Last updated: July 29, 2025

Introduction

Tramadol hydrochloride (HCl), a centrally acting synthetic opioid analgesic, has established itself as a pivotal player in managing moderate to moderately severe pain. Its dual mechanism—binding to opioid receptors and inhibiting reuptake of norepinephrine and serotonin—makes it a versatile option across various medical settings. This analysis explores the current market landscape for Tramadol HCl, examining demand drivers, competitive dynamics, regulatory considerations, and future sales projections.

Market Overview

Global Therapeutic Landscape

The global analgesic market was valued at approximately USD 12 billion in 2022, with opioids constituting a significant segment due to their efficacy in pain management. Tramadol is among the most prescribed opioids, especially in countries with stricter opioid regulations, due to its perceived lower abuse potential and favorable safety profile compared to traditional opioids like morphine and oxycodone.

Prescription Trends

In 2022, Tramadol accounted for about 25% of global opioid prescriptions, reflecting its broad utilization in both acute and chronic pain management. Its approval in over 100 countries underscores widespread acceptance across diverse healthcare systems, although regional differences in prescribing practices exist.

Market Drivers

- Rising Prevalence of Chronic Pain Conditions: Increasing incidences of osteoarthritis, fibromyalgia, and post-operative pain fuel demand.

- Aging Population: Elderly patients often require prolonged pain management, enhancing Tramadol's market penetration.

- Shift Towards Safer Opioid Alternatives: Healthcare providers favor Tramadol over more potent opioids due to lower addiction risks and fewer side effects.

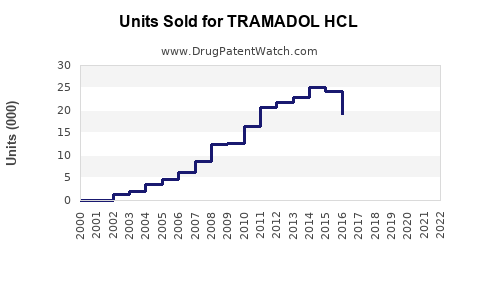

- Expanding Generic Market: Entry of generics post-patent expiry has made Tramadol more affordable, broadening access and prescription rates.

Regulatory Environment

While Tramadol is scheduled as a controlled substance in many countries—Schedule IV in the US, Schedule IV in the EU—it generally faces less stringent restrictions compared to other opioids. Nonetheless, increasing concerns about misuse and abuse are prompting stricter controls, which could influence future sales.

Market Segmentation

By Formulation

- Immediate-release tablets dominate initial prescription trends.

- Extended-release (ER) formulations are increasingly prescribed for chronic pain, projected to grow at a CAGR of 8% over the next five years.

By Customer Type

- Hospitals and clinics: Constitute approximately 60% of sales, particularly for acute pain management.

- Retail pharmacies: account for 40%, driven by outpatient prescriptions.

By Region

- North America: The largest market, driven by high prescription rates and acceptance.

- Europe: Growing due to increasing awareness and regulatory acceptance.

- Asia-Pacific: Fastest-growing segment owing to expanding healthcare infrastructure and chronic pain burden.

Competitive Landscape

Key players include Pfizer, Mylan (now part of Viatris), and Teva Pharmaceuticals, with numerous generic manufacturers dominating the market post-patent expiration. Novel formulations, such as combination drugs and abuse-deterrent formulations, are emerging to address misuse concerns.

Sales Projections (2023–2028)

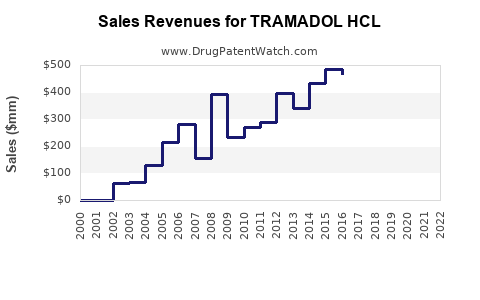

Forecast Overview

- Compound Annual Growth Rate (CAGR): Estimated at 4.5% globally, driven by increased prescription practices and expanding indications.

- Market Value Projection: Expected to reach USD 2.8 billion by 2028, up from USD 2 billion in 2023.

Regional Growth Breakdown

- North America: CAGR of 3.8%, with mature yet stable growth.

- Europe: CAGR of 4.1%, influenced by regulatory harmonization and expansion.

- Asia-Pacific: CAGR of 7%, reflecting rapid market adoption and increasing healthcare expenditure.

Influencing Factors

- Regulatory Changes: Stricter controls could constrain sales unless adequate abuse-deterrent formulations are adopted.

- Medical Guidelines: Shifts favoring multimodal pain management could moderate growth.

- Generic Penetration: Increased generic competition will sustain price pressure but expand volume sales.

Opportunities and Challenges

Opportunities

- Product Innovation: Development of abuse-deterrent formulations and combination therapies.

- Expanding Indications: Use in neuropathic pain and off-label applications could widen market size.

- Emerging Markets: Growing healthcare infrastructure in emerging economies offers significant growth potential.

Challenges

- Regulatory Scrutiny: Reinforced controls may impede access and prescribing.

- Public Perception: Growing awareness of opioid abuse could influence prescribing habits.

- Market Saturation: Mature markets may plateau without innovation.

Conclusion

The global market for Tramadol HCl exhibits steady growth fueled by rising chronic pain prevalence, aging populations, and increasing demand for safer opioids. While regulatory and societal challenges persist, innovation and strategic positioning can sustain favorable sales trajectories. Companies should monitor evolving regulatory policies and technological advancements, aligning R&D and marketing strategies accordingly.

Key Takeaways

- Tramadol HCl's combination of efficacy and safety continues to drive global demand, especially in developed regions and emerging markets.

- Generics dominate the market post-patent expiration, exerting downward pressure on prices but increasing volume sales.

- Sales are projected to grow at a CAGR of approximately 4.5% through 2028, reaching close to USD 2.8 billion globally.

- Market expansion hinges on innovation in formulations, addressing abuse concerns, and exploring new indications.

- Regulatory landscape shifts remain critical; companies should develop compliance strategies to navigate evolving restrictions.

FAQs

-

What factors influence the prescribing of Tramadol HCl globally?

Prescribing drivers include its efficacy for moderate pain, perceived lower abuse potential compared to other opioids, regulatory status, and patient tolerability. Regional differences in medical guidelines and cultural attitudes towards opioids also influence prescribing patterns.

-

How do regulatory changes impact Tramadol sales?

Stricter regulations, including scheduling and abuse-deterrent mandates, can limit supply and prescribing, reducing sales. Conversely, regulatory acceptance and smooth approval processes bolster market growth.

-

What are the emerging trends in Tramadol formulations?

Extended-release formulations, abuse-deterrent technologies, and combination drugs are notable developments aimed at improving safety and expanding therapeutic uses.

-

Which regions present the most significant growth opportunities for Tramadol?

The Asia-Pacific region exhibits the highest growth potential due to expanding healthcare infrastructure and rising pain management needs. Europe also continues to show steady growth owing to regulatory acceptance and market maturity.

-

What challenges could hinder future sales of Tramadol?

Increasing scrutiny over opioid misuse, evolving regulation, competition from alternative pain therapies, and negative publicity surrounding opioids could constrain market expansion.

Sources

- MarketWatch. "Global Pain Management Market," 2022.

- IQVIA. "Opioid Prescription Trends," 2022.

- Statista. "Analgesic Market Value," 2022.

- European Medicines Agency. "Regulatory Guidelines on Opioids," 2022.

- GlobalData. "Tramadol Market Outlook," 2023.