Share This Page

Drug Sales Trends for chlorhexidine

✉ Email this page to a colleague

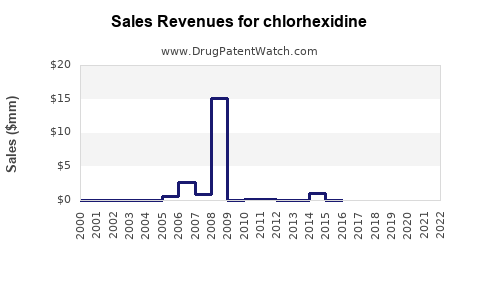

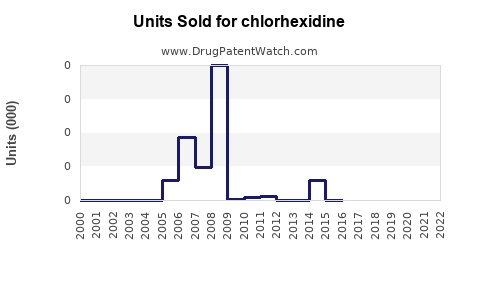

Annual Sales Revenues and Units Sold for chlorhexidine

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| CHLORHEXIDINE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| CHLORHEXIDINE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| CHLORHEXIDINE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| CHLORHEXIDINE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| CHLORHEXIDINE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Chlorhexidine

Introduction

Chlorhexidine is a broad-spectrum antimicrobial agent widely utilized in healthcare, oral hygiene, and veterinary applications. As a cornerstone in infection control, its market dynamics are influenced by evolving healthcare standards, rising antimicrobial resistance, and expanding applications. This report provides a comprehensive market analysis and sales projection framework for chlorhexidine, emphasizing key market drivers, competitive landscape, regulatory variables, and future growth potential.

Market Overview

Product Profile and Applications

Chlorhexidine’s primary forms include solutions, gels, mouthwashes, and topical creams. It is extensively used for:

- Oral health: Gingivitis treatment, preoperative mouth rinses.

- Surgical antisepsis: Skin disinfection before procedures.

- Water treatment: Disinfection in industrial and municipal water supplies.

- Veterinary medicine: Skin infections, wound cleaning.

- Others: Catheter and device coating, wound care.

Market Size and Growth Trends

The global chlorhexidine market was valued at approximately USD 350 million in 2022. It is projected to grow at a compounded annual growth rate (CAGR) of 4-6% through 2030, driven by increasing adoption in medical procedures, rising awareness of infection control, and expanding applications in emerging markets.

Market Drivers

Rising Healthcare-Associated Infections (HAIs)

The surge in HAIs globally prompts heightened use of chlorhexidine. WHO estimates over 1.7 billion patients affected annually, with infection prevention measures, including chlorhexidine-based protocols, integral to reducing morbidity and mortality.[1]

Aging Population and Chronic Diseases

An aging demographic profile, particularly in North America and Europe, leads to increased surgeries and wound care requirements, bolstering demand for antiseptics like chlorhexidine.[2]

Regulatory Approvals and Recommendations

Health agencies, including CDC and WHO, endorse chlorhexidine for preoperative skin preparation and oral health, reinforcing its market presence and adoption.[3]

Market Entry and Expansion in Emerging Economies

Growing healthcare infrastructure in Asia-Pacific, Latin America, and Africa elevates market penetration, expanding chlorhexidine’s reach beyond traditional markets.

Antimicrobial Resistance Concerns

Amid rising antibiotic resistance, antiseptics such as chlorhexidine are increasingly favored for infection control, though concerns about resistance development warrant ongoing surveillance.

Competitive Landscape

Major Players

Key companies include:

- Johnson & Johnson (Iodine-based antiseptics)

- 3M Healthcare

- DENTAID

- GlaxoSmithKline

- B. Braun Melsungen AG

These entities invest in R&D, regional distribution, and branding efforts to maintain competitive advantage.

Product Differentiation

Innovations focus on formulations with enhanced stability, reduced cytotoxicity, and improved patient compliance (e.g., alcohol-free mouthwashes).

Market Entry Barriers

Regulatory approval, clinical validation, and established brand loyalty pose hurdles for new entrants.

Regulatory and Safety Considerations

Approval Status

Chlorhexidine-containing products generally possess regulatory approval in key markets (FDA, EMA, WHO). However, restrictions on concentration levels and labeling aim to mitigate adverse effects.

Adverse Effects and Limitations

Potential side effects include staining of teeth, altered taste, and rare hypersensitivity. Resisting overuse mitigates resistance development, preserving efficacy.

Sales Projections

Short-term (2023-2025)

- Expected moderate growth (~4%) due to sustained usage in hospitals and dental practices.

- Increased product launches targeted at emerging markets.

Mid-term (2026-2028)

- Accelerated growth (~5-6%) driven by expanding applications in catheter and implant coatings, as well as wound dressings.

- Regulatory endorsements further supporting adoption.

Long-term (2029-2030)

- Market reaches approximately USD 510-550 million.

- Innovation and broader applications in infection prevention foster sustained growth.

Regional Forecasts

- North America & Europe: Stable growth driven by strict infection control protocols.

- Asia-Pacific: High CAGR (~6%) owing to expanding healthcare infrastructure.

- Latin America & Africa: Increasing adoption, albeit at varying rates, with growth projections of 4-6%.

Challenges and Opportunities

Challenges

- Potential for microbial resistance.

- Competition from alternative antiseptics like povidone-iodine, alcohol-based formulations.

- Regulatory scrutiny regarding safety profiles.

Opportunities

- Development of novel formulations with enhanced safety.

- Integration into medical device coatings and wound management systems.

- Increased research funding leading to new indications.

Conclusion

The chlorhexidine market stands on a robust growth trajectory, propelled by global infection control needs, expanding applications, and rising healthcare investments, particularly in developing regions. While competition and safety concerns pose challenges, innovation and strategic market penetration efforts will be pivotal in sustaining growth.

Key Takeaways

- Steady Growth: The global chlorhexidine market is projected to grow at a CAGR of 4-6% through 2030, reaching over USD 550 million.

- Driving Forces: The rise in healthcare-associated infections, aging populations, and expanding applications underpin market expansion.

- Regional Dynamics: Asia-Pacific and Latin America exhibit high growth potential, driven by healthcare infrastructure development.

- Innovation and Regulatory Influence: Product innovation and adherence to safety standards are critical to maintaining market share.

- Competitive Landscape: Leading firms are investing in R&D and regional expansion to capitalize on the market opportunities.

FAQs

-

What are the main applications of chlorhexidine?

Chlorhexidine is predominantly used in oral healthcare (gingivitis treatment, mouthwashes), surgical skin disinfection, wound care, and in water treatment processes. -

How does antimicrobial resistance impact chlorhexidine’s market?

While resistance concerns are emerging, chlorhexidine remains a mainstay in infection control. Continuous surveillance and formulation improvements aim to mitigate resistance development. -

What regions are expected to see the fastest market growth?

The Asia-Pacific region is forecasted to experience the highest CAGR, driven by expanding healthcare infrastructure and increasing awareness of infection prevention. -

Are there safety concerns associated with chlorhexidine?

Yes, potential side effects include teeth staining, taste disturbances, and rare hypersensitivity reactions. Regulatory agencies set concentration limits to mitigate risks. -

What future innovations could influence the chlorhexidine market?

Product formulations with enhanced safety, products integrated into medical devices, and new indications such as infection prevention in implant coatings are promising avenues for growth.

References

[1] World Health Organization. (2021). Infection prevention and control.

[2] United Nations. (2022). World Population Ageing.

[3] CDC. (2022). Guidelines for Disinfection and Sterilization.

More… ↓