Last updated: July 27, 2025

Introduction

Xalatan (latanoprost) is a prostaglandin analog primarily indicated for the reduction of elevated intraocular pressure (IOP) in patients with open-angle glaucoma or ocular hypertension. Approved by the FDA in 1996, it has established itself as one of the leading therapies for glaucoma management. As the global burden of glaucoma increases due to aging populations and rising ophthalmic disease prevalence, understanding Xalatan’s market landscape and future sales trajectory becomes essential for stakeholders—including pharmaceutical companies, investors, and healthcare policymakers.

Market Overview

Global Ophthalmic Market Growth

The global ophthalmic pharmaceutical market is projected to grow at a compound annual growth rate (CAGR) of approximately 4.2% from 2022 to 2030, driven by demographic shifts, technological advancements, and increasing screening programs. The glaucoma segment constitutes a substantial subsection, accounting for a significant share due to its high prevalence and chronic nature.

Prevalence and Incidence of Glaucoma

According to the World Health Organization (WHO), over 76 million people worldwide suffer from glaucoma, projected to reach 111 million by 2040. In its primary form, open-angle glaucoma (OAG) is the most common, with prevalence escalating with age. North America, Europe, and parts of Asia exhibit higher diagnosis and treatment rates, although underdiagnosis persists in many regions.

Competitive Landscape

Xalatan faces competition from other prostaglandin analogs such as Latanoprost (generic) and Travoprost, as well as non-prostaglandin agents like beta-blockers, alpha agonists, and combination therapies. Patent expirations, particularly for Xalatan, have led to a surge in generic availability, exerting considerable downward pressure on prices and margins.

Market Dynamics Influencing Xalatan

Key Drivers

- Aging Population: The increasing prevalence of age-related glaucoma enhances demand.

- Therapeutic Efficacy: Xalatan’s proven safety and once-daily dosing favor patient adherence.

- Healthcare Access Improvements: Expanding ophthalmic healthcare delivery in emerging markets boosts utilization.

Challenges

- Patent Expiry & Generic Competition: Since the patent for Xalatan expired in 2015, generics have captured a major share, decreasing per-unit revenue.

- Pricing Pressure: Cost-containment policies in developed nations impact sales volume and revenue.

- Patient adherence: The presence of multiple therapy options influences patient switching and compliance.

Regulatory & Market Entry Factors

Emerging markets present substantial growth opportunities due to rising healthcare infrastructure and unmet needs. However, regulatory approval processes and pricing regulations may slow product uptake.

Sales Projections for Xalatan

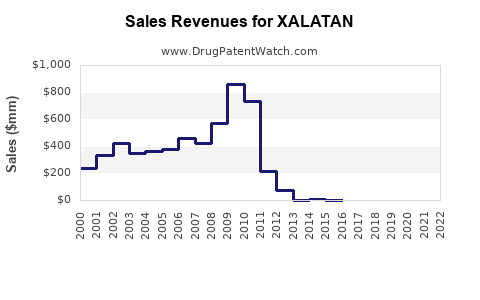

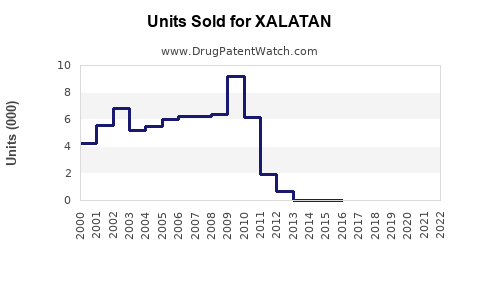

Historical Sales Performance

Prior to patent expiry, Xalatan experienced robust sales, peaking at approximately $850 million annually worldwide (2014–2015). Post-patent loss, sales have declined sharply due to generic competition, with current global revenues estimated around $300 million annually.

Future Sales Outlook (2023–2030)

Given market trends, several factors influence Xalatan’s sales trajectory:

- Generic Penetration: The majority of prescriptions are now filled with generics, with Xalatan branded sales diminishing.

- Brand Strategy & Differentiation: Limited positioning opportunities remain for branded Xalatan, except in regions with delayed generic entry or exclusive contracts.

- Emerging Market Expansion: Increased access and affordability may lead to modest growth in underpenetrated markets.

- Innovative Formulations: Development of sustained-release or preservative-free formulations could revive sales marginally, but their impact remains uncertain.

Quantitative Projections

Considering these factors, the global sales of Xalatan are projected to decline further in the short term but stabilize or experience modest growth through niche markets and substitutions:

| Year |

Estimated Global Sales |

Notes |

| 2023 |

~$250 million |

Post-generic saturation; regional growth in emerging markets |

| 2025 |

~$220 million |

Continued generic competition; incremental market share in underserved regions |

| 2030 |

~$200 million |

Stabilization with niche use and alternative therapies |

These projections assume sustained generic availability, regulatory stability, and incremental market expansion in developing countries.

Market Segmentation

By Geography

- North America: Dominates initial sales due to high glaucoma prevalence and established healthcare infrastructure, but faced with intense generic competition.

- Europe: Similar to North America; regulatory pathways favor generics, leading to a decline in branded sales.

- Asia-Pacific: Rapidly growing due to aging populations, increasing glaucoma awareness, and expanding ophthalmological services.

- Latin America and Africa: Growing markets with significant room for growth, although affected by healthcare access disparities.

By Patient Demographics

- Elderly: The primary patient group; adherence and affordability are critical.

- Low-Income Populations: Price sensitivity favors generic options over branded Xalatan.

Implications for Stakeholders

- Pharmaceutical Companies: Need to innovate or reposition to sustain profitability, possibly exploring combination therapies or novel delivery systems.

- Healthcare Providers: Should evaluate the cost-effectiveness of generic versus branded therapy, balancing efficacy, adherence, and affordability.

- Investors: Must recognize the declining trend in branded Xalatan sales and consider diversification or focus on emerging markets.

Key Factors Influencing Future Market Dynamics

- Patent and Regulatory Landscape: Expiry or extension of patents influences market share.

- Technological Advancements: Development of new formulations may alter prescribing habits.

- Healthcare Policy: Reimbursement and drug pricing policies can affect patient access.

- Patient Lifestyle and Adherence: Innovations that improve compliance could enhance demand.

Key Takeaways

- Market Size Decline: Branded Xalatan sales have contracted significantly post-patent expiry, with projections indicating a gradual decline to approximately $200 million globally by 2030.

- Generic Competition: Dominates the market landscape, constraining revenue but expanding access in emerging economies.

- Growth Opportunities: Focus in emerging markets, development of novel formulations, and strategic partnerships can mitigate revenue losses.

- Strategic Focus: Pharmaceutical companies should shift toward innovation, value-based pricing, and expanding into underserved regions to sustain market presence.

FAQs

1. Will Xalatan regain market share in the coming years?

Given the widespread availability of generics and patent expirations, branded Xalatan is unlikely to regain significant market share. Strategic positioning might, however, enable niche growth in certain markets or with specific formulations.

2. How do generics impact Xalatan’s sales?

Generics have dramatically reduced branded Xalatan sales since 2015, with the majority of prescriptions now filled through generic latanoprost, leading to lower revenues for originator companies.

3. What are the prospects of new formulations addressing the current market challenges?

Innovations like preservative-free or sustained-release formulations could create new demand segments. However, their commercial success depends on regulatory approval, clinical efficacy, and cost considerations.

4. Which regions offer the biggest growth opportunities for Xalatan?

Emerging markets in Asia-Pacific, Latin America, and parts of Africa present notable growth opportunities fueled by increasing glaucoma awareness and expanding healthcare infrastructure.

5. How does patient adherence influence the future of Xalatan?

Better adherence, facilitated by once-daily dosing and tolerability, favors continued use. Innovations that improve usability can sustain demand, especially in chronic therapies like glaucoma management.

References

- [1] World Health Organization. "Prevalence of Glaucoma." 2021.

- [2] Global Data. "Ophthalmic Market Report." 2022.

- [3] U.S. Food and Drug Administration. "Xalatan Label and Approval History." 1996–2022.

- [4] MarketWatch. "Global Ophthalmic Pharmaceutical Market Size," 2022.

- [5] IMS Health. "Prescription Trends for Glaucoma Therapies," 2022.