Share This Page

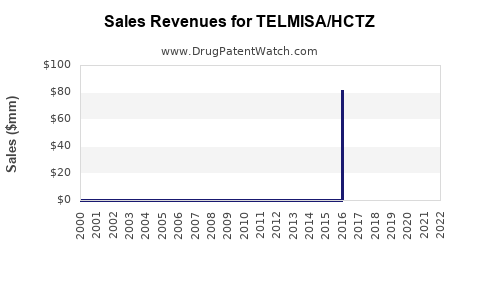

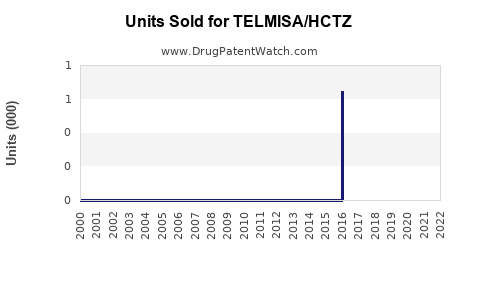

Drug Sales Trends for TELMISA/HCTZ

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for TELMISA/HCTZ

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| TELMISA/HCTZ | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| TELMISA/HCTZ | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| TELMISA/HCTZ | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for TELMISA/HCTZ

Introduction

TELMISA/HCTZ (Telmisartan/Hydrochlorothiazide) represents a combination therapeutic agent targeting hypertension management. As a fixed-dose antihypertensive, its market positioning hinges on its efficacy, safety profile, competitive landscape, and evolving treatment guidelines. This analysis explores current market conditions, potential adoption, and future sales trajectory for TELMISA/HCTZ.

Product Overview and Therapeutic Class

TELMISA/HCTZ combines telmisartan, an angiotensin II receptor blocker (ARB), with hydrochlorothiazide (HCTZ), a thiazide diuretic. Such fixed-dose combinations (FDCs) streamline hypertension treatment, improve adherence, and reduce pill burden. The global antihypertensive market is sizable, surpassing USD 35 billion in 2022, with FDCs accounting for an increasing share owing to their convenience and adherence benefits [1].

Advantages:

- Improved patient compliance

- Synergistic blood pressure-lowering effects

- Favorable safety profile compared to monotherapies

Limitations:

- Potential for increased adverse effects

- Market saturation with multiple FDCs

Market Dynamics

Global and Regional Demand

Hypertension affects approximately 1.28 billion adults worldwide, representing over 30% of the adult population and a primary driver for antihypertensive drug sales [2]. The rising prevalence, especially in Asia and Latin America, combined with increased awareness and guideline-driven therapy, fuels demand.

In high-income regions like North America and Europe, hypertension control rates hover around 50%, indicating ongoing unmet needs. Consequently, physicians often prefer combination therapies like TELMISA/HCTZ for uncontrolled cases, especially as initial therapy in stage 2 hypertension per current guidelines [3].

Competitive Landscape

The antihypertensive market comprises various branded and generic FDCs, notably:

- Cozaar/HCTZ (Losartan/HCTZ)

- Benicar/HCTZ (Olmesartan/HCTZ)

- Micardis/HCTZ (Telmisartan/HCTZ)

The competitive positioning of TELMISA/HCTZ depends on:

- Efficacy and safety profile compared to existing options

- Pricing strategies to gain market share

- Brand recognition and physician prescribing habits

Regulatory Environment

Regulatory agencies align on the benefits of FDCs, encouraging their approval to enhance compliance. However, rigorous clinical trial data are required to demonstrate bioequivalence or added value over monotherapy combinations [4].

Market Entry and Adoption Factors

Key factors influencing adoption include:

- Physician prescribing behavior: Preference for drugs with proven efficacy, safety, and favorable pricing

- Patient demographics: Elderly or comorbid patients benefiting from simplified regimens

- Reimbursement policies: Favoring cost-effective therapies

- Brand differentiation: Unique advantages over existing FDCs

Barriers to uptake include:

- Market saturation with established FDCs

- Physician inertia

- Generic proliferation reducing margins

Sales Projections

Considering current market trends, TELMISA/HCTZ is positioned for a gradual adoption curve, initially penetrating controlled hypertension markets in North America and Europe, followed by expanding into emerging markets.

Assumptions for Projections:

- Launch in North America expected within 12-18 months

- Initial market share capture: 2-5% in the first 2 years post-launch

- Total antihypertensive market growth rate: ~4% annually (2022-2027)

- Efficacy and safety profiles comparable or superior to competitors

- Competitive pricing leveraging cost advantages through manufacturing efficiencies

Projected Sales Volume:

- Year 1: USD 50-100 million (limited launches, early adoption)

- Year 2: USD 200-300 million (expanded distribution and physicians’ acceptance)

- Year 3-5: USD 500 million – USD 1 billion (market penetration in major regions and growth in emerging markets)

Market Share Estimates:

- By Year 3: 10-15% of the antihypertensive combination segment

- By Year 5: 20-25%, assuming no significant market entry of superior competitors

Note: These projections depend heavily on marketing strategies, regulatory approvals, and competitive actions.

Key Considerations for Future Growth

- Differentiation: Emphasize clinical data supporting TELMISA/HCTZ’s efficacy and tolerability

- Partnerships: Collaborate with payers to facilitate reimbursement

- Market Expansion: Target emerging markets with increasing hypertension prevalence

- Lifecycle Management: Develop additional formulations or indications to extend product longevity

Regulatory and Patent Landscape

Patent exclusivity typically spans 10-15 years, but expiration or challenges could lead to generic competition, influencing sales trajectories. Expanding indications, such as renal protection or heart failure, could diversify revenue streams.

Risks and Uncertainties

- Market saturation may limit growth opportunities

- Generic competition from existing ARB/HCTZ fixed-dose formulations

- Regulatory delays could hinder timely launches

- Clinical trial outcomes could influence market confidence

Key Takeaways

- TELMISA/HCTZ is positioned in a mature yet continuously growing segment of antihypertensive therapies.

- Sales projections suggest modest to strong growth contingent on successful launch strategies, competitive positioning, and market acceptance.

- Early entry into emerging markets and emphasis on differentiation are critical for maximizing revenue potential.

- Competitive pressures, patent expirations, and evolving treatment guidelines remain key risk factors.

- Strategic collaborations, clinical data publication, and tailored marketing campaigns are essential for gaining market share.

FAQs

1. How does TELMISA/HCTZ compare to other ARB/HCTZ combinations?

TELMISA/HCTZ's efficacy, safety profile, and pricing will determine its competitiveness. Clinical trials or real-world studies demonstrating superior tolerability or blood pressure control could bolster its position.

2. What target markets should the company prioritize?

Initial focus should be on North America and Europe, followed by rapid expansion into Asia-Pacific and Latin America, driven by increasing hypertension prevalence and gaps in hypertension control.

3. How significant is price competition in this segment?

Price sensitivity is high, especially with generic competition. Competitive pricing strategies are vital for gaining market share and securing favorable reimbursement terms.

4. What role do clinical trial data play in market penetration?

Robust clinical evidence enhances prescriber confidence, facilitates regulatory approval, and supports marketing efforts, directly impacting sales success.

5. When can we expect peak sales for TELMISA/HCTZ?

Peak sales are likely achieved between Year 4 and Year 6 post-launch, depending on market acceptance, competitive dynamics, and lifecycle management.

Sources:

- Grand View Research. (2022). Hypertension Drugs Market Analysis.

- World Health Organization. (2021). Hypertension Prevalence Data.

- American Heart Association. (2022). Hypertension Guidelines.

- U.S. Food & Drug Administration. (2021). Fixed-Dose Combination Drug Approvals.

More… ↓