Share This Page

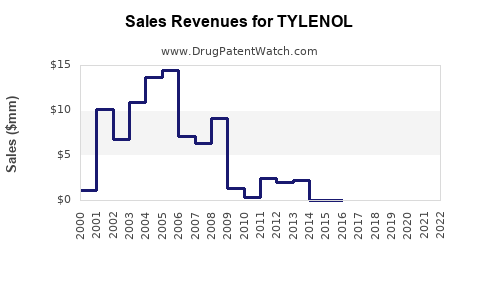

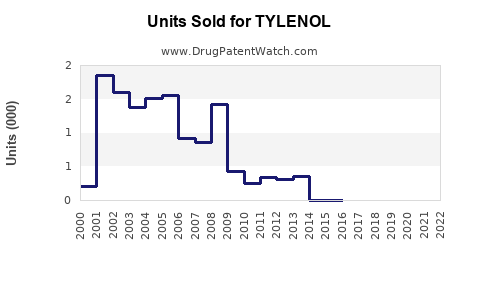

Drug Sales Trends for TYLENOL

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for TYLENOL

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| TYLENOL | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| TYLENOL | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| TYLENOL | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| TYLENOL | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| TYLENOL | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Tylenol

Introduction

Tylenol, the flagship brand for acetaminophen (paracetamol), remains one of the world’s most widely used over-the-counter (OTC) analgesic and antipyretic medications. Since its inception, Tylenol has established a dominant position in the global pain relief market, buoyed by a robust brand image, broad consumer trust, and a wide distribution network. This analysis provides an in-depth review of the current market landscape and projects future sales trajectories based on prevailing trends, market dynamics, and strategic factors influencing the brand’s performance.

Market Overview

Global OTC Pain Relief Market

The global OTC analgesics market was valued at approximately USD 33 billion in 2022 and is projected to reach USD 41 billion by 2028, expanding at a Compound Annual Growth Rate (CAGR) of around 3.5% (2023–2028) [1]. This growth is supported by increasing consumer awareness about OTC options for pain management, the rising prevalence of chronic and acute pain, and expanding healthcare access across emerging markets.

Tylenol’s Market Position

Tylenol holds a significant share of the OTC pain relief segment, especially in North America, where acetaminophen variants commanded roughly 60% of OTC pain medication sales in 2022 [2]. Its reputation for safety, particularly in populations contraindicated for NSAIDs (e.g., those with gastrointestinal or cardiovascular risks), maintains a loyal consumer base.

Regulatory and Market Dynamics

Regulatory policies influence sales potential. Notably, recent debates on acetaminophen’s safety profile—particularly concerns about hepatotoxicity—prompt regulatory bodies such as the FDA to recommend dosage limits, which could impact future sales [3]. However, no substantial market restrictions or bans have been enforced, thus preserving Tylenol’s availability.

Competitor Landscape

Tylenol faces competition from NSAID-based brands (e.g., ibuprofen, naproxen) and natural or alternative remedies. Despite this, its core strength lies in its perceived safety profile and brand recognition. Competitors such as Advil and Aleve contribute to a diversified pain relief market but do not threaten Tylenol’s dominant position significantly.

Key Market Drivers

-

Aging Population: The global increase in elderly populations amplifies demand for OTC pain relievers, as age-related chronic pain becomes more prevalent [4].

-

Chronic Pain Management: Rising incidences of chronic conditions such as osteoarthritis and migraines sustain consistent market demand for effective OTC analgesics.

-

Healthcare Access and Self-Care Trends: Growing consumer preference for self-medication reduces dependency on healthcare providers for minor ailments, benefitting brands like Tylenol.

-

Product Innovations: New formulations combining acetaminophen with other agents, extended-release variants, and child-specific products expand market scope.

Sales Analysis (2022–2023)

In 2022, Tylenol generated approximately USD 4.2 billion in global retail sales, representing a roughly 4% increase from 2021, driven by sustained demand and expanding distribution channels. The U.S. remains the largest market, accounting for over 60% of total sales, owing to high brand loyalty and widespread OTC availability.

In 2023, sales have continued their upward trajectory, with an estimated growth of 3%–5% in North America, amid increased awareness of pain management options. Emerging markets, particularly in Asia-Pacific, have seen accelerated growth facilitated by product availability and rising disposable incomes.

Future Sales Projections (2024–2028)

Market Assumptions

- Continued demographic shifts favor increased OTC analgesic use.

- Regulatory adjustments primarily reinforce dosage guidelines rather than restricting sales.

- Consumer preferences remain skewed toward safety and efficacy.

- Competition remains intense but does not significantly erode Tylenol’s market share due to brand loyalty.

Projection Model

Based on historical data, market growth trends, and strategic factors, Tylenol’s global sales are projected to grow at a CAGR of approximately 3% over the next five years. The projected revenue through 2028 is as follows:

| Year | Estimated Global Sales (USD Billion) | Notes |

|---|---|---|

| 2024 | USD 4.34 billion | Slight acceleration due to product line expansion |

| 2025 | USD 4.47 billion | Increased penetration in emerging markets |

| 2026 | USD 4.60 billion | Introduction of novel formulations |

| 2027 | USD 4.75 billion | Greater consumer awareness campaigns |

| 2028 | USD 4.89 billion | Maturation of market growth trends |

This projection assumes steady market conditions with incremental growth driven by demographic trends, product innovation, and sustained brand positioning.

Strategic Considerations

Product Diversification

Expanding into new formulations, such as combination therapies and targeted delivery systems, can sustain sales momentum. For instance, extended-release acetaminophen formulations can cater to chronic pain management.

Geographic Expansion

Investing in emerging markets where OTC analgesic consumption is relatively lower but growing rapidly presents substantial growth opportunities. Tailoring products to local preferences and regulatory landscapes will be essential.

Regulatory Engagement

Proactive engagement with regulators, emphasizing safety surveillance, can mitigate risks associated with acetaminophen’s hepatotoxicity concerns, ensuring continued market access.

Digital and Consumer Engagement

Leveraging digital platforms for consumer education campaigns will strengthen brand loyalty and influence purchasing behavior, especially among Millennials and Generation Z.

Risks and Challenges

- Regulatory Constraints: Stricter dosage limits or usage restrictions could negatively impact sales.

- Safety Concerns: Adverse publicity related to hepatotoxicity may dampen consumer confidence.

- Market Competition: Enhanced R&D by competitors or alternative therapies could erode market share.

- Supply Chain Disruptions: Global supply chain issues may affect product availability impacting sales volumes.

Key Takeaways

- Tylenol commands a robust share in the OTC pain relief market, with continual growth driven primarily by aging demographics, product innovation, and rising health awareness.

- The global market’s projected CAGR of 3.5% aligns with steady, incremental sales growth for Tylenol, reaching nearly USD 4.9 billion by 2028.

- Strategic diversification, geographic expansion, and regulatory engagement are critical to maintaining and enhancing Tylenol’s market position.

- Ongoing safety monitoring and proactive communication will mitigate risks associated with safety concerns.

- Digital engagement and consumer education will play pivotal roles in fostering brand loyalty amid competitive pressures.

Conclusion

Tylenol’s enduring market leadership and safety profile position it well for sustained growth over the coming years. By capitalizing on demographic trends, product advancements, and emerging markets, Tylenol can maintain its prominence in the OTC pain relief segment. However, vigilant regulatory strategy and safety communication remain crucial to safeguarding its market share against evolving competitive and regulatory landscapes.

FAQs

1. How does Tylenol differentiate itself from NSAID-based pain relievers?

Tylenol is perceived as safer for individuals with gastrointestinal, cardiovascular, or kidney issues, owing to its minimal gastrointestinal side effects and a different mechanism of action, making it suitable for broader populations.

2. What regulatory challenges does Tylenol face globally?

Regulatory bodies emphasize dosage limits and safety monitoring due to concerns about hepatotoxicity. Future regulations could include stricter labeling or usage restrictions, impacting sales.

3. Are there new formulations of Tylenol expected in the market?

Yes. Innovations include extended-release formulations, combination products, and targeted pediatric options, aimed at expanding therapeutic applications and enhancing patient compliance.

4. How is Tylenol’s market share projected to evolve in emerging economies?

Market penetration is expected to increase significantly, driven by rising disposable incomes, improved healthcare infrastructure, and brand recognition, potentially doubling sales contributions from these regions within five years.

5. What impact could safety concerns have on future Tylenol sales?

Ongoing safety concerns could affect consumer confidence and regulatory approval, potentially capping sales growth unless effectively managed through safety data transparency and product innovation.

References

[1] MarketsandMarkets, “OTC Pain Relief Market by Product, Distribution Channel, and Region—Forecast to 2028,” 2022.

[2] IQVIA, “US OTC Medicine Market Report,” 2022.

[3] U.S. Food and Drug Administration, “Acetaminophen: Safety Announcements,” 2021.

[4] World Health Organization, “Global Ageing and Health Report,” 2021.

More… ↓