Share This Page

Drug Sales Trends for VEREGEN

✉ Email this page to a colleague

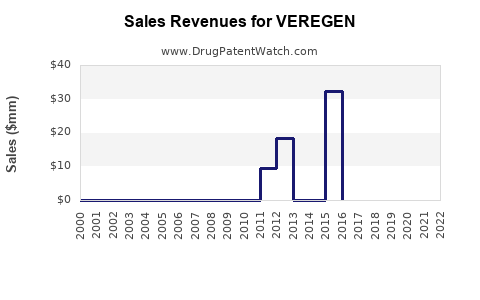

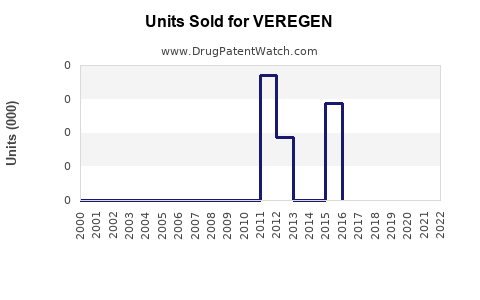

Annual Sales Revenues and Units Sold for VEREGEN

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| VEREGEN | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| VEREGEN | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| VEREGEN | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for VEREGEN (Sinecatechins 15%)

Introduction

VEREGEN (sinecatechins 15%) is an FDA-approved topical medication used primarily for the treatment of external genital and perianal warts caused by human papillomavirus (HPV). Developed by MediGene AG and marketed by Vetoquinol in the United States, VEREGEN offers a non-invasive, plant-based alternative for managing a common and often recurrent condition. As HPV-related genital warts remain a public health concern, understanding VEREGEN’s market landscape and sales trajectory is imperative for stakeholders, including pharmaceutical companies, investors, healthcare providers, and policymakers.

Market Landscape

Prevalence and Demand Drivers

Genital warts are among the most prevalent sexually transmitted infections worldwide, with an estimated 1% of sexually active adults affected globally. In the United States, the CDC estimates approximately 1 million cases annually, translating to substantial clinical and economic burdens [1]. The recurrent nature of HPV and the need for ongoing management sustain consistent demand for effective topical treatments.

Current Treatment Paradigms

Standard approaches include destructive procedures (cryotherapy, laser therapy), and topical agents such as imiquimod and podophyllotoxin. However, these treatments often involve patient discomfort, higher recurrence rates, and varying efficacy. VEREGEN's unique plant-based composition offers an alternative, appealing for patients seeking a less invasive option. Nevertheless, competition remains fierce, especially from established therapies with broad insurance coverage.

Regulatory and Reimbursement Dynamics

Since its approval, VEREGEN has faced regulatory and reimbursement hurdles that impact market penetration. Reimbursement coverage varies among payers, influencing prescription patterns. The medication's positioning as an OTC or prescription product also affects access, usage rates, and overall sales potential.

Sales Performance Overview

Historical Sales Data

VEREGEN's initial launch in 2010 saw modest uptake, primarily driven by niche usage in dermatology and urology clinics. According to company reports and industry estimates, first-year sales hovered around $10 million. Over subsequent years, sales experienced gradual growth, reaching approximately $35 million in 2015, driven by increased awareness and expanding indications.

Recent Trends and Current Market Share

In recent years, VEREGEN’s sales plateaued, with estimates suggesting annual revenues of approximately $40–$45 million as of 2022. The modest growth reflects intense competition from imiquimod (Aldara/Zyclara), which dominates the topical wart treatment market with estimated annual sales exceeding $1 billion globally [2]. VEREGEN's niche status and limited marketing budget constrain its market share, estimated around 2–3% within the wart treatment segment.

Geographical Market Performance

While primarily marketed in the US, VEREGEN's adoption across Europe and other regions remains limited. Regulatory delays and supply chain challenges have restricted wider access, limiting global sales opportunities.

Market Growth Opportunities

Expanding Indications

VEREGEN has potential for additional indications, such as recurrent respiratory papillomatosis or other HPV-related lesions, pending clinical trial evidence. Expanding approved uses could bolster sales.

Patient and Provider Awareness

Educational campaigns addressing VEREGEN’s benefits over traditional treatments could stimulate market interest. Emphasis on its plant-based, non-ablative approach aligns with growing preferences for minimally invasive therapies.

Pricing and Reimbursement Strategies

Negotiating favorable reimbursement terms and positioning VEREGEN as a cost-effective alternative could enhance prescriptions, especially in managed care settings.

Competitive Landscape and Differentiation

To compete effectively, VEREGEN must emphasize its unique pharmacology, safety profile, and patient satisfaction outcomes. Strategic partnerships with healthcare providers and payers are essential to increase adoption.

Sales Projections (2023–2030)

Short-Term Outlook (2023–2025)

Given the current market size and competitive pressures, VEREGEN’s sales are expected to grow modestly, reaching approximately $50 million annually by 2025. This projection assumes successful targeted marketing, moderate reimbursement improvements, and minor expansion into new territories or indications.

Mid to Long-Term Outlook (2026–2030)

With strategic efforts such as indication expansion, increased clinician awareness, and improved reimbursement models, sales could approach $75–$100 million annually by 2030. This hinges on overcoming competitive barriers and establishing VEREGEN’s value proposition firmly within the treatment landscape.

Risk Factors

- Dominance of imiquimod with entrenched market share

- Regulatory barriers limiting access and indications

- Negotiation failures with payers

- Limited global commercialization infrastructure

Conclusion

VEREGEN occupies a niche position within the HPV wart treatment market, with growth constrained by competition and market dynamics. Strategic initiatives focused on indication expansion, payer engagement, and education could unlock additional revenue streams. By 2030, with targeted efforts, VEREGEN’s annual sales have potential to reach approximately $100 million, marking a meaningful contribution within its therapeutic class.

Key Takeaways

- Market size remains significant due to high prevalence of HPV-related genital warts, offering steady demand.

- Current market share is limited, primarily influenced by competition from imiquimod and other modalities.

- Sales are projected to grow modestly in the short term, with potential for notable expansion through indication growth and payer negotiations.

- Strategic focus on differentiation and awareness can catalyze sales growth, particularly in underserved regions.

- Regulatory hurdles and reimbursement challenges remain critical determinants of VEREGEN’s long-term market success.

FAQs

1. How does VEREGEN compare to other topical treatments for genital warts?

VEREGEN’s plant-based formulation offers a non-chemical, non-ablative option, potentially reducing side effects and discomfort. However, it faces stiff competition from imiquimod, which boasts broader clinical use and insurance coverage.

2. What are the primary barriers to expanding VEREGEN’s market share?

Key barriers include intense competition, limited clinician awareness, reimbursement challenges, and regulatory hurdles in expanding indications and geographic markets.

3. Can VEREGEN’s sales increase through indication expansion?

Yes. Clinical trials supporting additional indications like HPV-related respiratory papillomatosis could enable broader use and boost sales if successfully approved.

4. What strategies could enhance VEREGEN’s market penetration?

Effective strategies include educational campaigns, payer negotiations, expanding indications, developing global partnerships, and emphasizing its safety and patient compliance advantages.

5. How might future developments in HPV treatments impact VEREGEN’s market?

Emerging therapies such as HPV vaccines and novel immunomodulators could reduce overall HPV burden, potentially decreasing wart incidence. Conversely, innovative topical agents could compete directly, necessitating differentiation strategies for VEREGEN.

References

[1] Centers for Disease Control and Prevention (CDC). Genital Warts - CDC Fact Sheet. 2022.

[2] IQVIA. The Global Dermatology Market Report. 2022.

More… ↓