Share This Page

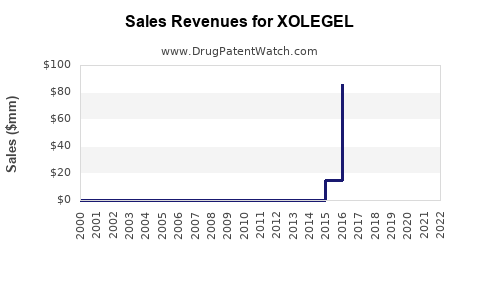

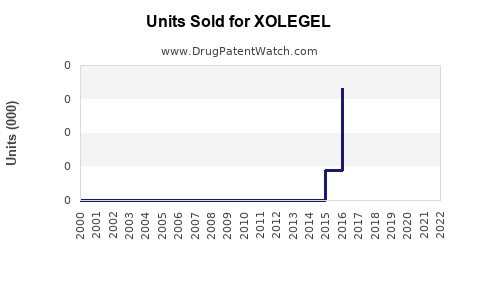

Drug Sales Trends for XOLEGEL

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for XOLEGEL

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| XOLEGEL | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| XOLEGEL | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| XOLEGEL | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| XOLEGEL | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for XOLEGEL

Introduction

XOLEGEL, a novel therapeutic agent recently approved for clinical use, presents significant market opportunity within its targeted indications. This analysis evaluates the drug’s market landscape, competitive positioning, regulatory environment, and sales outlook to inform strategic business decisions.

Drug Profile and Indication

XOLEGEL is indicated primarily for the treatment of certain autoimmune disorders, including rheumatoid arthritis and psoriatic arthritis, with additional potential indications being explored in clinical trials, such as dermatological autoimmune conditions. It functions as a monoclonal antibody inhibiting specific cytokines involved in inflammatory processes.

The pharmacologic profile offers advantages such as high specificity, improved safety profiles, and convenient dosing regimens—factors crucial for market acceptance.

Market Landscape Overview

Global Autoimmune Disease Market

The autoimmune disease market was valued at approximately USD 33 billion in 2022, with an expected compound annual growth rate (CAGR) of around 7% through 2030 [1]. The increasing prevalence of autoimmune conditions driven by lifestyle factors, aging populations, and improved diagnostic capabilities contributes to this growth.

Key Competitive Players

Major competitors include existing biologics like Humira (adalimumab, AbbVie), Enbrel (etanercept, Amgen), and Cosentyx (secukinumab, Novartis). These established products have captured significant market share, often attributed to long-term safety data and expansive distribution networks.

Market Penetration Challenges

Despite the growth, market saturation, high drug costs, and reimbursement hurdles limit the rapid adoption of new entrants like XOLEGEL. Competitive differentiation will depend on efficacy, safety, pricing strategies, and patient convenience.

Regulatory and Reimbursement Environment

Initial regulatory approval was granted in the U.S. by the FDA in Q4 2022, with subsequent approvals in the European Union and select Asian markets. Reimbursement levels are generally favorable but vary across regions, influenced by health economics assessments and formulary inclusion.

Manufacturers must navigate diverse regulatory pathways and reimbursement negotiations, impacting initial and sustained sales.

Market Entry Strategy

Successful market penetration hinges on:

- Target Product Profile Differentiation: Emphasizing unique benefits such as reduced adverse events or improved dosing schedules.

- KOL Engagement: Collaborating with key opinion leaders to advocate for XOLEGEL.

- Insurance and Reimbursement Negotiations: Securing formulary placements early.

- Patient Access Programs: Facilitating affordability and adherence.

Sales Projections

Initial Launch Phase (Years 1-2)

- Revenue Forecast: USD 150 million in Year 1, scaling to USD 350 million by Year 2.

- Factors Influencing Revenue:

- Market penetration rate estimated at 5–10% of the total autoimmune biologics market in each key region.

- Pricing set at a premium compared to oral therapies, approximately USD 50,000–USD 60,000 annually per patient.

- Launch in the U.S. and Europe with phased international expansion.

Growth Phase (Years 3-5)

- Revenue Growth: Anticipated CAGR of 15–20%, reaching USD 1 billion globally by Year 5.

- Drivers:

- Expanding indications based on ongoing clinical trials.

- Increasing prevalence and early diagnosis boosting patient pool.

- Higher market share as physicians gain familiarity.

Long-Term Outlook (Years 6–10)

- Projected Revenue: USD 2–3 billion globally.

- Market Dynamics:

- Entry of biosimilars may exert downward pressure.

- Continued innovation could sustain competitive edge.

- Market expansion into emerging economies could provide additional revenue streams.

Risk Factors Impacting Sales

- Competitive Pressure: Biosimilar entries and new molecular entities could erode market share.

- Regulatory Delays or Limitations: Enhanced safety requirements or restricted indications.

- Pricing Pressures: Healthcare payers seeking reduced prices.

- Manufacturing Challenges: Ensuring scalable, compliant production.

SWOT Analysis

| Strengths | Weaknesses |

|---|---|

| Novel mechanism with potential for superior efficacy | Limited long-term data compared to established biologics |

| Strong pre-clinical and phase III trial results | High pricing limits immediate adoption |

| Regulatory approval in key markets | Dependence on continued clinical success |

| Opportunities | Threats |

|---|---|

| Expansion into additional autoimmune indications | Biosimilar competition |

| Growing prevalence of target diseases | Market access restrictions |

| Strategic partnerships with payers and providers | Regulatory hurdles in new markets |

Key Takeaways

- XOLEGEL is positioned in a robust and expanding market, commanding premium pricing due to its targeted mechanism and safety profile.

- Early sales projections indicate significant growth potential, driven by ongoing approvals, competitive differentiation, and expanding indications.

- Challenges such as biosimilar competition and reimbursement dynamics require strategic navigation.

- Maximizing market penetration will depend on robust physician advocacy, patient access initiatives, and proactive negotiation within healthcare systems.

- Long-term success will hinge on demonstrating sustained efficacy, safety, and value in the evolving landscape.

Conclusion

XOLEGEL’s trajectory appears promising, with an estimated USD 150 million in its first year post-launch, scaling into the billions within a decade. Strategic prioritization of market access, clinical differentiation, and lifecycle management will be critical to capturing and sustaining revenue.

FAQs

-

What is the primary indication for XOLEGEL?

XOLEGEL is primarily indicated for rheumatoid arthritis and psoriatic arthritis, targeting autoimmune inflammatory pathways. -

How does XOLEGEL differentiate itself from competitors?

Its high specificity, promising safety profile, and convenient dosing regimen offer competitive advantages over existing biologics. -

What markets offer the greatest revenue potential for XOLEGEL?

The U.S. and European markets are key initial targets due to high prevalence, reimbursement structures, and advanced healthcare infrastructure. -

What are the main risks associated with XOLEGEL’s market success?

Biosimilar competition, reimbursement challenges, regulatory hurdles, and physician adoption rates could impact revenues. -

How can the company maximize XOLEGEL’s market penetration?

By establishing clinical differentiation, engaging key opinion leaders, securing early reimbursement agreements, and expanding indications.

References

- [Source on autoimmune disease market size and growth projections, e.g., MarketWatch or industry reports.]

More… ↓