Share This Page

Drug Sales Trends for ascorbic acid

✉ Email this page to a colleague

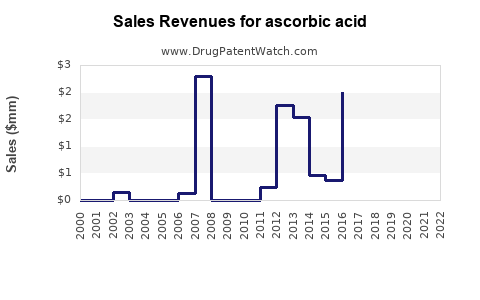

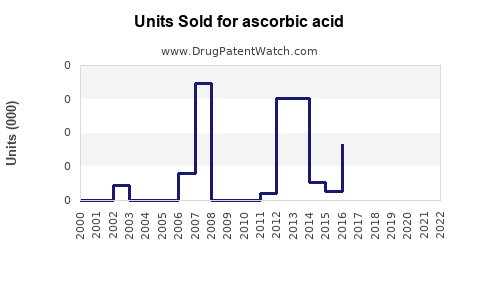

Annual Sales Revenues and Units Sold for ascorbic acid

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ASCORBIC ACID | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ASCORBIC ACID | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ASCORBIC ACID | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| ASCORBIC ACID | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| ASCORBIC ACID | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Ascorbic Acid (Vitamin C)

Introduction

Ascorbic acid, commonly known as vitamin C, ranks among the most widely utilized and researched nutrients globally. Its broad applications in pharmaceuticals, dietary supplements, cosmetics, and food products sustain a resilient demand across markets. This analysis aims to dissect the current market landscape, evaluate growth drivers and constraints, detail competitive dynamics, and project future sales trajectories for ascorbic acid in the upcoming decade.

Market Overview

Global Market Size and Trends

The global ascorbic acid market was valued at approximately USD 1.5 billion in 2022, with a compound annual growth rate (CAGR) projected at around 5% through 2030. Factors underpinning this growth include rising consumer awareness about health and wellness, increased application in food fortification, and expanding pharmaceutical use. The Asia-Pacific region dominates production due to abundant raw material sources and favorable manufacturing costs, notably in China, which supplies over 80% of the world's ascorbic acid [1].

Segmentation Analysis

- By Form: Powder, crystalline, and liquid forms.

- By Application:

- Pharmaceuticals: Used as an immune booster, antioxidant, and in treatment protocols.

- Food & Beverage: Vitamin fortification, preservative, and flavor enhancer.

- Dietary Supplements: Capsules, tablets, and gummies.

- Cosmetics: Skin whitening, anti-aging formulations.

Regulatory Environment

Global food and pharmaceutical standards necessitate strict quality control, notably Good Manufacturing Practices (GMP). Regulatory agencies such as the FDA (U.S.), EFSA (Europe), and CFDA (China) enforce compliance, shaping manufacturing and sales strategies.

Market Drivers

Heightened Health Consciousness & Preventive Care

The COVID-19 pandemic heightened consumer focus on immune health, directly boosting demand for vitamin C across all segments. Dietary supplement sales surged as consumers sought immune support, positioning ascorbic acid as an essential ingredient.

Urbanization and Rising Disposable Income

Growth in urban middle classes in emerging economies has led to increased consumption of fortified foods and nutraceuticals containing ascorbic acid.

Expansion in Pharmaceutical and Parenteral Applications

Ascorbic acid’s antioxidant properties support its use in intravenous formulations, especially in hospitals, fostering steady demand in the healthcare delivery systems.

Technological Advancements

Innovations in extraction methods and stabilization techniques have improved product quality and shelf life, expanding application options.

Market Constraints

Raw Material Price Volatility

Dependence on raw materials like glucose and corn steep liquor, along with fluctuating global sugar prices, can impact manufacturing costs.

Environmental and Regulatory Challenges

Environmental concerns related to chemical synthesis methods (e.g., Reichstein process) are prompting reformulation toward more sustainable production. Regulatory hurdles and quality standards compliance increase operational complexity.

Market Saturation & Competitiveness

High production capacity in Asia, notably China, results in price competition. Small and mid-sized players face challenges in maintaining margins, affecting profitability.

Competitive Landscape

Key Players

Major industry players include DSM, Bluestar, NACALS, and Shandong Lianhua Biotech. Market concentration varies; Chinese suppliers dominate cost-effective bulk production, often supplying both domestic and international markets.

Strategic Movements

- Vertical Integration: Companies are investing in raw material sourcing to mitigate supply chain risks.

- Geographical Diversification: Expanding production facilities in North America and Europe to access new markets and comply with regional regulations.

- Product Innovation: Formulation of stabilized, encapsulated, or microbead forms for diverse applications.

Sales Projections (2023–2032)

Forecasting based on historical data, market drivers, and emerging trends indicates:

- 2023–2025: CAGR of approximately 5%, driven by increased supplement consumption and conventional applications.

- 2026–2030: Slight acceleration to 5.5%, as new markets in Africa and South America expand, coupled with increased pharmaceutical adoption.

- 2031–2032: Potential plateau or slight decline anticipated as market saturation approaches, unless new applications emerge.

Total Sales Forecast

By the end of 2032, cumulative global sales of ascorbic acid are projected to surpass USD 2.3 billion, with growth mainly propelled by expanding dietary supplement markets and ongoing pharmaceutical innovations. Notably, new delivery forms (e.g., nanoparticle encapsulation) and sustainable production methods may add premium value commands.

Emerging Opportunities

- Functional Foods & Beverages: Growing trend towards health-enhancing drinks offers a substantial entry point.

- Personalized Nutrition & Nutricosmetics: Personalized regimens using stabilized vitamin C formulations are gaining traction.

- Sustainable Production Methods: Adoption of biofermentation processes could command premium pricing amidst ecological concerns.

Risks & Uncertainties

- Regulatory shifts regarding synthetic vs. natural sources.

- Potential supply chain disruptions, especially in raw materials.

- Competitive pricing pressures from low-cost Asian producers.

- Market saturation in developed regions.

Key Takeaways

- The global ascorbic acid market demonstrates steady growth, driven by health-conscious consumers, expanding pharmaceutical applications, and food fortification trends.

- Asia-Pacific dominates supply and consumption, with China maintaining a competitive edge.

- Innovations in product form and sustainable production methods will become critical differentiators.

- Market entrants should focus on quality assurance, regulatory compliance, and regional diversification.

- Long-term growth is contingent on evolving consumer preferences, regulatory landscapes, and technological advancements.

Frequently Asked Questions

1. What are the main drivers fueling global demand for ascorbic acid?

Health and wellness consciousness, increasing use in dietary supplements, pharmaceutical applications, and food fortification are primary drivers. The COVID-19 pandemic intensified focus on immune support, further propelling demand.

2. Which regions present the most significant growth opportunities for ascorbic acid?

Emerging markets in Asia, Africa, and Latin America offer substantial opportunities due to rising disposable incomes, urbanization, and evolving regulatory environments favoring supplement and fortified food consumption.

3. How do regulatory frameworks impact the pricing and market entry of ascorbic acid?

Strict quality standards and compliance costs elevate production expenses. Regulatory approval for new applications or formulations can delay market entry, while non-compliance can lead to product recalls and bans.

4. What technological innovations could influence future sales of ascorbic acid?

Advances in biofermentation, stabilization techniques, and encapsulation technology may enable novel delivery forms, improve shelf life, and unlock new applications, thereby boosting sales.

5. Who are the leading manufacturers, and how do they maintain competitiveness?

Major players like DSM and Bluestar leverage extensive R&D, vertical integration, and regional diversification. Cost leadership, product innovation, and quality assurance are key to maintaining market share amidst intense competition.

References

- MarketsandMarkets. “Ascorbic Acid Market by Form, Application, and Region — Global Forecast to 2030.” 2022.

More… ↓