensitive markets.

2. Are there new formulations of clonidine that could boost sales?

Yes. Extended-release formulations and combination therapies are being developed, which improve patient adherence and expand indications, potentially increasing sales.

3. What are the main competitors to clonidine in its primary indications?

For hypertension, ACE inhibitors, calcium channel blockers, and beta-blockers are key competitors. In ADHD, stimulant medications like methylphenidate and amphetamines dominate, alongside non-stimulant options such as guanfacine.

4. How does the opioid crisis influence clonidine’s market?

Clonidine is increasingly prescribed off-label to manage opioid withdrawal symptoms, which expands its off-label usage and overall demand in addiction medicine.

5. What future therapeutic developments could impact clonidine?

Novel alpha-2 agonists, alternative antihypertensive agents, and therapies for mental health disorders such as PTSD could alter the competitive landscape, either complementing or substituting clonidine use.

Sources:

[1] GlobalData. “Clonidine Market Analysis” (2022).

[2] IQVIA IMS Health. “Pharmaceutical Market Review” (2022).

[3] U.S. Food and Drug Administration (FDA). “Drug Approvals and Labeling”.

[4] MarketWatch. “Hypertension Drugs Market Trends” (2023).

[5] Allied Market Research. “Neurovascular and Psychiatry Drug Market Forecast” (2023).