Share This Page

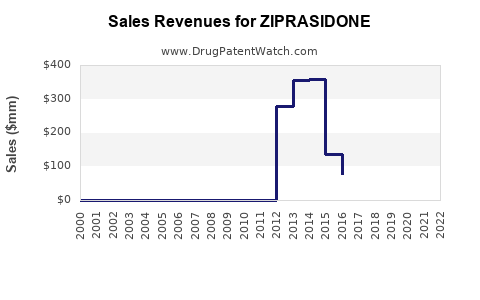

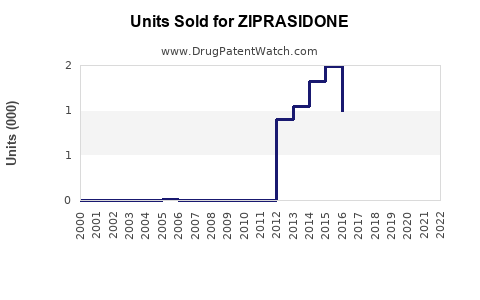

Drug Sales Trends for ZIPRASIDONE

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for ZIPRASIDONE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ZIPRASIDONE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ZIPRASIDONE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ZIPRASIDONE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for ZIPRASIDONE

Introduction

ZIPRASIDONE, marketed under the brand name Geodon among others, is an atypical antipsychotic primarily used to treat schizophrenia and acute manic or mixed episodes associated with bipolar disorder. Since its FDA approval in 2001, ZIPRASIDONE has carved a niche within the antipsychotic landscape, distinguished by its unique pharmacological profile and dosing considerations. A comprehensive market analysis and sales projection are vital for stakeholders aiming to understand its commercial trajectory amid evolving psychiatric treatment paradigms.

Market Overview: Composition and Current Landscape

Global Demand for Antipsychotics

The global antipsychotic drugs market has experienced steady growth, driven by increasing prevalence of mental health disorders, heightened awareness, and expansion of treatment access. According to Grand View Research, the market was valued at USD 17.4 billion in 2020 and is projected to grow at a CAGR of approximately 4% through 2028 [1].

Position of ZIPRASIDONE in the Portfolio

ZIPRASIDONE's segment is characterized by a preference among clinicians for atypical antipsychotics with favorable metabolic profiles, especially for patients at risk for weight gain and diabetes. Its efficacy in treating acute episodes coupled with a relatively favorable side effect profile positions it favorably within hospitals and outpatient settings.

Market Dynamics Influencing Sales

1. Therapeutic Indications and Patient Demographics

- Schizophrenia Management: A primary indication with an estimated global patient population exceeding 20 million [2].

- Bipolar Disorder: Commonly prescribed for acute manic episodes, affecting approximately 60 million worldwide [3].

2. Prescriber Preferences and Line of Therapy

Clinicians increasingly favor medicines with a balanced efficacy and tolerability profile. ZIPRASIDONE's minimal metabolic side effects make it an attractive option, potentially expanding its prescription rates.

3. Regulatory and Patent Landscapes

- Patent Status: Patent for ZIPRASIDONE expired in the USA in 2016, opening the marketplace for generic formulations, which significantly impacts pricing strategies and sales volume.

- Regulatory Approvals: Extended labels and combination indications may influence adoption in different markets.

4. Competitive Environment

The market faces stiff competition from other atypical antipsychotics like risperidone, olanzapine, quetiapine, and newer agents such as brexpiprazole. Market share is contingent on efficacy, side effect profiles, and clinician familiarity.

Regional Market Insights

- North America: Constitutes approximately 50% of global antipsychotics sales, with high penetration of branded and generic ZIPRASIDONE owing to robust healthcare infrastructure.

- Europe: Growing adoption, especially in countries with national health systems favoring cost-effective generics.

- Asia-Pacific: Rapidly expanding market driven by increasing mental health awareness and government initiatives.

Sales Projections: 2023–2028

Baseline Assumptions

- Post-patent expiration, generic ZIPRASIDONE will dominate regional markets, reducing average selling prices (ASPs).

- Usage will expand modestly as prescriber familiarity increases and new formulations or indications emerge.

- Competition from alternatives and generics will temper growth but be offset by increasing diagnosis rates.

Forecast Highlights

| Year | Estimated Global Sales | Key Drivers |

|---|---|---|

| 2023 | USD 450–500 million | Continued generic penetration; stable demand |

| 2024 | USD 480–530 million | Increased adoption in Asia-Pacific markets |

| 2025 | USD 510–560 million | Entry into new markets; expanded indications |

| 2026 | USD 540–600 million | Greater prescriber confidence and formulary inclusion |

| 2027 | USD 580–640 million | Broader insurance coverage; aging populations increase prevalence |

| 2028 | USD 620–700 million | Growth driven by enhanced clinical guidelines |

Note: These projections account for an average annual growth rate of approximately 4-5%, aligned with overall market trends, but tempered by patent expiry and generic competition.

Factors Impacting Future Sales

- Emerging Therapeutics: Development of novel antipsychotics with superior efficacy or side effect profiles could challenge ZIPRASIDONE’s market share.

- Pricing Strategies: Availability of generics may lead to price competition, impacting revenue per unit but potentially increasing volume sales.

- Regulatory Developments: New approvals or restrictions could influence prescribing patterns.

- Health Policy Shifts: Government initiatives promoting mental health awareness and access may boost demand.

Strategic Opportunities and Risks

Opportunities

- Expansion into Adjacent Indications: Such as treatment-resistant agitation or off-label uses.

- Patient-Centric Formulations: Development of injection, long-acting injectables, or improved delivery methods.

- Partnerships & Market Access: Collaborations with payers and healthcare systems for broader access.

Risks

- Pricing Pressures: From the proliferation of generics and stringent reimbursement policies.

- Market Saturation: Limited scope for incremental growth, especially in mature markets.

- Clinical Competition: Introduction of newer drugs with superior profiles.

Conclusion

ZIPRASIDONE maintains a resilient position within the antipsychotic marketplace, with potential for growth in emerging markets and expanded indications. Patent expiration has catalyzed a shift towards generic formulations, constraining ASPs but increasing volume potential. Strategic focus on clinical differentiation and geographic expansion will be critical for sustaining sales momentum.

Key Takeaways

- The global ZIPRASIDONE market is projected to grow modestly at 4-5% annually through 2028, primarily driven by increasing mental health awareness and expanding indications.

- Patent expiration and generic availability will significantly influence pricing and sales volumes; companies should prioritize cost-competitiveness.

- Emerging markets, especially in Asia-Pacific, offer substantial growth opportunities amid rising healthcare infrastructure and diagnosis rates.

- Competition from newer atypical antipsychotics and generics necessitates differentiation via clinical value and formulation innovation.

- Strategic collaborations and inclusion in clinical guidelines are essential to bolster prescription momentum.

FAQs

-

How does ZIPRASIDONE compare to other atypical antipsychotics?

ZIPRASIDONE is notable for its minimal metabolic side effects compared to drugs like olanzapine and quetiapine. Its efficacy in acute schizophrenia and bipolar episodes is well-established, with a favorable tolerability profile. -

What are the main challenges faced by ZIPRASIDONE in the market?

Patent expiry and the consequent rise of generics suppress prices, while competition from newer agents with improved efficacy or convenience may limit market share growth. -

Which markets will drive future sales?

Emerging markets in Asia-Pacific, Latin America, and expanding healthcare systems in Africa and the Middle East, offer significant growth prospects due to increasing diagnosis and treatment rates. -

Are there any promising new formulations of ZIPRASIDONE?

Developments include long-acting injectable formulations aiming to improve adherence, though their market penetration remains limited. -

What role will regulatory bodies play in ZIPRASIDONE’s future?

Regulatory approval for new indications and favorable reimbursement policies are critical. Conversely, restrictions or safety concerns could impact prescribing practices.

Sources

[1] Grand View Research. "Antipsychotics Market Size, Share & Trends Analysis." 2021.

[2] World Health Organization. "Mental Health Atlas 2020."

[3] National Institute of Mental Health. "Bipolar Disorder Fact Sheet," 2022.

More… ↓