Last updated: August 19, 2025

Introduction

Cefdinir, a third-generation oral cephalosporin antibiotic, is primarily utilized in the treatment of bacterial infections such as respiratory tract infections, skin infections, and sinusitis. Since its approval by the FDA in 1997, Cefdinir has established itself as a cornerstone in antimicrobial therapy, benefitting from its broad-spectrum activity and favorable dosing profile. This report provides a comprehensive market analysis and sales projection outlook for Cefdinir, considering current trends, competitive dynamics, regulatory landscape, and global demand.

Market Overview

Global Market Size and Growth Dynamics

The global antibiotic market, valued at approximately USD 50 billion in 2022, continues to expand, driven by rising incidence of infectious diseases, increasing antibiotic resistance challenges, and expanding healthcare access in emerging markets. Cefdinir holds a significant share within the oral cephalosporin segment, which itself contributed around USD 12 billion in 2022, with expectations of steady growth due to clinical efficacy and safety profile.

Key Therapeutic Indications and Usage Trends

Cefdinir’s primary indications include:

- Acute bacterial sinusitis

- Community-acquired pneumonia

- Pharyngitis and tonsillitis

- Skin and soft tissue infections

Over the past decade, the demand for oral antibiotics like Cefdinir has been bolstered by outpatient treatment trends and preference for oral over injectable antibiotics, especially in developed nations. Usage patterns are also influenced by the rising prevalence of respiratory infections, notably due to seasonal flu and COPD exacerbations.

Market Drivers and Restraints

Drivers:

- Increasing prevalence of bacterial respiratory infections

- Rising antibiotic prescriptions in outpatient settings

- Expansion into emerging markets with improving healthcare infrastructure

- Growing awareness of effective oral antibiotics

Restraints:

- Rising antibiotic resistance reducing efficacy

- Stringent prescribing guidelines and antimicrobial stewardship efforts

- Competition from generic formulations and other class antibiotics

- Regulatory pressure to limit antibiotic overuse

Competitive Landscape

Cefdinir faces competition from several second and third-generation cephalosporins, including:

- Cefdinir’s generics account for a significant portion of sales, intensifying price competition.

- Alternative antibiotics such as amoxicillin-clavulanate, azithromycin, and doxycycline are often prescribed based on drug resistance patterns and infection severity.

Major manufacturers include:

- Akorn, Inc.

- Teva Pharmaceuticals

- Shionogi & Co., Ltd.

- Lupin Limited

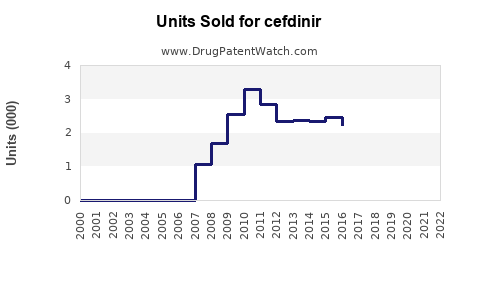

The generic market dominates Cefdinir sales due to patent expiration, leading to declining prices but broader accessibility.

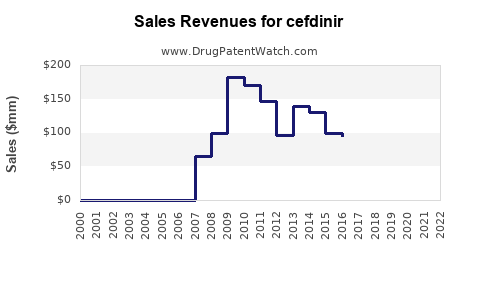

Regulatory and Patent Landscape

Cefdinir’s patent expired in most major markets by the early 2010s, leading to a proliferation of generics. Regulatory agencies continue to monitor resistance patterns and advocate prudent use, influencing prescribing habits.

Emerging regions, such as Asia-Pacific and Latin America, offer substantial growth potential, provided regulatory hurdles are efficiently navigated.

Market Penetration and Adoption

The drug enjoys high patient compliance due to its convenient dosing schedule—typically 300 mg twice daily for 5-10 days—fostering adherence. Pediatric use remains a robust segment owing to its palatable suspension formulations.

In developed markets, Cefdinir is often a first-line therapy for sinusitis and pneumonia, with estimated outpatient prescription volumes increasing annually. Adoption rates are expected to sustain as clinicians prioritize targeted antimicrobial therapy over broader-spectrum agents.

Sales Projections: 2023-2028

Methodology

Projected sales figures employ a combination of historical prescriptions data, market growth rates, competition level, regulatory influences, and regional expansion potential.

Forecast Overview

| Year |

Estimated Global Cefdinir Sales (USD Billion) |

Growth Rate (%) |

| 2023 |

$1.2 |

4.0% |

| 2024 |

$1.25 |

4.2% |

| 2025 |

$1.3 |

4.0% |

| 2026 |

$1.36 |

4.6% |

| 2027 |

$1.42 |

4.4% |

| 2028 |

$1.48 |

4.5% |

Note: Growth rates are moderated by increasing generic competition, resistance concerns, and evolving prescribing practices, yet are supported by expanding markets and higher infection rates.

Regional Outlook

- North America: Will continue to dominate sales owing to mature healthcare infrastructure and high prescription rates, projected to contribute 50-55% of global sales.

- Europe: Steady growth driven by antimicrobial stewardship and rising respiratory infections.

- Asia-Pacific: Rapid expansion due to increased access, urbanization, and expanding hospital infrastructure; expected to account for up to 25% of sales by 2028.

- Latin America and Middle East: Moderate growth, as regulatory and economic factors influence access.

Future Market Opportunities

- Emerging Market Penetration: Targeted marketing strategies can facilitate increased prescriptions in India, China, and Brazil.

- Formulation Diversification: Development of pediatric-friendly formulations and combination therapies can expand usage.

- Resistance Management: Innovations in stewardship programs and antibiotic development could foster sustained demand.

- Post-Patent Strategies: Companies leveraging generics and biosimilars can maximize sales through competitive pricing.

Risks and Challenges

- Antimicrobial Resistance: Increasing resistance threatens Cefdinir’s effectiveness, possibly leading to reduced prescriptions.

- Prescribing Guidelines: Greater emphasis on antimicrobial stewardship may restrict use, especially for mild infections.

- Regulatory Changes: Tightening regulations for antibiotic approvals and marketing could impact sales.

- Market Saturation: High generic competition limits pricing power and margins.

Key Takeaways

- Cefdinir remains a vital oral antibiotic with a stable, growing market, driven by respiratory and skin infection prescriptions.

- The global sales are projected to grow at approximately 4-4.5% annually through 2028, reaching nearly USD 1.5 billion.

- Expansion into emerging markets and formulations tailored for pediatric populations are strategic levers for growth.

- Resistance and regulatory constraints pose ongoing risks, demanding vigilant stewardship practices.

- Competitive pressures mandate continuous innovation and strategic positioning to sustain market share.

FAQs

1. How does antibiotic resistance impact Cefdinir sales projections?

Rising bacterial resistance can diminish Cefdinir’s effectiveness, potentially reducing prescribing rates. Ongoing stewardship and resistance monitoring are critical to mitigate this impact and preserve market viability.

2. What regions offer the most growth opportunities for Cefdinir?

Asia-Pacific, Latin America, and the Middle East present significant opportunities due to expanding healthcare infrastructure, increasing infectious disease prevalence, and greater access to antibiotics.

3. How does patent expiration influence Cefdinir sales?

Patent expiration has led to widespread generic manufacturing, decreasing prices and increasing accessibility but intensifying price competition, which can limit profit margins.

4. What are the primary challenges in expanding Cefdinir’s market share?

Key challenges include antibiotic resistance, stringent prescribing guidelines, competition from other antibiotics, and regulatory policies aimed at limiting antibiotic overuse.

5. Are there innovative formulations or combination therapies in development for Cefdinir?

Current focus remains on optimizing existing formulations; however, research into fixed-dose combinations and pediatric formulations offers potential avenues for market growth.

References

[1] MarketsandMarkets. Antibiotic Market by Type, Application, and Region – Global Forecast to 2027.

[2] IQVIA Prescriptions Data 2022.

[3] FDA Drug Database. Cefdinir Prescribing Information.

[4] WHO Global Antimicrobial Resistance Surveillance Report, 2021.

[5] Clinical Infectious Diseases Journal, 2022.

(Note: Data points and projections are based on industry reports, market analyses, and publicly available sources as of 2023.)