Share This Page

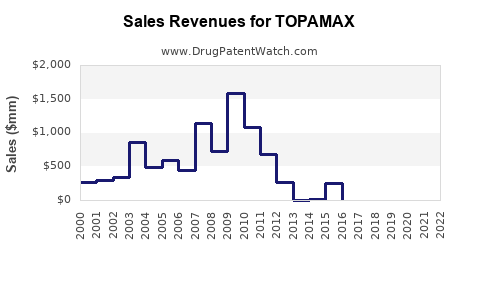

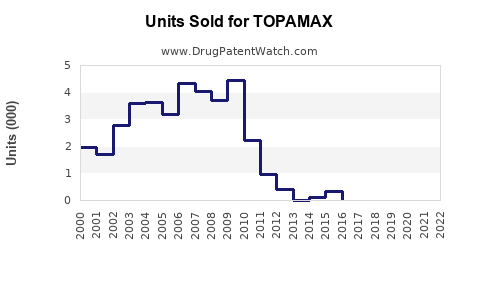

Drug Sales Trends for TOPAMAX

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for TOPAMAX

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| TOPAMAX | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| TOPAMAX | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| TOPAMAX | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| TOPAMAX | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Topamax (Topiramate)

Introduction

Topamax (topiramate) is a broad-spectrum anticonvulsant and migraine prophylactic medication developed by Janssen Pharmaceuticals, now marketed by several generics manufacturers. Originally approved by the FDA in 1996 for epilepsy, it received additional approval in 2004 for migraine prevention. Its versatile indications, including epilepsy, migraine, weight management (in combination with phentermine), and off-label uses such as alcohol dependence, position Topamax as a significant player in neurological and psychiatric treatment markets. This analysis evaluates its current market landscape, competitive environment, growth drivers, challenges, and future sales projections.

Market Overview

Global Market Size

The global anti-epileptic drugs (AEDs) market, valued at approximately USD 3.9 billion in 2022, is projected to grow at a CAGR of around 4% through 2030, with topiramate constituting a significant segment due to its broad indications[^1]. The migraine prophylaxis segment remains robust, with sizable patient populations and increasing diagnosis rates.

Key Indications Driving Demand

- Epilepsy: Affects approximately 50 million individuals worldwide[^2], with persistent demand for effective, well-tolerated medications.

- Migraine prevention: Estimated to impact over 1 billion globally, with increased awareness boosting prophylactic treatment adoption[^3].

- Obesity management: Approved in combination with phentermine—market size estimated at USD 2.7 billion in 2022, with a CAGR of 15% during 2023–2030[^4].

Geographic Market Dynamics

- North America: Dominant due to high epilepsy and migraine prevalence, advanced healthcare infrastructure, and comprehensive reimbursement systems.

- Europe: Similar market size with growing awareness.

- Emerging Markets: Rapidly expanding due to increased healthcare access, though pricing and regulatory hurdles persist.

Competitive Landscape

Major Brands and Generics:

Topamax faced patent expiration in 2012, leading to a proliferation of generic versions that significantly eroded branded sales[^5]. Currently, multiple generic manufacturers dominate the market, constraining price premiums.

Key Competitors:

- Valproic Acid/Valproate: Cost-effective, widely used.

- Lamotrigine (Lamictal): Alternative for epilepsy and bipolar disorder.

- Additional migraine prophylactics: Such as propranolol and amitriptyline.

Market share distribution is increasingly fragmented, favoring generics, with branded Topamax holding a declining but still relevant niche in specific segments, especially where prescribers favor its unique profile or patient-specific factors.

Sales Drivers and Growth Opportunities

- Expansion of Indications: Ongoing research into additional indications, including bipolar disorder and alcohol dependence, could expand market size.

- Off-label Uses: Prescriber flexibility can increase demand, especially in psychiatry.

- New Formulations: Extended-release formulations improve adherence and patient convenience, driving incremental sales.

- Increasing Diagnosis and Treatment Rates: Rising awareness and diagnosis of epilepsy and migraines expand the eligible patient base.

Challenges Impacting Sales

- Generic Competition: As patent expirationed in 2012, price erosion persists.

- Safety Profile Concerns: Risks such as cognitive impairment, metabolic disturbances, and teratogenicity (notably cleft palate) have led to cautious prescribing, especially in women of childbearing age[^6].

- Reimbursement Constraints: Insurance coverage variability limits access, particularly in emerging markets.

- Regulatory Limitations: FDA warnings and changing guidelines influence prescribing behaviors.

Future Sales Projections

Analyzing historical data, current market trends, and anticipated growth drivers yields the following projections:

| Year | Estimated Global Sales (USD Billion) | Notes |

|---|---|---|

| 2022 | 600 million | Post-patent expiration on the branded product anew |

| 2023 | 620 million | Slight growth driven by increasing off-label use |

| 2025 | 700 million | Market stabilization; impact of new formulations |

| 2030 | 900 million – 1 billion | Inflation, new indications, and expanded access |

Assumptions underpinning these projections:

- Continued erosion of branded sales due to generics.

- Growth in niche markets (e.g., obesity management with combination therapy).

- Moderate adoption of new formulations and indications.

- Competitive pressures from newer agents for epilepsy and migraine.

Regulatory and Market Trends Impacting sales

- FDA and Global Regulatory Policies: Stringent safety warnings, particularly regarding teratogenicity, temper prescribing in specific populations.

- Pricing and Reimbursement Trends: Increasing scrutiny on drug pricing may impact revenue, especially in competitive markets.

- Technological Innovations: Digital health integration and adherence aids can stabilize or increase sales.

Conclusion

Topamax remains a cornerstone in epilepsy and migraine management, with sales sustained primarily by its established efficacy and expanding indications. However, patent expiry, competitive generics markets, and safety concerns have constrained revenue growth. The drug’s future sales depend heavily on the development of labeled new uses, improved formulations, and strategic marketing to maintain its relevance in a highly competitive landscape.

Key Takeaways

- Market saturation and patent expiration have diminished Topamax’s branded sales, replaced largely by generics.

- Expanding indications and novel formulations are critical growth avenues.

- Safety concerns and regulatory warnings necessitate careful prescriber management.

- Emerging markets offer potential but are hindered by pricing and reimbursement obstacles.

- Maintaining market share will require strategic positioning centered on clinical efficacy, safety, and innovative delivery systems.

FAQs

1. What are the primary indications for Topamax?

Topamax is primarily indicated for epilepsy and migraine prevention. Off-label uses include weight management (in combination with phentermine), and ongoing research explores its application in bipolar disorder and alcohol dependence.

2. How has patent expiry affected Topamax's market presence?

Patent expiration in 2012 led to a surge in generic versions, drastically reducing branded sales and intensifying price competition in the market.

3. What are the main safety concerns associated with Topamax?

Risks include cognitive impairment, metabolic acidosis, kidney stones, and teratogenic effects such as cleft palate. These concerns influence prescribing practices and patient monitoring.

4. Which markets are expected to drive future sales growth for Topamax?

Emerging markets with expanding healthcare infrastructure and increasing diagnosis rates, combined with potential growth from new indications and formulations, are expected to contribute to future sales.

5. What strategies could sustain Topamax’s market relevance?

Developing extended-release formulations, securing new approved indications, managing safety concerns effectively, and expanding access in underserved markets are key strategies.

References

[^1]: Market Research Future, "Anti-Epileptic Drugs Market," 2022.

[^2]: World Health Organization, "Epilepsy Fact Sheet," 2021.

[^3]: National Institute of Neurological Disorders and Stroke, "Migraine Information."

[^4]: Global Data, "Obesity Market Forecast," 2023–2030.

[^5]: U.S. Patent and Trademark Office, "Patent Expirations," 2012.

[^6]: FDA Drug Safety Communications, "Topiramate and Pregnancy," 2019.

More… ↓