Last updated: July 28, 2025

Introduction

Amlodipine, a calcium channel blocker primarily used for managing hypertension and angina, remains a cornerstone in cardiovascular therapy. Its widespread prescription, favorable safety profile, and patent status contribute to a resilient market. A comprehensive market and sales forecast offers insights into its trajectory amid evolving healthcare landscapes, regulatory shifts, and competitive dynamics.

Market Overview

Global Market Size

The global antihypertensive drugs market was valued at approximately US$44 billion in 2022, with calcium channel blockers (CCBs) like amlodipine representing a significant segment, estimated at around 30%. Consequently, the CCB market alone exceeds US$13 billion annually (1).

Therapeutic Indications and Prescription Trends

Amlodipine’s primary indications—hypertension and angina—are hepatically prevalent. According to the World Health Organization (WHO), hypertension affects over 1.3 billion adults worldwide (2). The rising global prevalence directly fuels demand. The Department of Health and Human Services projects a 4-5% annual increase in antihypertensive drug consumption through 2030 (3).

Competitive Landscape

Major pharmaceutical firms, including Pfizer, Novartis, and Mylan, dominate amlodipine's market segment. Generic formulations significantly eroded original patent-held brand premiums post-patent expiry around 2010-2012, leading to price erosion but broader access (4). Notably, generic versions comprise over 70% of sales revenue.

Regulatory and Policy Factors

Regulatory agencies, such as the U.S. FDA, monitor safety signals associated with long-term antihypertensive use, but generally recognize amlodipine's safety profile. National health policies emphasizing accessible hypertension control bolster prescribing rates.

Market Drivers

- Aging Population: Globally, populations over 60 years are increasing, a demographic with higher hypertension prevalence (2).

- Increasing Hypertension Awareness: Global health campaigns elevate diagnosis and treatment rates.

- Cardiovascular Disease (CVD) Burden: Amlodipine’s role in CVD risk management ensures sustained demand.

- Pricing and Generics: Stable manufacturing costs facilitate competitive pricing, increasing patient access.

Market Barriers

- Market Saturation: Brisk generic competition limits premium pricing.

- Medical Guidelines: Evolving hypertension management guidelines favor various drug classes, potentially causing shifts in prescribing patterns.

- Side Effect Profile: Mild adverse effects like peripheral edema can influence adherence, impacting sales.

Sales Projections

Short-Term (2023-2027)

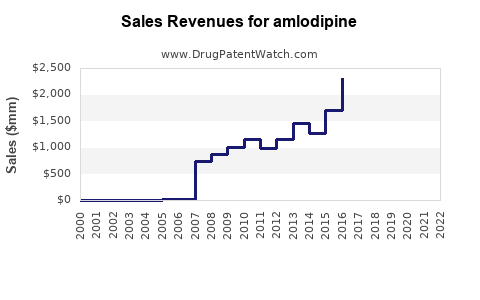

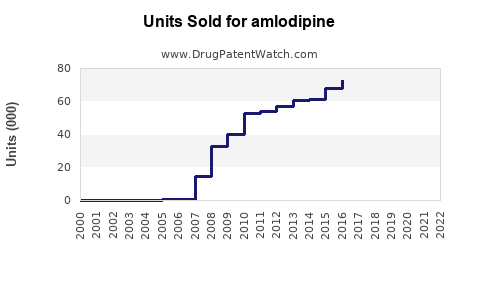

In the next five years, global sales of amlodipine are projected to grow at a compound annual growth rate (CAGR) of approximately 3%. This steady growth considers increased hypertension prevalence, maintained prescriber confidence, and the expanding role of biosimilar and generic formulations.

Projected Revenue: Estimated to reach approximately US$20 billion worldwide by 2027, up from an estimated US$15 billion in 2022 (5).

Long-Term (2028-2033)

Long-term projections forecast a moderate CAGR of 2-2.5%, driven by demographic shifts and innovation in combination therapies. Market saturation may marginally temper growth, but the persistent global CVD burden sustains demand.

Market Share Dynamics: Potential emergence of combination pills (amlodipine with other antihypertensives) could redefine sales distribution, offering incremental revenue streams.

Regional Market Outlook

- North America: Continues to lead, driven by high hypertension awareness, with sales reaching US$7 billion in 2022.

- Europe: Stable growth, with an emphasis on cardiovascular preventive strategies.

- Asia-Pacific: Fastest expansion, projected CAGR of ~4%, fueled by urbanization, lifestyle changes, and healthcare infrastructure development.

- Latin America and Africa: Increasing access, but constrained by affordability and infrastructure limitations.

Emerging Trends and Opportunities

- Biosimilars and Generics: Further cost reductions could enhance access, especially in price-sensitive markets.

- Fixed-Dose Combinations (FDCs): Increasing prescriptions of amlodipine-based FDCs improve adherence, stimulating sales.

- Digital Health Integration: Remote monitoring and telemedicine elevate atrial pressure management, potentially increasing drug utilization.

Impact of External Factors

- COVID-19 Pandemic: Disrupted supply chains and delayed elective treatments constrained short-term demand, but long-term projection remains positive.

- Policy Initiatives: Emphasis on non-communicable disease (NCD) management by WHO and national agencies is expected to sustain demand.

- Patent Expiry Effects: Monopoly periods for branded formulations ended over a decade ago, with generics dominating sales.

Conclusion

Amlodipine maintains a prominent position in antihypertensive therapy, consistently demonstrating robust sales driven by demographic, epidemiological, and healthcare policy factors. While generic competition constrains premium pricing, the drug's essential status and versatility affirm sustained demand.

Key Takeaways

- Stable Growth: The amlodipine market is expected to grow at a CAGR of approximately 3% through 2027.

- Market Expansion: Asia-Pacific is the fastest-growing region, with rising hypertension prevalence and expanding healthcare access.

- Generics and FDCs: Cost-effective generics and fixed-dose combinations are vital for expanding patient access and enhancing sales.

- Regulatory Environment: Continued policy support for hypertension management sustains market stability.

- Innovation Opportunities: Development of combination therapies and digital health solutions offers incremental growth opportunities.

FAQs

1. How will patent expirations impact amlodipine sales?

Patent expirations have led to the proliferation of generics, reducing prices and expanding access, which sustains overall sales volume despite reduced margins for branded versions.

2. What regional factors influence amlodipine sales growth?

Regions with rising hypertension prevalence, such as Asia-Pacific and Latin America, offer significant growth potential due to expanding healthcare infrastructure and awareness.

3. How do emerging combination therapies affect the amlodipine market?

Fixed-dose combinations incorporating amlodipine improve adherence and patient outcomes, leading to increased prescriptions and sales growth.

4. Are there safety concerns that could impact market growth?

Amlodipine's safety profile is well-established. However, rare adverse effects like peripheral edema could influence prescriber preferences if alternative therapies demonstrate better tolerability.

5. What future innovations could influence the amlodipine market?

Advances include biosimilar development, digital health integrations for blood pressure management, and novel combination formulations, all poised to sustain and potentially expand demand.

References

[1] GlobalData. (2022). Antihypertensive Drugs Market Report.

[2] WHO. (2021). Hypertension Fact Sheet.

[3] US Department of Health and Human Services. (2022). Hypertension and Cardiovascular Disease Projections.

[4] IMS Health. (2012). Generic Drugs Impact Report.

[5] MarketWatch. (2022). Amlodipine Sales Outlook.