Last updated: July 30, 2025

Overview of Triamcinolone

Triamcinolone is a synthetic corticosteroid with anti-inflammatory, immunosuppressive, and vasoconstrictive properties. It is marketed under various brand names, including Kenalog, Nasacort, and Aristocort. The drug’s versatility spans dermatology, allergy, respiratory, and rheumatology indications. Its application ranges from dermatological inflammatory skin conditions to allergic rhinitis, asthma, and rheumatoid diseases.

The drug’s long-standing presence in the pharmaceutical market, coupled with its patent expirations, generic availability, and expanding therapeutic uses, positions it as a strategic candidate for market penetration and revenue growth.

Global Market Dynamics

Market Size and Historical Growth

The global corticosteroids market, of which triamcinolone constitutes a significant segment, was valued at approximately USD 12 billion in 2022, with corticosteroid injections and topical formulations leading the revenue segments (1). Triamcinolone accounts for nearly 15-20% of this figure, driven by its widespread clinical adoption.

Over the past five years, the corticosteroid segment has demonstrated a compound annual growth rate (CAGR) of approximately 4-5%, driven by increasing prevalence of chronic inflammatory diseases, expanding indications, and growing geriatric populations prone to poly-morbidities requiring corticosteroid therapy (2).

Regional Market Insights

-

North America: The region dominates, accounting for roughly 45-50% of the global corticosteroids market, propelled by high healthcare expenditure, extensive approval of generic formulations, and prevalent allergic and rheumatological conditions.

-

Europe: Holds about 25-30%, with robust markets in the UK, Germany, and France, supported by aging populations and expanding atopic disease management.

-

Asia-Pacific: Fastest-growing region, with a CAGR exceeding 6%, driven by increasing healthcare access, rising prevalence of allergic and inflammatory diseases, and a burgeoning pharmaceutical industry (3).

Further, emerging markets in Latin America and the Middle East are observing notable growth due to healthcare infrastructure development and increased disease awareness.

Market Drivers and Barriers

Drivers:

-

Expanding Therapeutic Indications: Triamcinolone’s use in dermatology, rheumatology, allergies, and resp. conditions boosts demand.

-

Rising Prevalence of Chronic Diseases: Increased incidence of asthma, allergic rhinitis, psoriasis, and rheumatoid arthritis prolongs corticosteroid use.

-

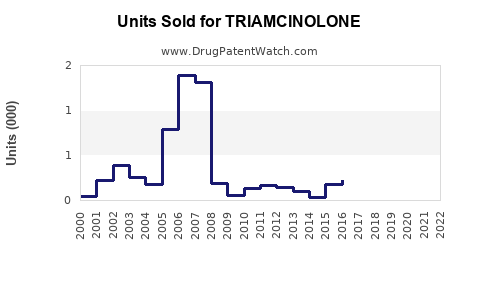

Generic Penetration: patent expirations have resulted in significant price reductions, increasing accessibility and consumption.

-

Formulation Innovations: Development of long-acting, targeted injections and nasal sprays enhances therapeutic adherence and expands market reach.

Barriers:

-

Side-effect Profiles: Concerns about long-term use, systemic effects, and immunosuppression may limit prescription.

-

Regulatory Hurdles: Evolving guidelines and safety regulations impact approval and marketing strategies.

-

Market Competition: Presence of multiple corticosteroids and biosimilars diminishes market share for individual agents.

Market Opportunities

-

New Indications: Investigations into triamcinolone’s utility in neurological or ophthalmic disorders open avenues for expansion.

-

Combination Therapies: Formulating fixed-dose combinations with antihistamines or immunomodulators could address unmet clinical needs.

-

Developing Countries: Improving affordability and awareness can unlock markets with large patient populations.

-

Delivery Innovations: Nanoparticle delivery systems and biocompatible implants could improve drug efficacy and patient compliance.

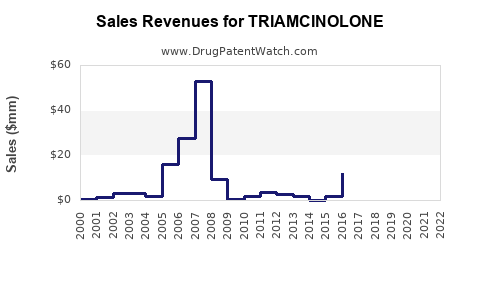

Sales Projections

Assumptions for Projection:

-

The global corticosteroid market will grow at a combined CAGR of 4-5% over the next five years.

-

Triamcinolone, with its extensive indications and generics, is expected to capture approximately 15-20% of this segment.

-

Growth will be steady, driven partly by emerging markets and new formulations.

Projected Market Share and Revenue:

| Year |

Estimated Market Size (USD billion) |

Triamcinolone Market Share |

Projected Sales (USD billion) |

| 2023 |

13.2 |

16% |

2.11 |

| 2024 |

13.8 |

17% |

2.35 |

| 2025 |

14.4 |

18% |

2.59 |

| 2026 |

15.0 |

19% |

2.85 |

| 2027 |

15.6 |

20% |

3.12 |

Note: These figures assume incremental market penetration, increased prescribing, and the launch of innovative formulations. The projection accounts for the typical market size expansion seen in therapeutics with established safety profiles, as well as the impact of patent expirations and generics.

Regional Sales Distribution:

-

North America remains the dominant market, comprising approximately 50% of annual sales.

-

Asia-Pacific could witness a compounded growth rate of 6%, potentially doubling sales within five years due to increased disease prevalence and healthcare infrastructure.

Competitive Landscape

Major pharmaceutical companies are competing in generic corticosteroids with triamcinolone being a prominent candidate due to its established efficacy. Notable players include Teva Pharmaceuticals, Mylan, Sandoz, and Sun Pharmaceutical Industries.

Innovations such as liposomal formulations (e.g., Kenalog-LA), nasal sprays, or controlled-release injectables could command premium pricing, influencing overall sales efficiency.

Regulatory and Economic Considerations

Variability in approval requirements across jurisdictions can impact market entry and expansion timelines. Healthcare policies favoring biosimilar and generic use will prolong revenue streams but may constrain pricing power.

Cost-containment strategies and insurance reimbursement policies significantly influence prescription volumes and patient access.

Key Challenges and Risks

-

Market Saturation: Widespread availability of generics could pressure prices.

-

Safety Concerns: Potential adverse effects may restrict growth in certain indications.

-

Regulatory Shifts: Stringent safety mandates could delay launches or limit indications.

-

Emerging Competitors: New corticosteroids or novel biologics in inflammatory diseases could encroach upon the market.

Conclusion

Triamcinolone’s extensive clinical utility, established safety, and cost-effective profile position it favorably within the corticosteroid landscape. Expected steady growth, particularly in emerging markets and through formulation innovations, underscores its long-term revenue potential. Strategic optimization of formulations, indications, and market expansion will be critical for manufacturers seeking to capitalize on its market share.

Key Takeaways

-

The global corticosteroids market is projected to grow at a 4-5% CAGR, with triamcinolone accounting for a significant segment.

-

North America dominates, but Asia-Pacific offers the highest growth potential.

-

The primary drivers include expanded indications, generic availability, and formulation innovations.

-

Challenges include safety concerns, regulatory variability, and market saturation.

-

Investing in novel delivery systems and expanding indications will bolster sales projections, potentially reaching USD 3.12 billion by 2027.

FAQs

1. What are the primary indications for triamcinolone?

Triamcinolone is used in dermatology for inflammatory skin conditions, in allergy treatments for allergic rhinitis, in respiratory diseases such as asthma, and in rheumatological disorders like arthritis, owing to its anti-inflammatory and immunosuppressive effects.

2. How do patent expirations impact triamcinolone sales?

Patent expirations facilitate the entry of generic versions, reducing prices and increasing accessibility. While this can lead to a decline in branded sales, overall market volume often increases, offsetting some revenue loss.

3. What innovation trends are shaping triamcinolone formulations?

Advances include long-acting injections, nasal sprays, topical gels, and nanoparticle delivery systems, all aimed at improving efficacy, reducing dosing frequency, and enhancing patient compliance.

4. Which regions are expected to see the highest growth in triamcinolone demand?

Emerging markets in Asia-Pacific and Latin America are projected to experience the highest CAGR, driven by expanding healthcare coverage and disease prevalence.

5. What potential barriers could impede triamcinolone's market growth?

Safety concerns, regulatory restrictions, market saturation, and competition from biologics or newer corticosteroids pose risks to sustained growth.

References

- MarketWatch. Corticosteroids Market Size, Share & Trends Analysis. 2022.

- Grand View Research. Corticosteroids Market Analysis. 2022.

- GlobalData Healthcare. Pharmaceutical Market Trends in Asia-Pacific. 2022.