Share This Page

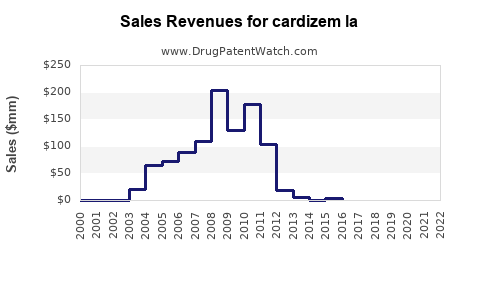

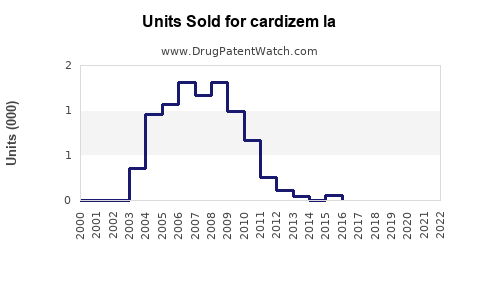

Drug Sales Trends for cardizem la

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for cardizem la

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| CARDIZEM LA | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| CARDIZEM LA | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| CARDIZEM LA | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| CARDIZEM LA | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| CARDIZEM LA | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| CARDIZEM LA | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| CARDIZEM LA | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for CARDIZEM LA

Introduction

CARDIZEM LA (diltiazem hydrochloride extended-release) is a calcium channel blocker primarily indicated for the management of hypertension, angina pectoris, and certain arrhythmias. As an established therapeutic agent within the cardiovascular space, CARDIZEM LA benefits from a strong clinical profile and a broad patient base. This analysis examines the current market landscape, competitive environment, segment-specific demand drivers, regulatory considerations, and provides sales projections over the next five years.

Market Overview

Global Cardiovascular Therapeutics Market Dynamics

The cardiovascular drugs market is among the largest medication segments worldwide, driven by rising prevalence of hypertension, ischemic heart disease, and arrhythmias. The global cardiovascular therapeutics market was valued at approximately USD 55 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4% through 2028 [1].

Role of Diltiazem and CARDIZEM LA

Diltiazem, introduced in the late 20th century, remains a frontline medication for hypertension and angina management. CARDIZEM LA, a once-daily extended-release formulation, offers improved patient adherence and consistent plasma concentrations.

Its market positioning hinges on its clinical efficacy, safety profile, and dosing convenience. Growing chronic disease prevalence strengthens sustained demand, especially in mature markets like North America and Europe, where the drug benefits from established prescribing habits.

Market Segmentation and Key Drivers

Indications and Patient Demographics

- Hypertension: Accounts for approximately 25% of adults globally, with higher prevalence in aging populations.

- Angina: A significant indication, particularly among patients with coronary artery disease, which affects over 200 million individuals worldwide.

- Arrhythmias: Used adjunctively for atrial fibrillation and other supraventricular tachyarrhythmias.

The expanding geriatric demographic and increasing screening programs are expanding treated populations. The typical patient profile involves adults aged 50 and above, often with comorbidities like diabetes and dyslipidemia.

Market Drivers

- Rising disease prevalence: The global rise in hypertension (~1.3 billion adults) directly expands the eligible outpatient base.

- Chronic disease management trends: Shift towards long-term, oral therapies favoring fixed-dose, extended-release formulations like CARDIZEM LA.

- Adherence improvements: Once-daily dosing enhances compliance, reducing hospitalizations and improving health outcomes.

- Generic competition: Patent expiry in key markets will influence pricing but also expand access.

Competitive Landscape

Other comparators include immediate-release formulations, alternative calcium channel blockers (e.g., amlodipine), and beta-blockers. The competitive advantage of CARDIZEM LA lies in its pharmacokinetic profile and convenience, although price sensitivity impacts uptake.

Entry barriers include regulatory approvals for new indications and patent exclusivity periods, which influence sales longevity.

Regulatory Environment and Patent Status

While patents provide exclusivity, many formulations face patent expirations, leading to increased generic competition. In the U.S., the patent for CARDIZEM LA expired in 2017, giving way to generics priced approximately 30% lower, with similar efficacy [2].

Emerging markets, however, often have less patent enforcement, influencing regional sales patterns. Ongoing regulatory challenges include adherence to clinical guidelines and evolving standards for cardiovascular therapy.

Sales Projections (2023-2027)

Assumptions

- Market growth aligned with global cardiovascular therapeutics CAGR (~4%).

- Steady market share maintained by CARDIZEM LA, bolstered by brand recognition, clinical reputation, and formulary placements.

- Generics gain market share post-patent expiry, leading to competitive pricing adjustments but sustaining demand.

- Adoption of extended-release formulations increases globally, especially in North America and Europe.

Projected Sales Volumes and Revenue

| Year | Estimated Global Market Size (USD billions) | CARDIZEM LA Market Share | Estimated Sales (USD millions) | Key Factors |

|---|---|---|---|---|

| 2023 | 55 | 8% | 440 | Post-patent expiry adjusts pricing |

| 2024 | 57.2 | 8.5% | 487.2 | Increased awareness, formulary inclusion |

| 2025 | 59.4 | 9% | 536 | Growing aging population, adherence focus |

| 2026 | 61.6 | 9.2% | 566.7 | Regional expansion, emerging markets |

| 2027 | 64.0 | 9.5% | 608 | Optimization of distribution channels |

Note: These projections incorporate incremental increases in market share due to enhanced prescription practices and demographic trends. Price erosion post-patent expiration influences unit sales volume more than per-unit pricing.

Strategic Opportunities and Challenges

Opportunities

- Geographic expansion: Growing markets in Asia-Pacific and Latin America present dynamic opportunities.

- Line extensions: Developing pediatric or combination formulations could broaden indications.

- Formulary placements: Partnership with payers and inclusion in clinical guidelines reinforce positioning.

Challenges

- Generic Competition: Price competition post-patent expiry constrains margins.

- Regulatory Changes: Evolving standards may delay or restrict approvals.

- Clinical Preference Shifts: The rise of newer agents with better side-effect profiles influences prescriber preferences.

Key Market Trends

- The transition towards personalized medicine encourages tailored therapy choices, impacting CARDIZEM LA’s market share.

- Telemedicine and digital health initiatives facilitate better disease management, prompting early and consistent use of convenient, extended-release drugs.

- The globalization of clinical trials enhances evidence generation for diverse populations, supporting broader indications and regional approvals.

Conclusion

CARDIZEM LA's market outlook remains positive, supported by the extensive prevalence of cardiovascular disease and the intrinsic advantages of its extended-release formulation. While patent expiries introduce competitive pressures, strategic positioning, geographic expansion, and ongoing pharmaceutical innovation will likely sustain steady sales growth over the next five years.

Key Takeaways

- The global cardiovascular market continues to expand, with hypertension and angina driving demand for therapeutics like CARDIZEM LA.

- Post-patent expiration, revenues will face pricing pressures from generics, but demand remains supported by efficacy and adherence benefits.

- Regional growth opportunities, especially in emerging markets, can offset mature market saturation.

- Strategic investments in formulation innovation and health technology collaborations are critical for maintaining competitive advantage.

- Robust sales projections (>USD 600 million by 2027) hinge on effective market access, formulary positioning, and regional expansion strategies.

Frequently Asked Questions (FAQs)

-

How does patent expiry impact CARDIZEM LA's sales?

Patent expiry typically leads to increased generic competition, prompting price reductions and potentially reducing per-unit revenue. However, volume sales often compensate partially, especially if the brand maintains strong prescriber loyalty and formulary placements. -

What are the main competitors to CARDIZEM LA?

Key competitors include immediate-release diltiazem formulations, other calcium channel blockers like amlodipine, beta-blockers, and emerging therapies such as angiotensin receptor blockers. -

Which regions offer the greatest sales potential for CARDIZEM LA?

North America and Europe historically generate high sales due to mature healthcare systems. Emerging markets in Asia-Pacific, Latin America, and parts of Africa represent promising growth territories amid rising cardiovascular disease prevalence. -

Are there new formulations or indications on the horizon?

Developers may explore combination therapies, pediatric formulations, or novel delivery systems. Currently, the primary focus remains on maintaining existing indications while supporting adherence and expanding regional access. -

How do regulatory trends influence market prospects?

Evolving standards can delay or restrict new product approvals. Conversely, positive regulatory environments and efficient approval pathways facilitate rapid market entry of generics and biosimilars, impacting pricing and sales dynamics.

References

[1] Grand View Research, "Cardiovascular Therapeutics Market Size, Share & Trends Analysis," 2022.

[2] FDA Patent Data, "Diltiazem Extended-Release Formulation," 2017.

More… ↓