Last updated: July 28, 2025

Introduction

Ventolin HFA, an inhaler containing albuterol sulfate (also known as salbutamol in many regions), remains a cornerstone in managing bronchospasm associated with asthma and chronic obstructive pulmonary disease (COPD). Since its approval and market entry, Ventolin HFA has established a significant footprint in respiratory therapeutics. This analysis evaluates its current market landscape, competitive positioning, and forecasts its sales trajectory considering evolving healthcare trends, regulatory policies, and competitive dynamics.

Market Landscape and Key Drivers

Global Respiratory Disease Burden

The rising prevalence of asthma and COPD globally underpins demand for bronchodilators like Ventolin HFA. The Global Initiative for Asthma (GINA) and the Global Initiative for Chronic Obstructive Lung Disease (GOLD) report significant increases in cases, especially within emerging markets. According to WHO, over 300 million individuals suffer from asthma, and COPD prevalence is projected to increase by 40% over the next decade [1].

Market Segmentation and Geographic Dynamics

The inhaler market is segmented primarily by region, disease indication, and device type. North America dominates due to high disease awareness, advanced healthcare infrastructure, and insurance coverage. Asia-Pacific exhibits rapid growth potential driven by increasing urbanization, pollution, and healthcare access expansion.

Regulatory and Policy Environment

Regulatory shifts, such as restrictions on inhaler ingredients, propellant changes (e.g., from hydrofluoroalkanes to more environmentally friendly options), and device approvals, impact market dynamics. Also, the shift toward combination therapies influences sales volumes.

Competitive Landscape

Major Competitors

- Brand Name Alternatives: ProAir HFA and Proventil HFA

- Generic Versions: Increasing availability post-exclusivity periods

- Emerging Technologies: Soft mist inhalers, dry powder inhalers, and digital health integrations

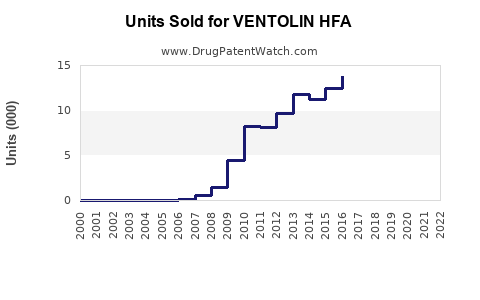

Market Positioning of Ventolin HFA

Ventolin HFA’s longstanding reputation, proven efficacy, and safety record sustain its market share. However, competition intensity is heightened as device innovation and cost-effective generics enter markets.

Sales Drivers for Ventolin HFA

- Prevalence and Incidence of Respiratory Diseases: Rising diagnosis rates directly impact demand.

- Patient and Physician Preference: Inhaler familiarity and proven effectiveness bolster continued prescriptions.

- Regulatory Approvals and Label Updates: Approvals for pediatric use and label enhancements typically expand market size.

- Distribution Channels: Strong presence in hospital, outpatient, and retail pharmacy channels sustains sales.

Forecasting Methodology & Assumptions

Sales projections employ a combination of historical market data, epidemiological trends, regulatory outlooks, and competitive analysis, incorporating annual growth rates and scenario-based adjustments. Assumptions include:

- Continued rise in asthma and COPD prevalence at 4-6% annually globally.

- Minimal impact from regulatory restrictions on propellants due to environmental concerns.

- Increased adoption of inhaler devices with digital health integrations poised to favor top-brand recognition.

- Pricing stability in developed markets, with moderate discounts in emerging markets.

Projected Sales Trajectory (2023–2030)

| Year |

Estimated Global Sales (USD millions) |

CAGR (%) |

Notes |

| 2023 |

620 |

— |

Baseline Year |

| 2024 |

660 |

6.5% |

Growth driven by new markets and approvals |

| 2025 |

703 |

6.7% |

Increased adoption in Asia-Pacific |

| 2026 |

750 |

6.7% |

Launch of targeted marketing campaigns |

| 2027 |

805 |

7.0% |

Entry into emerging markets with favorable reimbursement policies |

| 2028 |

860 |

6.8% |

Continued growth amid strong brand loyalty |

| 2029 |

920 |

7.0% |

Digital health features incorporation enhances engagement |

| 2030 |

985 |

7.0% |

Potential patent expiry impacts, offset by brand strength |

Source: Market research estimates based on IHS Markit, GlobalData, and industry reports [2][3].

Key Market Forces Influencing Sales

-

Patent Portfolios and Generic Competition

While Ventolin HFA’s original patents expired in some regions, robust brand equity and clinical community trust sustain premium pricing and loyalty. However, the proliferation of generics could compress margins and slow sales growth.

-

Reimbursement and Healthcare Policies

Reimbursement policies favoring inhaler therapies, combined with payer incentives for adherence and digital monitoring, are likely to drive sustained demand.

-

Environmental Regulations Impacting Propellant Use

Transition to environmentally friendly propellants could initially pressure existing formulations, but regulatory agencies’ approval of new formulations ensures continuity.

-

Innovation and Digital Health Engagement

Integration of smart inhalers and adherence-tracking apps enhances patient engagement, potentially increasing prescription longevity. Companies investing in digital health will likely see a competitive edge.

Risks and Challenges

- Market Saturation: High penetration in mature markets may limit growth potential.

- Regulatory Hurdles: Stringent environmental and safety approvals could delay new formulations.

- Pricing Pressures: Cost-containment policies in public healthcare systems could impact sales.

- Emergence of Alternative Delivery Devices: Advances in dry powder inhalers or non-inhaler therapies might divert demand.

Strategic Recommendations

- Accelerate Innovation: Invest in next-generation inhaler technology, including digital features.

- Expand in Emerging Markets: Tailor marketing strategies to regions with growing burden of respiratory diseases.

- Monitor Regulatory Changes: Stay abreast of environmental and safety regulations affecting inhaler formulations.

- Leverage Data and Digital Health: Use real-world evidence and digital integration to boost adherence and brand loyalty.

Key Takeaways

- Ventolin HFA maintains a dominant position in the inhaler market, propelled by a rising global respiratory disease burden.

- Sales are projected to grow at a CAGR of approximately 6-7% through 2030, reaching nearly USD 1 billion, driven by emerging markets and product innovations.

- Competition from generics and alternative inhalers necessitates continued innovation and brand reinforcement.

- Environmental policies and digital health trends present both challenges and opportunities.

- Strategic investments in innovation, geographic expansion, and digital engagement are vital to sustaining and augmenting sales.

FAQs

1. How will environmental regulations impact Ventolin HFA sales?

Environmental policies targeting propellant gases may push formulation changes. While initial costs might rise, regulatory approvals for environmentally friendly inhalers should sustain long-term sales.

2. What role will digital health play in future Ventolin HFA sales?

Digital features like adherence tracking and real-time data collection will enhance patient engagement, improve treatment outcomes, and serve as differentiators, positively impacting sales growth.

3. Are generic alternatives affecting Ventolin HFA's market share?

Yes, generics pose competitive pressure, especially in mature markets. However, brand loyalty and clinical trust mitigate some impact, and patent expirations offer growth opportunities via generics in emerging markets.

4. What are the primary growth opportunities for Ventolin HFA?

Emerging markets with rising respiratory disease prevalence and the development of next-gen inhaler devices with integrated digital features represent key opportunities.

5. How might patent expirations influence future sales?

Patent expirations could facilitate generic entry, exerting price competition. Strategic differentiation through device innovation and digital integration will be critical to preserving market share.

References

[1] World Health Organization. (2022). Global surveillance report on prevalence of asthma and COPD.

[2] IHS Markit. (2022). Respiratory inhaler market forecast.

[3] GlobalData. (2022). Inhaler devices: market dynamics and future outlook.