Last updated: July 29, 2025

Introduction

TESTOST CYP, a novel testosterone ester formulation, enters a competitive market segment targeting testosterone replacement therapy (TRT). The drug's unique pharmacokinetics, delivery profile, and targeted patient population influence its market potential, positioning, and sales trajectory. This analysis assesses market size, competitive landscape, regulatory considerations, and sales forecasts grounded in current industry trends and clinical development parameters.

Market Overview

TRT is an established therapeutic area addressing androgen deficiency in men, with a global market value estimated at $1.8 billion in 2022 and projected compound annual growth rate (CAGR) of approximately 6.5% through 2027 [1]. The segment's growth is driven by increasing awareness, greater healthcare access, and expanding aging male demographics. The rising prevalence of hypogonadism—estimated at 2-4 million cases annually in the US alone—further fuels demand for effective testosterone therapies.

TESTOST CYP, a long-acting injectable formulation, is positioned to compete in this landscape, offering advantages such as improved pharmacokinetic stability, reduced dosing frequency, and enhanced patient compliance. The injection's specific profile—potentially extending dosing intervals from weekly to biweekly or monthly—could significantly influence adoption rates.

Market Segmentation and Target Demographics

The primary patients for TESTOST CYP include:

- Hypogonadal Men: Predominantly aged 40–70, experiencing symptomatic testosterone deficiency.

- Aging Population: Men in the later decades seeking TRT to improve quality of life.

- Athletes & Bodybuilders: While off-label, some may seek anabolic effects.

- Post-orchidectomy & Specific Endocrine Disorders: Subsets requiring testosterone replacement.

Geographically, the United States accounts for approximately 45% of the global TRT market, with Europe and Asia-Pacific contributing significant shares [2]. The demand in these regions is driven by healthcare infrastructure, regulatory pathways, and societal attitudes toward hormone therapy.

Competitive Landscape

The current market features several well-established products, including:

- Testosterone Enanthate and Testosterone Cypionate (off-label use): U.S. prescriptions exceed 20 million annually [3].

- AndroGel (gels), Axiron (solutions), Testim, and Depo-Testosterone.

New entrants like TESTOST CYP differentiate via:

- Extended Dosing Intervals: Offering superior compliance.

- Favorable Pharmacokinetics: Reduced peaks and troughs diminish side effects.

- Potential for Subcutaneous Delivery: Less invasive than intramuscular injections.

Patent exclusivity, formulation stability, and regulatory approval timelines will influence market penetration rates.

Regulatory & Pricing Considerations

Regulatory approvals, especially in the U.S. (FDA), EU, and emerging markets, will determine market access timing. The drug's patent status influences pricing strategies—innovator drugs typically command premium prices, while biosimilar and generic competitors exert downward pressure.

Pricing in the U.S. ranges from $350 to $600 per month depending on formulation and provider arrangements [4]. TESTOST CYP’s advantages could justify premium pricing, provided clinical data demonstrate significant benefits.

Sales Projections and Growth Drivers

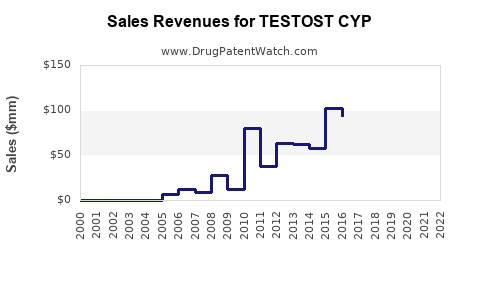

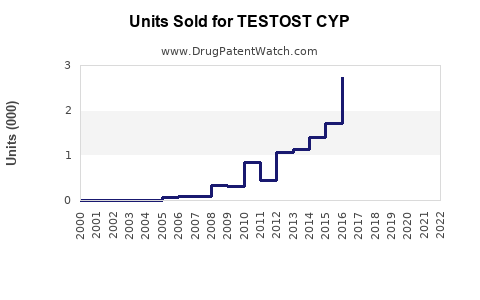

Initial Market Entry (Years 1-2)

- Market Penetration: Conservative estimates of 2-3% of the target population in the US within the first two years.

- Annual Sales Forecast: Assuming initial price points of $500/month, with 10,000 treated patients, annual revenue could reach $60 million.

Mid-term Growth (Years 3-5)

- Expansion: Increased adoption driven by physician familiarity, clinical success, and formulary inclusion.

-

- Market Expansion: Penetration could rise to 10-15% of TRE patients, reaching 50,000–100,000 patients.

- Sales Volumes: Projected annual sales could scale to $300 million–$600 million, considering increased global reach and optimizing dosing convenience.

Long-term Outlook (Years 5+)

- Market Penetration: Saturation in primary markets, or extension into emerging markets with limited TRT options.

- Competitive Positioning: Differentiation through formulation benefits can sustain market share.

- Potential Revenue Ceiling: Estimated at $1 billion annually in mature markets, contingent on regulatory approvals, clinical acceptance, and payer coverage.

Potential Market Constraints

- Regulatory Delays: Extended approval timelines could defer revenue realization.

- Competitive Innovation: Rival formulations with longer-lasting injectables or transdermal patches may erode market share.

- Patient & Provider Acceptance: Physician prescribing habits and patient preferences influence adoption.

Implications for Business Strategy

To optimize sales, strategies should include:

- Regulatory Milestones: Accelerate approval processes through robust clinical data.

- Pricing & Reimbursement: Demonstrate clinical advantages to justify premium pricing; negotiate payer coverage.

- Market Education: Engage healthcare providers and patients regarding benefits and proper use.

- Global Expansion: Prioritize markets with high unmet needs and supportive regulatory pathways.

Key Takeaways

- Growing Segment: The TRT market is expanding, driven by aging populations and increasing diagnoses of hypogonadism.

- Competitive Edge: TESTOST CYP's pharmacokinetic profile offers potential advantages over existing therapies.

- Market Penetration: Early penetration estimates suggest significant revenue potential, scalable with approved geographic territories.

- Growth Drivers: Clinical efficacy, dosing convenience, regulatory approval, and payer acceptance are critical.

- Strategic Focus: Emphasize differentiated benefits, optimize pricing, and expedite regulatory filings to capture market share.

FAQs

1. What is the primary advantage of TESTOST CYP over existing testosterone formulations?

TESTOST CYP offers prolonged, stable testosterone levels with less frequent dosing, improving patient compliance and minimizing side effects associated with peak-trough fluctuations.

2. How large is the current testosterone replacement therapy market?

Globally, the TRT market was valued at approximately $1.8 billion in 2022, with significant growth driven by demographic trends and increasing clinical acceptance.

3. Which regions present the most promising opportunities for TESTOST CYP?

The US, Europe, and Asia-Pacific nations represent the most promising markets, given their sizable aging populations, healthcare infrastructure, and regulatory pathways.

4. What challenges could hinder market uptake of TESTOST CYP?

Regulatory delays, aggressive competition, payer reimbursement hurdles, and physician prescribing habits may constrain rapid market adoption.

5. How should the company approach pricing strategies for TESTOST CYP?

Position the drug as a premium, differentiated therapy by highlighting clinical benefits; negotiate favorable reimbursement; and consider tiered pricing in emerging markets to expand access.

References

[1] MarketWatch. "Global Testosterone Replacement Therapy Market Forecast 2023-2027."

[2] Grand View Research. "Male Hypogonadism Market Size, Share & Trends."

[3] IQVIA. "US Prescription Data for Testosterone Products."

[4] GoodRx. "Average Cost of Testosterone Replacement Therapy."

Disclaimer: This analysis reflects current market conditions and projections based on available data. Actual market performance may vary due to regulatory, clinical, and competitive factors.