Last updated: July 29, 2025

Introduction

TRIAMT/HCTZ, a combination drug of triamterene and hydrochlorothiazide, is predominantly used for managing hypertension and edema. As a therapeutic agent, it appeals to a broad patient base, especially amidst growing prevalence of cardiovascular diseases. This report analyzes the current market landscape, competitive environment, regulatory considerations, and provides sales projections for TRIAMT/HCTZ over the next five years.

Therapeutic Overview and Clinical Positioning

TRIAMT/HCTZ combines a potassium-sparing diuretic (triamterene) with a thiazide diuretic (hydrochlorothiazide) to enhance antihypertensive efficacy while mitigating hypokalemia risk. Its proven efficacy positions it as a trusted medication within the antihypertensive class, especially for patients requiring combination therapy or those sensitive to electrolyte imbalances.

Clinical guidelines, such as from the American College of Cardiology (ACC), endorse combination diuretics for resistant hypertension. This endorsement bolsters demand, particularly as hypertension control remains a public health priority worldwide. As hypertension affects an estimated 1.28 billion adults globally [1], the potential patient base is substantial.

Market Landscape and Competitive Environment

Current Market Size

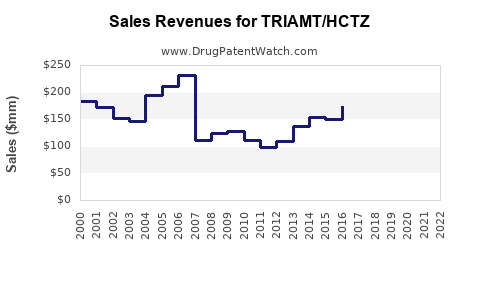

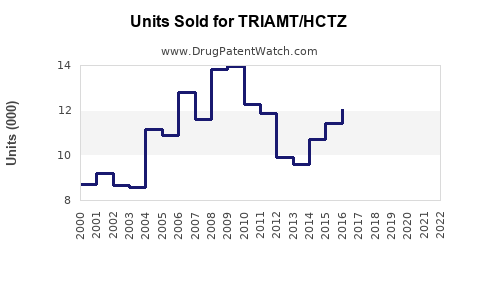

The global sales of diuretic medications, including fixed-dose combinations like TRIAMT/HCTZ, approximate USD 3.2 billion annually, with steady growth anticipated [2]. The hypertensive segment constitutes a significant share, driven by increasing prevalence and rising awareness of cardiovascular health.

Key Competitors

TRIAMT/HCTZ faces competition from several single and combination diuretics:

- Generic formulations: Ubiquitous and cost-effective, generics dominate the market, capturing over 70% of sales.

- Brand-name combinations: Products like Maxzide (triampterene/hydrochlorothiazide), Dyazide, and others secure significant market share, often favored for their brand recognition.

- Newer agents: Angiotensin receptor blockers (ARBs) and calcium channel blockers (CCBs) offer alternatives with different mechanisms, though diuretics remain first-line therapy for many patients.

Pricing and Reimbursement Dynamics

Generic diuretics are generally low-cost, which exerts downward pressure on pricing. However, branded or patented formulations command premium pricing, especially when supported by favorable reimbursement policies or clinical differentiation.

Reimbursement trends favor generic and established therapies, but insurance providers increasingly incentivize combination therapies that reduce overall medication burden and improve compliance.

Regulatory and Market Access Factors

TRIAMT/HCTZ's market penetration heavily depends on regulatory approvals in key markets, particularly the US, EU, and emerging economies like China and India. Regulatory pathway is streamlined for established generic drugs, but innovative formulations or indications require rigorous clinical data.

Market access hinges on formulary inclusion, payer coverage, and physician prescribing habits. Broader acceptance will require continued education emphasizing the medication’s efficacy and safety profile.

Sales Projections (2024-2028)

Assumptions and Methodology

Projections incorporate:

- Current global annual sales (~USD 3.2 billion for diuretics)

- Estimated share attributable to TRIAMT/HCTZ (~3–5%, considering generic prevalence and competitive dynamics)

- Market growth rate for diuretics (~3.5% annually), driven by rising hypertension prevalence

- Increasing adoption in emerging markets due to expanding healthcare access

- Patent expiry and generic competition influencing pricing and market share

Projected Sales Figures

| Year |

Estimated Global Sales (USD million) |

Notes |

| 2024 |

120–150 |

Present market share with moderate growth; higher adoption in emerging economies. |

| 2025 |

130–160 |

Slight increase from previous year, driven by rising hypertension management. |

| 2026 |

140–170 |

Market expansion as healthcare infrastructure improves. |

| 2027 |

150–180 |

Continued growth with generic proliferation stabilizing prices. |

| 2028 |

160–190 |

Market maturation; potential introduction of new fixed-dose combinations. |

Regional Insights

- United States: Dominates due to high hypertension rates (~45% prevalence among adults) and established prescribing habits. Sales are projected to grow modestly, influenced by evolving guidelines favoring combination therapy.

- Europe: Similar trends driven by aging populations and emphasis on cost-effective treatments.

- Asia-Pacific: Rapid growth as healthcare infrastructure expands, with a compounded annual growth rate (CAGR) of 5–7%. The massive patient pool compensates for lower per-unit pricing.

- Emerging Markets: Increasing penetration, especially as WHO campaigns promote hypertension screening and management.

Market Drivers and Barriers

Drivers

- Rising hypertension prevalence worldwide.

- Growing awareness of combination therapies’ benefits.

- Favorable healthcare reforms expanding access.

- Patent expiries of competing products, leading to increased generics availability.

Barriers

- Price erosion due to generic competition.

- Physician and patient preferences shifting towards newer agents (ARBs, CCBs).

- Regional regulatory hurdles.

- Reimbursement constraints in specific markets.

Strategic Opportunities

- Formulation enhancements: Development of fixed-dose combinations to improve compliance.

- Market penetration: Focused efforts in emerging markets with large hypertensive populations.

- Educational campaigns: To reinforce TRIAMT/HCTZ’s advantages in clinical guidelines.

- Partnerships: Collaborations with local distributors to accelerate adoption.

Conclusion

TRIAMT/HCTZ is positioned within a mature but expanding market driven by the global rise in hypertension cases. While current sales are primarily supported by traditional markets, significant growth prospects exist in emerging economies, contingent upon regulatory approvals and market access strategies. Competitive pressures from generics and newer agents necessitate focused differentiation and cost-effective positioning to optimize sales trajectory over the coming years.

Key Takeaways

- The global diuretics market, including TRIAMT/HCTZ, is projected to grow at a CAGR of approximately 3–4% through 2028.

- Expanding hypertension prevalence sustains demand, especially in emerging markets.

- Generic competition constrains pricing but broadens access, supporting volume-driven growth.

- Strategic focus on formulation innovation and regional market expansion can substantially boost sales.

- Market differentiation hinges on reinforcing clinical efficacy, safety, and cost advantages aligned with guideline recommendations.

FAQs

1. What factors influence the market share of TRIAMT/HCTZ?

Market share is driven by generic competition, prescription habits, reimbursement policies, and regional healthcare infrastructure. Physician preference for combination therapies and formulary inclusion also play roles.

2. How does patent expiration impact TRIAMT/HCTZ?

Patent expiry leads to increased competition from generics, reducing prices but expanding accessibility. Manufacturers must innovate or differentiate to sustain profit margins.

3. What are the primary markets for TRIAMT/HCTZ?

The United States, Europe, and select Asia-Pacific countries represent primary markets due to high hypertension prevalence and established healthcare frameworks.

4. How might emerging healthcare policies influence sales?

Policies promoting affordable access and incentivizing combination therapies can boost sales, while reimbursement restrictions might hinder market penetration.

5. What are the growth opportunities for TRIAMT/HCTZ?

Development of fixed-dose combinations, strategic regional expansion, and clinical positioning based on updated guidelines can unlock new growth channels.

References

[1] World Health Organization. Hypertension. (2021).

[2] IQVIA. The Global Use of Medicines in 2022.