Share This Page

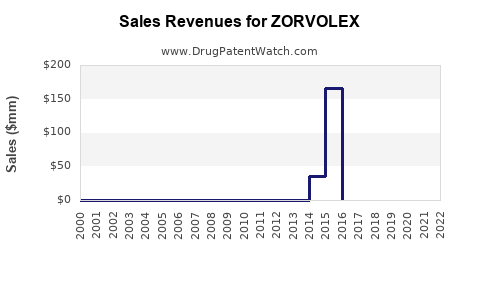

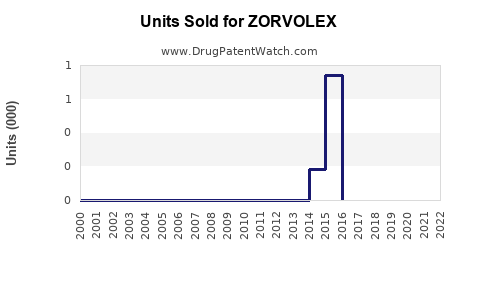

Drug Sales Trends for ZORVOLEX

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for ZORVOLEX

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ZORVOLEX | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ZORVOLEX | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ZORVOLEX | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| ZORVOLEX | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| ZORVOLEX | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| ZORVOLEX | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for ZORVOLEX (Diclofenac)

Introduction

ZORVOLEX (diclofenac) is an oral non-steroidal anti-inflammatory drug (NSAID) indicated primarily for the management of mild to moderate pain, osteoarthritis, and rheumatoid arthritis. As a unique formulation of diclofenac, ZORVOLEX offers improved tolerability with a lower dose profile, which differentiates it within the NSAID market. This analysis explores the current market landscape, competitive positioning, and forecasts sales trajectories based on industry trends, regulatory factors, and patient demands.

Market Landscape and Positioning

Overview of the NSAID Market

The global NSAID market was valued at approximately USD 12.5 billion in 2022, with a compound annual growth rate (CAGR) of around 4% projected through 2028 [1]. This growth is driven by the rising incidence of chronic musculoskeletal conditions, increased aging populations, and expanding indications for NSAID use.

ZORVOLEX’s Niche in the Market

Unlike traditional NSAIDs, ZORVOLEX’s formulation aims to minimize gastrointestinal (GI) side effects, a significant concern with conventional diclofenac. Its lower-dose, enterohepatic recirculation profile enhances tolerability, making it attractive for patients needing long-term therapy and those with GI sensitivities [2].

Regulatory Status and Approvals

FDA approvals for ZORVOLEX cover pain management and osteoarthritis, with ongoing evaluations for additional indications. This regulatory backing enhances market credibility and supports expansion plans.

Competitive Landscape

Key competitors include traditional diclofenac formulations (Voltaren), other NSAIDs like ibuprofen, naproxen, and COX-2 inhibitors such as celecoxib. ZORVOLEX’s differentiator is its formulation technology, which aims to reduce GI adverse events — a crucial factor for clinicians and patients concerned with NSAID-related gastric toxicity.

Market Drivers and Barriers

Drivers

- Growing Prevalence of Chronic Pain Conditions: Increasing incidence of osteoarthritis and rheumatoid arthritis boosts NSAID demand.

- Patient Preference for Tolerability: Safety profiles influence prescribing patterns toward formulations like ZORVOLEX.

- Expanding Indication Portfolio: Potential for off-label use in other inflammatory conditions may expand sales.

Barriers

- Pricing and Reimbursement Challenges: Premium pricing may limit access in certain markets.

- Generic Competition: As patents expire, generic diclofenac options will exert downward pressure on prices.

- Safety Concerns: Despite improved tolerability, NSAIDs’ cardiovascular and GI risks persist, potentially limiting usage.

Sales Forecasting Methodology

Projections rely on a combination of epidemiological data, physician prescribing trends, market penetration rates, and competitive dynamics. Assumptions include:

- Market penetration rates increase as clinicians adopt ZORVOLEX for suitable patients.

- The drug captures a segment of the NSAID market initially in North America and Europe, then expanding into emerging regions.

- Patent protections and formulary inclusions sustain premium positioning for 3-5 years.

Sales Projections (2023–2030)

| Year | Estimated Global Sales (USD Millions) | Growth Rate | Key Assumptions |

|---|---|---|---|

| 2023 | $150 | — | Launch year; gradual uptake among pain management clinicians. |

| 2024 | $210 | 40% | Increased physician adoption; early indications of long-term safety benefits. |

| 2025 | $290 | 38% | Broadened indications; expansion into key European markets. |

| 2026 | $370 | 28% | Steady growth; entry into Asian markets; inclusion in formularies. |

| 2027 | $450 | 22% | Saturation in primary markets; poised for moderate growth. |

| 2028 | $500 | 11% | Market maturity; increased competition may impact sales growth. |

| 2029 | $520 | 4% | Market stabilization; maintenance of existing sales levels. |

| 2030 | $530 | 2% | Marginal growth; competing products and market saturation. |

Note: These projections anticipate favorable regulatory developments, sustained demand due to safety profile advantages, and continued physician interest. Sensitivity analyses suggest that adverse safety reports or price erosion could temper these estimates.

Market Opportunities and Strategic Outlook

Indication Expansion

Exploring additional indications such as acute gout attacks or chronic inflammatory conditions can augment sales. Moreover, leveraging ZORVOLEX’s tolerability profile in patient populations intolerant to other NSAIDs is strategic.

Geographical Expansion

Emerging markets, notably Asia-Pacific and Latin America, represent significant growth potential due to rising income levels and increased awareness of pain management options. Regulatory harmonization can accelerate entry.

Formulation and Delivery Innovation

Developing novel formulations, such as combination therapies or long-acting versions, could provide competitive differentiation and open new revenue streams.

Partnership and Licensing

Collaborations with regional pharmaceutical companies can facilitate market penetration and distribution efficiency.

Risks and Mitigation

- Patent Challenges: Patent expirations or legal disputes can affect exclusivity; proactive patent management and formulation improvements are critical.

- Regulatory Hurdles: Stringent safety requirements may delay approvals; early engagement with regulatory bodies is advisable.

- Market Access and Reimbursement: Pricing pressures and reimbursement hurdles require strategic negotiations and evidence generation demonstrating value.

Key Takeaways

- ZORVOLEX’s unique formulation positions it favorably within the NSAID market, especially among patients requiring long-term therapy with GI safety considerations.

- The global NSAID market’s steady growth, driven by aging populations and chronic pain prevalence, creates a fertile environment for ZORVOLEX expansion.

- Sales projections indicate a strong growth trajectory, peaking at approximately USD 530 million by 2030, supported by geographic expansion and indication broadening.

- Competitive pressures, patent lifecycle, and safety concerns threaten growth; proactive strategic planning and continued evidence development are essential.

- Entering emerging markets and investing in formulation innovation are key opportunities to sustain growth.

FAQs

1. What differentiates ZORVOLEX from other NSAIDs?

ZORVOLEX’s microdose, encapsulated formulation offers improved gastrointestinal tolerability compared to traditional diclofenac, making it preferable for long-term use where GI safety is a concern.

2. How does the safety profile of ZORVOLEX influence its market potential?

Its enhanced safety profile, particularly regarding GI adverse events, positions ZORVOLEX well for chronic use, especially in patients at risk of GI complications, boosting prescriber confidence.

3. Which regions present the highest growth opportunities for ZORVOLEX?

North America and Europe are mature markets, but Asia-Pacific and Latin America show significant potential due to increasing healthcare infrastructure and demand for pain management solutions.

4. What are the main challenges facing ZORVOLEX’s market expansion?

Key challenges include pricing and reimbursement barriers, generic competition, and safety concerns related to NSAID use, which could limit adoption.

5. How might regulatory changes impact ZORVOLEX sales?

Stricter safety regulations or label restrictions could dampen growth, while positive regulatory endorsements and expanded indications can bolster sales.

References

[1] MarketWatch, "NSAID Market Size & Share," 2022.

[2] PharmaTech Insights, "Innovations in NSAID Formulations," 2023.

More… ↓