Last updated: July 28, 2025

Introduction

Aripiprazole, marketed under brand names such as Abilify, is an atypical antipsychotic medication mainly indicated for schizophrenia, bipolar disorder, depression augmentation, and irritability associated with autism spectrum disorder. Since its approval by the U.S. Food and Drug Administration (FDA) in 2002, aripiprazole has established itself as a pivotal product within the psychiatric therapeutic landscape. This analysis explores the current market dynamics, growth drivers, competitive landscape, and sales projections for aripiprazole over the next five years, providing insights instrumental for pharmaceutical stakeholders and investors.

Market Overview

The global antipsychotic drugs market was valued at approximately USD 14 billion in 2022, with aripiprazole constituting a significant segment due to its broad therapeutic application and favorable side-effect profile compared to traditional antipsychotics. The drug’s unique mechanism of action, as a partial agonist at dopamine D2 receptors, provides a therapeutic advantage in managing a spectrum of psychiatric disorders, further bolstering its market presence.

In the context of psychiatric disorder prevalence, the World Health Organization reports that schizophrenia affects over 20 million people worldwide, and bipolar disorder impacts an estimated 45 million individuals globally[1]. The rising burden of mental health conditions, coupled with increased awareness and diagnosis, underscores sustained demand for effective pharmacotherapies like aripiprazole.

Market Drivers

Increasing Prevalence of Psychiatric Disorders

Rising incidence rates of schizophrenia and bipolar disorder bolster demand for antipsychotic medications. Urbanization, lifestyle changes, and heightened awareness facilitate earlier diagnosis and treatment initiation, propelling sales.

Expansion of Therapeutic Indications

Initially approved for schizophrenia and bipolar disorder, aripiprazole’s label expansions to include depression augmentation (FDA approval in 2007) and irritability associated with autism (in 2009) have diversified its application scope. The advent of long-acting injectable (LAI) formulations has further enhanced adherence and broadened patient access.

Pediatric and Geriatric Population Growth

The inclusion of pediatric and geriatric populations in treatment algorithms increases the patient pool. Off-label use in certain cases further augments market potential.

Competitive Packaging and Pricing Strategies

Patent protections, alongside strategies like pricing flexibility and co-pay assistance programs, sustain market share amidst generic competition.

Advances in Pharmacovigilance

Improvements in safety profiles and reduction in adverse effects foster confidence among prescribers, maintaining renewal rates.

Market Challenges

Patent Expirations and Generic Competition

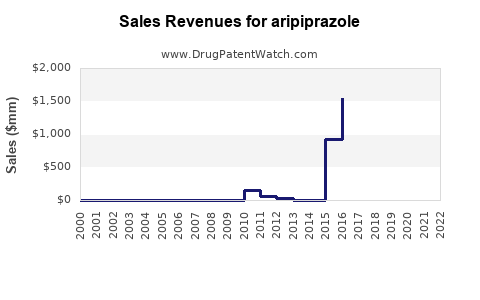

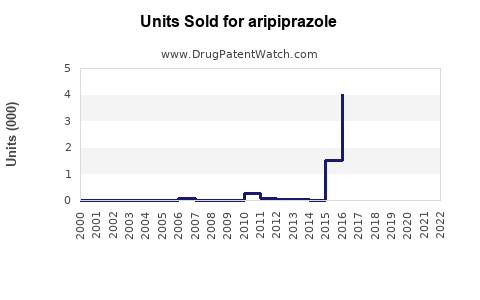

The patent for Abilify expired in 2015 in the U.S., opening the market to generics, which significantly eroded brand sales[2]. However, branded formulations retain premium pricing in certain geographies and specialized indications.

Side-Effect Profile and Safety Concerns

Although generally well-tolerated, aripiprazole's side effects, including akathisia, weight gain, and metabolic disturbances, may limit use in some populations.

Market Saturation

In mature markets like North America and Europe, saturation limits growth; thus, expansion hinges on new indications and formulations.

Regulatory and Reimbursement Dynamics

Changes in healthcare policies, drug pricing regulations, and reimbursement criteria impact sales trajectories.

Regional Market Dynamics

North America

The largest market, driven by high psychiatric disorder prevalence, advanced healthcare infrastructure, and robust pharmaceutical innovation. The U.S. accounts for approximately 70% of global aripiprazole sales[3].

Europe

Significant but slower growth due to reimbursement constraints and market saturation. Nonetheless, regulatory support for newer formulations sustains moderate expansion.

Asia-Pacific

Emerging market with high growth potential, attributed to increasing mental health awareness, expanding healthcare access, and rising disposable income. Countries like China and India exhibit rising prescriptions for aripiprazole, especially in schizophrenia management.

Rest of World

Limited by healthcare infrastructure and affordability barriers but showing incremental growth aligned with globalization of mental health services.

Sales Projections (2023–2028)

Baseline Scenario: Assuming moderate growth driven by increased indications, generic competition, and regional expansion, global aripiprazole sales are projected to grow at a compound annual growth rate (CAGR) of approximately 4.5%.

| Year |

Estimated Global Sales (USD Billion) |

Key Drivers |

| 2023 |

4.5 |

Post-patent expiry stabilization |

| 2024 |

4.7 |

Launch of biosimilars in select markets |

| 2025 |

4.9 |

Expansion into emerging markets |

| 2026 |

5.1 |

New indications and formulations |

| 2027 |

5.3 |

Increased adoption in pediatric/geriatric populations |

| 2028 |

5.6 |

Diversification and improved adherence strategies |

Key factors influencing forecasts:

- Generic Competition: While generics have compromised sales in primary markets, branded formulations retain niche value, especially for specific indications.

- Formulation Innovation: Introduction of long-acting injectables and novel delivery systems can rejuvenate sales.

- New Indications: Pending approvals for additional psychiatric and neurological indications could provide substantial revenue uplifts.

- Pricing and Reimbursement Policies: Optimistic shifts in access and coverage can accelerate growth.

Conclusion

The aripiprazole market remains resilient amid patent expirations, driven by expanding therapeutic indications, formulation innovations, and regional diversification. While challenges like generic competition and safety concerns persist, strategic focus on novel formulations and emerging markets will be crucial for sustaining sales momentum. Stakeholders should prioritize investments in research for additional indications, formulation enhancements, and market extension strategies to capitalize on the evolving landscape.

Key Takeaways

- Stable Demand in Mature Markets: Despite patent expirations, branded aripiprazole maintains value through targeted indications and formulations.

- Growth in Emerging Markets: Asia-Pacific and other developing regions offer significant upside, driven by expanding mental health awareness.

- Innovation as a Catalyst: Development of long-acting injectable forms and new therapeutic indications will be vital to sustain and boost sales.

- Competitive Landscape Evolution: Biosimilars and generics will intensify pricing pressures, necessitating differentiation through clinical value.

- Regulatory Environment Impact: Pandemics, policy changes, and healthcare reforms will influence market trajectories; proactive adaptation remains essential.

FAQs

1. How has patent expiration impacted aripiprazole sales?

Patent expiration in 2015 led to a surge in generic versions, which significantly reduced branded sales in primary markets. However, branded formulations still command premium pricing in niche indications and regions with stricter regulatory controls.

2. What are the main therapeutic indications driving aripiprazole sales?

Schizophrenia remains the primary indication, complemented by bipolar disorder, depression augmentation, irritability associated with autism spectrum disorder, and off-label uses. The introduction of long-acting injectable formulations further expands its reach.

3. Which regions are expected to exhibit the highest growth in aripiprazole demand?

Emerging markets in Asia-Pacific (notably China and India), driven by increasing mental health awareness and healthcare infrastructure, are anticipated to experience the highest growth rates over the next five years.

4. What role do new formulations play in future sales?

Long-acting injectable formulations improve medication adherence, reduce relapse, and appeal to clinicians seeking convenient treatment options. Their market penetration is likely to be a significant growth driver.

5. What challenges could impede aripiprazole’s market growth?

Generic competition, safety concerns related to side effects, market saturation in Western countries, and fluctuating healthcare reimbursement policies pose ongoing risks. Continuous innovation and strategic marketing are necessary to mitigate these challenges.

References

[1] World Health Organization. (2021). Mental Health Fact Sheets.

[2] U.S. FDA. (2015). Abilify (aripiprazole) Patent Status and Market Dynamics.

[3] IQVIA. (2022). Global Pharma Market Reports.