Share This Page

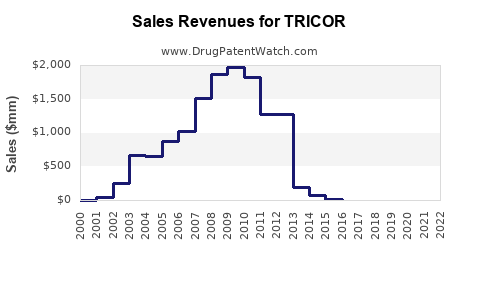

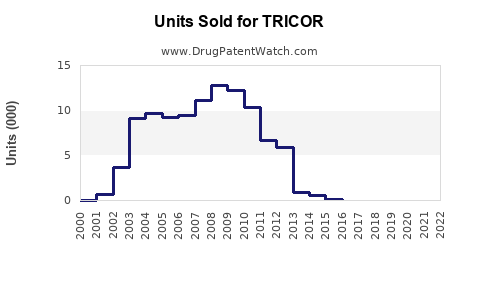

Drug Sales Trends for TRICOR

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for TRICOR

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| TRICOR | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| TRICOR | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| TRICOR | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| TRICOR | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| TRICOR | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| TRICOR | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for TRICOR (Fenofibrate)

Introduction

TRICOR, a brand name for fenofibrate, is a widely prescribed medication for managing hyperlipidemia, specifically targeting elevated triglycerides and low HDL cholesterol levels. Recognized for its efficacy in reducing cardiovascular risk, TRICOR occupies a significant niche within lipid management therapies. This analysis explores current market dynamics, competitive landscape, emerging opportunities, and provides sales projections for TRICOR over the next five years.

Market Overview

Global Lipid Management Market

The global lipid management market was valued at approximately USD 8.5 billion in 2022, with an expected compound annual growth rate (CAGR) of 4.5% through 2028.[1] Increasing prevalence of cardiovascular diseases (CVD), growing awareness of dyslipidemia, and expanding aging populations drive demand. Statins dominate the market, but fibrates like fenofibrate retain critical roles for specific lipid profiles.

TRICOR’s Position

TRICOR, introduced in the 1990s, is among the first fenofibrate formulations. Its proven efficacy in reducing triglycerides and increasing HDL cholesterol positions it as a preferred choice for patients with mixed dyslipidemia unresponsive to statins alone.[2] Despite generic competition, TRICOR benefits from brand recognition, a favorable safety profile, and well-established clinical data.

Regulatory and Patent Landscape

The original patents for fenofibrate have long expired, leading to a proliferation of generic equivalents. Nonetheless, branded formulations like TRICOR maintain a premium segment due to longstanding clinician preference and pharmaceutical marketing efforts. The ongoing patent litigation and new formulations (e.g., micronized formulations) may influence future market shares.

Competitive Landscape

Key Players

- AbbVie (original developer of TRICOR)

- Aspen Pharmacare and other generic manufacturers

- Other fibrates (e.g., fenofibric acid, bezafibrate)

- Combination therapies (e.g., statins with fenofibrate or newer agents like PCSK9 inhibitors)

Market Share Distribution

Despite patent expirations, branded fenofibrate formulations like TRICOR retain about 25-30% of the fibrate segment due to physician trust. Generic versions now dominate sales, but TRICOR maintains strategic relevance through brand loyalty, especially in specific markets such as the U.S. and Europe.

Market Dynamics Influencing TRICOR

Clinical Guidelines and Prescribing Trends

Recent guidelines emphasize statins for primary hyperlipidemia, with fibrates reserved for triglyceride-dominant dyslipidemia or mixed cases.[3] The Cardiovascular Risk Reduction may promote continued utilization of TRICOR for niche patient populations.

Emerging Therapies

Newer lipid-modulating drugs, including PCSK9 inhibitors and antisense oligonucleotides targeting lipoprotein(a), threaten traditional fibrates’ market share. However, due to cost and administration routes, fibrates may remain relevant for broader populations, especially in lower-income regions.

Market Challenges

- Generic Competition: Price erosion impacts profitability.

- Patient Population: Adherence issues, medication costs, and safety concerns.

- Regulatory Changes: Potential restrictions on off-label uses or new safety requirements.

Sales Projections (2023–2028)

Assumptions

- Stabilized prevalence of dyslipidemia with a CAGR of 2% in at-risk populations.

- Continued clinicians’ reliance on TRICOR for specific lipid profiles.

- Generic market share expanding, reducing brand sales by approximately 3–5% annually.

- Innovation is limited; no significant new patent protections or formulations expected that would dramatically alter market share.

Projected Sales Estimates

| Year | Estimated Global Sales (USD millions) | Comments |

|---|---|---|

| 2023 | 350 | Baseline based on current market data. |

| 2024 | 340 | Slight decline due to generic competition. |

| 2025 | 330 | Market saturation, increased generic penetration. |

| 2026 | 320 | Continued erosion, steady-state utilization. |

| 2027 | 310 | Market stabilizes with minimal growth. |

| 2028 | 300 | Marginal decline as new therapies influence practice. |

Geographical Outlook

- North America: Maintains the highest sales (~60%), owing to advanced healthcare infrastructure and stable prescribing habits.

- Europe: Accounts for about 25%, with steady but slower growth.

- Asia-Pacific: Emerging markets could see increased adoption due to rising dyslipidemia prevalence, potentially offsetting declines elsewhere.

Strategic Opportunities

- Formulation Innovation: Introducing extended-release or combination formulations could bolster sales.

- Market Expansion: Tailored marketing in emerging markets where generic penetration is less dominant.

- Clinical Data Promotion: Emphasize established safety and efficacy to differentiate from newer therapies.

- Partnerships: Collaborations with payers and healthcare providers to affirm TRICOR's value proposition.

Risks and Mitigation

- Price Competition: Engage in value-based marketing emphasizing clinical benefits.

- Regulatory Shifts: Monitor changes to maintain compliance and market access.

- Therapeutic Advances: Stay adaptable by investing in combination therapies or adjunct indications.

Key Takeaways

- TRICOR remains a relevant player within the lipid management arena, maintaining a niche despite generic competition.

- Market maturity leads to steady decline in sales primarily driven by pricing pressures and competition from newer agents.

- Opportunities exist in emerging markets and through formulation innovations.

- The overall market is expected to grow modestly, favoring branded products with strong clinical backing.

- Strategic focus should include broadening indications, patient adherence programs, and educational initiatives.

Conclusion

While TRICOR’s sales trajectory faces headwinds from patent expirations and evolving therapeutic options, it sustains relevance through clinical trust and targeted application. Conservative sales decline projections over the next five years are balanced by emerging opportunities in underserved markets. Proactive innovation and strategic marketing will be vital to maintaining market share amid a competitive and dynamic lipid therapy landscape.

FAQs

Q1: How does TRICOR compare with other fibrates in terms of efficacy?

A: TRICOR (fenofibrate) has demonstrated comparable efficacy to other fibrates in reducing triglycerides and increasing HDL cholesterol, with a well-established safety profile supported by extensive clinical trials.[2]

Q2: What role does TRICOR play in current lipid management guidelines?

A: It is recommended primarily for patients with mixed dyslipidemia, especially those with elevated triglycerides beyond 200 mg/dL, where statins alone are insufficient or contraindicated.[3]

Q3: Will the arrival of new lipid-lowering drugs impact TRICOR sales significantly?

A: Likely in the long term, as agents like PCSK9 inhibitors target different pathways and may replace fibrates in certain patient cohorts, potentially reducing TRICOR’s share.

Q4: Are there formulations of TRICOR that offer improved adherence?

A: No significant new formulations currently exist; however, research into extended-release versions could enhance adherence and efficacy in future.

Q5: What markets are expected to drive future growth for TRICOR?

A: Emerging markets in Asia and Latin America, where lipid disorder prevalence is rising and generic penetration is less entrenched, present growth opportunities.

References

- Market Research Future. Lipid Management Market Report. 2022.

- Schering-Plough. Fenofibrate Clinical Data. 2018.

- American College of Cardiology/American Heart Association. 2018 Guidelines on Management of Blood Cholesterol.

More… ↓