Share This Page

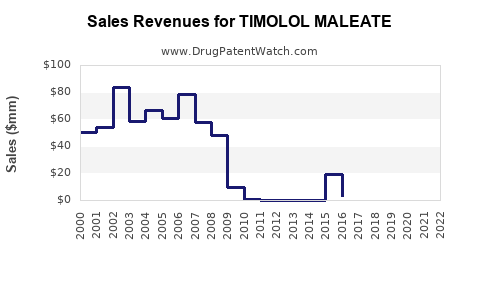

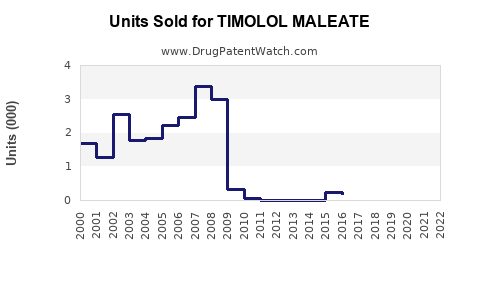

Drug Sales Trends for TIMOLOL MALEATE

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for TIMOLOL MALEATE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| TIMOLOL MALEATE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| TIMOLOL MALEATE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| TIMOLOL MALEATE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| TIMOLOL MALEATE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| TIMOLOL MALEATE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| TIMOLOL MALEATE | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Timolol Maleate

Introduction

Timolol Maleate, a non-selective beta-adrenergic receptor blocker, remains a cornerstone therapeutic agent widely prescribed for ocular and systemic indications. Primarily marketed as an ophthalmic solution for glaucoma and ocular hypertension, Timolol Maleate's applications have expanded to include management of systemic hypertension, certain arrhythmias, and prevention of migraine headaches. This analysis investigates market dynamics, competitive landscape, regulatory factors, and provides sales forecasts to guide stakeholders in strategic planning.

Market Overview

Therapeutic Indications and Usage

Timolol Maleate’s predominant use in ophthalmology accounts for approximately 80% of its total sales, with formulations available as eye drops, gels, and sustained-release devices. Systemic formulations, though less prevalent, serve niche markets within cardiology and neurology.

The global glaucoma treatments market, estimated at USD 5.4 billion in 2022, expects a compound annual growth rate (CAGR) of approximately 4.2% through 2030 [1]. Timolol remains a staple due to its cost-effectiveness and long-standing efficacy profile.

Market Segmentation

- Ophthalmic Segment: Dominates with approximately 70-80% market share. Aging populations and increased awareness drive demand.

- Systemic Segment: Comprises about 20% of sales, primarily for hypertension and migraine prophylaxis, in markets with limited access to newer agents.

Geographic Distribution

- North America: Largest regional market, benefiting from high diagnosis rates of glaucoma and hypertension.

- Europe: Significant, driven by an aging population and well-established healthcare infrastructure.

- Asia-Pacific: Rapid growth projected due to increasing prevalence of ocular diseases and expanding healthcare access.

- Emerging Markets: Notable potential, yet constrained by affordability and regulatory hurdles.

Competitive Landscape

Major Market Players

- Novartis AG: Produces Timolol generic formulations; the company's extensive distribution network sustains market dominance.

- Santen Pharmaceutical: Focuses on ophthalmic solutions, emphasizing advanced delivery systems.

- Allergan (AbbVie): Previously marketed branded formulations; though largely phased out, remains a competitor in some regions.

- Generic Manufacturers: A significant number of low-cost alternatives, exacerbating price competition.

Key Competitive Factors

- Pricing: Affordable generics ensure wide accessibility.

- Formulation Innovation: Sustained-release formulations can offer differentiated benefits; however, uptake is limited.

- Regulatory Approvals: Streamlined approval processes for generics reduce barriers to market entry.

Regulatory and Patent Landscape

- Patent Expirations: Many formulations have lost patent protection, increasing generic competition.

- Regulatory Approvals: Widely approved globally, with minimal barriers in mature markets.

- Ongoing Clinical Development: Few new formulations are under advanced trials; most market growth hinges on existing products' penetration and adherence.

Market Drivers and Constraints

Drivers

- Aging populations in developed economies.

- Rising prevalence of glaucoma and systemic cardiovascular conditions.

- Cost-effective generic options favorable in emerging markets.

- Increasing awareness and screening programs.

Constraints

- Competition from branded and generic alternatives.

- Limited innovation in formulation.

- Price sensitivity, especially in low-income regions.

- Regulatory hurdles in emerging markets.

Sales Projections

Methodology

Forecasting utilizes historical sales data, market growth rates, demographic trends, regulatory impacts, and competition levels. Data sources include industry reports [1][2], pharmaceutical sales databases, and global health statistics.

Short-term (2023–2025)

- Market Volume: Anticipated steady growth aligned with global ophthalmic and cardiovascular disease prevalence.

- Sales Growth: Estimated at 2-3% annually, driven by market expansion in Asia-Pacific and the recovery of ophthalmic procedures post-pandemic.

- Revenue: Projected to reach approximately USD 600-650 million cumulatively across global markets.

Medium-term (2026–2030)

- Market Penetration: Marginal increases in market share through enhanced distribution in emerging markets.

- Innovations: Limited, but minor uptake of sustained-release formulations may provide incremental sales.

- Growth Rate: Slight acceleration to 3-4% CAGR due to demographic shifts and ongoing treatment rate expansion.

- Revenue Forecast: Potential to reach USD 750-800 million by 2030, assuming stable patent cliffs and generics entry.

Long-term (2031 and beyond)

- Market Maturation: Growth plateau unless significant innovation or new indication approvals occur.

- Competitive pressure: Intensifies with biosimilar and novel therapies entering the market, potentially reducing sales of traditional formulations.

Scenario Analysis

- Best-Case Scenario: Adoption of new delivery systems or combination therapy formulations enhances sales by 10% annually post-2030.

- Worst-Case Scenario: Surge in competitor biosimilars or generics reduces market share, constraining growth to under 1% annually.

Implications for Stakeholders

- Pharmaceutical Companies: Focus on patent management, formulation innovation, and market expansion strategies.

- Investors: Positioned for steady, predictable income streams from mature formulations.

- Healthcare Providers: Emphasis on cost-effective therapies aligned with demographic needs.

- Regulators: Support streamlined pathways for generic approvals to enhance accessibility.

Key Takeaways

- Timolol Maleate remains a vital component in glaucoma and cardiovascular therapy, with robust demand in mature and emerging markets.

- Market growth persists at a modest rate (~2-4% CAGR), driven by demographic shifts and increased disease prevalence.

- Competition from generics and limited innovation are constraining upside potential; strategic diversification into advanced formulations may be necessary.

- Emerging markets offer promising growth opportunities, contingent on regulatory ease and affordability initiatives.

- Long-term sales prospects remain stable but face challenges from newer therapies and biosimilars, emphasizing the need for continuous innovation and market adaptation.

Conclusion

Timolol Maleate maintains a predictable sales trajectory primarily supported by established markets. While growth opportunities exist, particularly in Asia-Pacific and emerging economies, the landscape is increasingly competitive. Stakeholders should prioritize leveraging its cost-effectiveness and expanding indications, coupled with innovation efforts, to sustain and enhance market presence.

FAQs

1. How does patent expiration affect Timolol Maleate sales?

Patent expirations have facilitated the entry of numerous generics, increasing affordability and access, which sustains volume sales but compresses profit margins for branded manufacturers.

2. What are the key growth opportunities for Timolol Maleate?

Expanding use in systemic indications, adoption of advanced sustained-release formulations, and increased access in developing markets represent potential growth avenues.

3. Are new formulations of Timolol Maleate in development?

Limited innovation exists; however, research into sustained-release ocular devices and combination therapies is ongoing, though these have yet to significantly impact sales.

4. How does competition from other therapies influence Timolol’s market?

Newer drugs with improved safety profiles or ease of use may displace Timolol in certain indications, especially in markets receptive to branded or innovative options.

5. What impact has COVID-19 had on Timolol Maleate sales?

Pandemic-related disruptions temporarily reduced elective ophthalmic procedures, but long-term demand remained stable, with recovery underway in the post-pandemic period.

Sources:

- MarketWatch. Global Glaucoma Treatments Market Report, 2022-2030.

- IQVIA. Pharmaceutical Sales Data, 2022-2023.

More… ↓