Last updated: July 28, 2025

Introduction

Clonazepam, a benzodiazepine with potent anticonvulsant and anxiolytic properties, dominates a significant segment within the pharmacotherapy landscape for neurological and psychiatric conditions. Approved by the FDA in 1975 for epilepsy, panic disorder, and other anxiety-related conditions, it remains a pivotal therapeutic agent owing to its efficacy and established safety profile. This analysis assesses the current market dynamics, growth drivers, competitive landscape, regulatory environment, and provides sales forecasts for Clonazepam over the next five years.

Market Overview

Global Market Size

The global benzodiazepine market, encompassing Clonazepam, was valued at approximately USD 635 million in 2022, with Clonazepam constituting a substantial proportion due to its broad clinical applications. The rising prevalence of epilepsy, anxiety disorders, and panic attacks drives sustained demand (Grand View Research, 2022).

Key Indications

Clonazepam’s primary indications include:

- Epilepsy: Particularly absence seizures, myoclonic seizures.

- Panic Disorder and Anxiety: Approved for acute and prophylactic treatment.

- Movement Disorders: Off-label uses in restless legs syndrome and certain tremors.

Market Segments

The market is segmented into:

- By Application: Epilepsy, anxiety disorders, off-label use.

- Formulation: Oral tablets, solutions, injectables (less common).

- End User: Hospitals, specialized clinics, outpatient pharmacies.

Geographical Breakdown

North America accounts for roughly 45% of the market, driven by high prevalence of target indications and advanced healthcare infrastructure. Europe contributes around 30%, with growth fueled by increased awareness. Asia-Pacific, poised for rapid expansion, comprises about 15%, owing to expanding healthcare access and rising neurological disorder prevalence. Rest of World (RoW) holds approximately 10%.

Market Drivers

Growing Prevalence of Neurological and Psychiatric Disorders

- Epilepsy: Globally, an estimated 50 million people have epilepsy, with a significant percentage on benzodiazepine therapy (WHO, 2021).

- Anxiety and Panic Disorders: Affect approximately 264 million people worldwide, increasing demand for effective anxiolytics such as Clonazepam.

Shift Toward Long-term Management

Clonazepam’s long half-life (approximately 30-40 hours) makes it favorable for chronic management, fostering sustained demand.

Regulatory Approvals and Off-Label Uses

Emerging evidence supports extension into new therapeutic areas, potentially expanding market segments. However, regulatory restrictions due to abuse potential temper growth.

Patent and Market Exclusivity

Commercial availability remains generic-based, limiting pricing power but ensuring widespread accessibility.

Competitive Landscape

Leading Manufacturers

- Teva Pharmaceuticals

- Mylan (now part of Viatris)

- Sandoz (Novartis)

- Sun Pharma

- Lupin

Generic manufacturers dominate due to patent expiration, with minimal brand-name players remaining.

Emerging Competition

- Novel compounds targeting specific seizure types or anxiety subpopulations.

- Non-benzodiazepine therapies such as SSRIs and antiepileptics offering alternative treatment options.

Regulatory Challenges

- Increased scrutiny over dependence and abuse potential.

- Stringent prescribing guidelines reduce over-prescription and complicate market expansion.

Regulatory Environment

Regulations significantly influence market trajectory:

- Controlled Substance Classification: Clonazepam is Schedule IV in the US, imposing restrictions on prescribing, dispensing, and monitoring.

- Withdrawal of certain formulations to limit misuse.

- Regional variations in scheduling and prescribing laws influence market size and access.

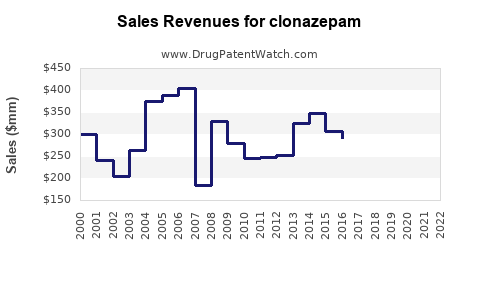

Sales Projections (2023–2028)

Using a compounded annual growth rate (CAGR) of approximately 4%—accounting for rising prevalence, generic penetration, and consistent clinical adoption—the following projections are outlined:

| Year |

Estimated Market Size (USD Million) |

| 2023 |

680 |

| 2024 |

710 |

| 2025 |

740 |

| 2026 |

770 |

| 2027 |

800 |

| 2028 |

832 |

Assumptions:

- Continued prevalence of target conditions.

- Steady adoption and generic competition maintaining affordable pricing.

- Regulatory environment remaining stable with no major restrictions.

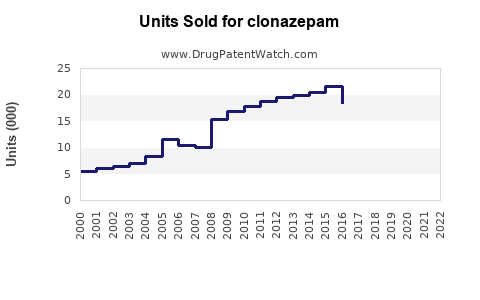

This modest growth trajectory reflects the mature status of the Clonazepam market, tempered by regulatory constraints and the rise of alternative therapies.

Key Market Challenges

- Abuse and Dependence Risks: Stringent prescribing policies may restrict access, limiting volume growth.

- Market Saturation: Widespread generic availability constrains pricing power.

- Off-label Use Limitations: Regulatory scrutiny over off-label prescribing can impact extended market segments.

- Regional Disparities: Variations in regulatory and healthcare infrastructure impact market penetration.

Market Opportunities

- New Formulations: Long-acting or depot formulations could enhance patient management.

- Digital Monitoring: Implementation of digital adherence tools to optimize therapeutic outcomes.

- Market Expansion in Emerging Economies: Rising healthcare investments facilitate access expansion.

Conclusion

Clonazepam’s market remains stable with moderate growth prospects, driven by its established efficacy in epilepsy and anxiety disorders. While competition and regulatory challenges temper rapid expansion, the drug’s long-term role in neurological and psychiatric therapy ensures consistent demand. Strategic positioning in emerging markets, innovation in delivery systems, and adherence to regulatory standards may sustain growth momentum.

Key Takeaways

- The global Clonazepam market is valued at approximately USD 635 million, with a projected CAGR of around 4% through 2028.

- Its primary users are patients with epilepsy and anxiety disorders, with North America leading in consumption.

- Patent expirations have led to widespread generic availability, capping pricing growth but improving accessibility.

- Regulatory restrictions aimed at curbing abuse pose barriers but ensure responsible use.

- Future growth hinges on innovations in formulations, digital health integration, and expansion into underserved markets.

Frequently Asked Questions

1. What factors influence the declining sales growth of Clonazepam?

Regulatory restrictions, risk of dependence, the emergence of alternative therapies, and market saturation limit rapid sales growth. Stringent prescribing guidelines reduce overprescription, impacting volume.

2. How does the regulatory environment affect Clonazepam sales globally?

As a Schedule IV controlled substance, Clonazepam faces strict regulations that deter misuse but also restrict prescribing flexibility. Variations across regions impact market access and sales volume.

3. What are the key opportunities for expanding Clonazepam’s market share?

Innovations in drug delivery (long-acting formulations), digital adherence tools, and strategic entry into emerging economies can foster market expansion.

4. How does generic competition influence pricing strategies?

Transforming into a generic market reduces prices and margins, emphasizing efficiency and volume over premium pricing. Manufacturers focus on process optimization and market penetration.

5. Are there significant off-label uses of Clonazepam impacting the market?

Yes, off-label uses in movement disorders and sleep disturbances contribute to steady demand but are subject to regulatory oversight, which may limit further growth.

Sources:

[1] Grand View Research, "Benzodiazepines Market Analysis," 2022.

[2] World Health Organization, "Epilepsy Factsheet," 2021.

[3] U.S. Food and Drug Administration, Drug Approvals and Regulations.