Last updated: July 28, 2025

Introduction

Budesonide is a potent glucocorticoid with anti-inflammatory properties primarily used in treating respiratory, gastrointestinal, and allergic conditions. It is marketed globally for indications such as asthma, chronic obstructive pulmonary disease (COPD), Crohn’s disease, ulcerative colitis, and allergic rhinitis. Given the evolving healthcare landscape, demographic shifts, and the pharmaceutical pipeline, understanding budesonide’s market dynamics is essential for stakeholders aiming to optimize investments and strategic positioning.

Market Overview

Global Market Size and Growth Trajectory

The global corticosteroids market, within which budesonide is a key player, is projected to reach approximately USD 10.2 billion by 2027, growing at a compound annual growth rate (CAGR) of around 4.5% from 2022 to 2027 [1]. Within this landscape, inhaled and oral formulations of budesonide command significant market share owing to their efficacy and safety profiles, especially for respiratory and inflammatory bowel disease indications.

Key Therapeutic Segments

-

Respiratory Diseases: As the leading segment, inhaled budesonide addresses asthma and COPD, accounting for about 60% of the drug’s sales. Inhalers like Pulmicort (a notable budesonide inhalation product) remain essential in managing pediatric and adult respiratory conditions.

-

Gastrointestinal Disorders: Oral formulations target Crohn’s disease and ulcerative colitis, contributing about 25% to sales. The intra-abdominal delivery’s favorable safety profile enhances treatment adherence.

-

Allergic and Other Conditions: Nasal sprays for allergic rhinitis constitute the remaining share, with products like Rhinocort Aqua (budesonide nasal spray).

Market Drivers

- Surge in respiratory disease prevalence, driven by urbanization, pollution, and smoking habits.

- Increasing diagnosis and treatment of inflammatory bowel diseases globally.

- Rising geriatric population with chronic respiratory and gastrointestinal conditions.

- Expanded approval and adoption of budesonide generics, leading to price reductions and wider access.

Regional Market Distribution

- North America: Largest market share (~40%) due to high healthcare expenditure, advanced healthcare infrastructure, and widespread awareness.

- Europe: Growing at a similar pace, propelled by aging populations and strong pharmaceutical penetration.

- Asia-Pacific: Fastest growth (CAGR of approximately 6%), driven by rising disease prevalence, increasing healthcare spending, and expanding pharmaceutical manufacturing.

Competitive Landscape

Major pharmaceutical companies dominate the budesonide market. Notably:

- AstraZeneca: Markets Pulmicort, a leading inhaled formulation.

- Teva Pharmaceuticals: Offers generic versions, increasing affordability.

- Mylan (now part of Viatris): Supplies generic budesonide products.

- Dr. Reddy’s Laboratories: Emerging markets focus with generic inhaled and oral formulations.

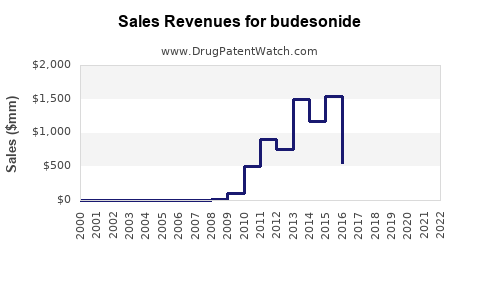

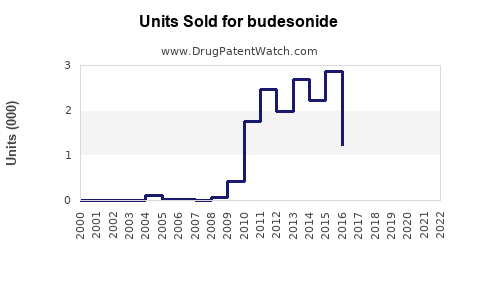

Strategic collaborations, patent expirations, and the launch of combination therapies influence the competitive landscape. The expiration of key patents in the late 2010s facilitated a surge in generic competition, intensifying price competition but expanding market access.

Regulatory and Patent Environment

Patent protections generally extend around 7-12 years post-approval, with some formulations benefiting from supplementary patent protections. The patent cliff and subsequent generics have impacted revenue streams but also increased market penetration.

Regulatory environments in highly regulated economies (FDA in the U.S., EMA in Europe) mandate rigorous clinical data for approvals. Recent approvals for new formulations, delivery devices, and combination therapies expand therapeutic options and reinforce market growth.

Sales Projections (2023–2030)

Methodology

Projections incorporate historical sales data, demographic trends, competitive dynamics, pipeline developments, patent expiry timelines, and unmet clinical needs. Scenario analyses consider potential approvals, market penetration rates, and pricing strategies.

Projected Growth Areas

-

Respiratory Therapy Market: Anticipated CAGR of 4.2% over the next decade, driven by increased COPD and asthma diagnoses and improved inhaler adherence technologies. Pulmicort and equivalent inhalers are expected to sustain dominant market positions.

-

Gastroenterology Sector: A projected CAGR of about 5.0%, fueled by rising IBD incidence globally. The oral and enema formulations of budesonide will benefit from new delivery innovations and expanded indications.

-

Emerging Markets: Forecasted to grow faster (>6%), as trade barriers lower, and healthcare infrastructure improves.

Revenue Forecasts

- 2023: Estimated global sales of inhaled budesonide products approximately USD 3.5 billion; oral formulations around USD 1.2 billion.

- 2025: Combined sales projected to approach USD 6.5 billion, with inhaled forms (~USD 3.9 billion) leading.

- 2030: Expected to reach USD 8–9 billion, assuming sustained generic penetration, introduction of novel formulations, and expansion in emerging markets.

Potential Market Challenges

- Generic Competition: Rapid entry of generics post-patent expiry pressure pricing and profit margins.

- Regulatory Hurdles: Delays in approval of new formulations or indications could affect projections.

- Reimbursement Policies: Variability across regions may impact sales volumes and margins.

- Evolving Treatment Paradigms: Growth in biologic and targeted therapies could reduce reliance on corticosteroids like budesonide.

Strategic Opportunities

- Development of combination inhalers with bronchodilators (e.g., budesonide-formoterol) expands therapeutic use.

- Expanding into pediatric and personalized medicine segments.

- Investing in novel delivery devices to improve adherence.

- Targeting emerging markets with tailored pricing strategies.

Key Takeaways

- Growing Demand: The global market for budesonide is forecast mild to moderate growth, driven by the expanding prevalence of respiratory and inflammatory diseases.

- Market Dynamics: Patent expiries and generic competition will continue to influence revenue streams, prompting innovation and strategic positioning.

- Regional Opportunities: Asia-Pacific and Latin America represent significant growth opportunities, especially through affordable formulations and increased healthcare access.

- Pipeline and Formulation Innovation: New inhaler devices and combination therapies will sustain competitive advantage and drive incremental sales.

- Regulatory Landscape: Monitoring regional regulatory developments remains critical to capitalizing on upcoming approval opportunities.

FAQs

1. What are the primary therapeutic indications for budesonide?

Budesonide is primarily indicated for asthma, COPD, Crohn’s disease, ulcerative colitis, and allergic rhinitis, owing to its anti-inflammatory properties.

2. How does patent expiry affect the market for budesonide?

Patent expiries facilitate generic entry, significantly reducing prices and expanding access but also intensifying competition and pressure on branded product revenues.

3. What are the emerging trends in budesonide formulations?

Innovations include combination inhalers (e.g., budesonide with formoterol), improved inhaler devices for better adherence, and targeted delivery systems.

4. Which regions are expected to drive the highest growth in budesonide sales?

While North America remains the largest market, Asia-Pacific is projected to experience the fastest growth, driven by rising disease prevalence and improving healthcare infrastructure.

5. What are the main challenges facing the budesonide market?

Challenges include competition from generics, regulatory delays, reimbursement hurdles, and the evolving landscape of alternative therapies such as biologics.

References

- Market Research Future. “Corticosteroids Market By Type, Application & Region - Forecast till 2027.”

- Grand View Research. “Inhaled Corticosteroids Market Size, Share & Trends Analysis.”

- Evaluate Pharma. “Pharmaceutical Market Outlook 2022-2030.”

- IQVIA. “Global Prescriber and Sales Data for Respiratory Drugs.”

- FDA & EMA Regulatory Publications.

This comprehensive market analysis provides critical insights into budesonide’s current positioning, future growth opportunities, and strategic considerations essential for industry stakeholders seeking to optimize market penetration and investment returns.