Last updated: July 29, 2025

Introduction

Tadalafil, marketed primarily under the brand name Cialis, is a phosphodiesterase type 5 (PDE5) inhibitor approved for the treatment of erectile dysfunction (ED), benign prostatic hyperplasia (BPH), and pulmonary arterial hypertension (PAH). Since its initial FDA approval in 2003, tadalafil has established a significant position within the global pharmaceutical landscape, driven by expanding indications, a growing patient demographic, and ongoing innovation in formulations. This report provides a comprehensive market analysis alongside sales projections to assist stakeholders in strategic planning and investment decisions.

Global Market Overview

Market Size and Growth Trajectory

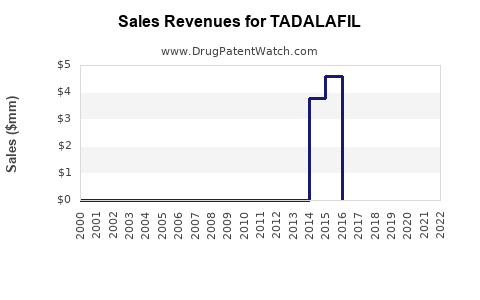

The global tadalafil market has experienced a robust compound annual growth rate (CAGR) of approximately 8% from 2018 to 2022, fueled by rising prevalence of ED and BPH, increasing healthcare awareness, and patent expirations that led to the availability of generic formulations. Valued at approximately $4.5 billion in 2022, the market is projected to surpass $8 billion by 2030, according to projections by Grand View Research[1].

Key Drivers

- Prevalence of Erectile Dysfunction: According to the International Society for Sexual Medicine, ED affects over 150 million men globally, with projections indicating a rise to 322 million by 2025[2].

- Aging Population: The global population aged 50 and above is expanding, directly correlating with increased ED and BPH cases.

- Expanding Indications: Beyond ED and BPH, tadalafil’s approval for pulmonary arterial hypertension widens its therapeutic scope.

- Novel Formulations & Delivery Methods: Development of long-acting formulations, orodispersible tablets, and combination therapies enhances patient adherence and expands market reach.

Market Segments

- By Indication: ED (largest share), BPH, PAH

- By Distribution Channel: Hospital pharmacies, retail pharmacies, online pharmacies

- By Geography: North America dominates, followed by Europe, Asia-Pacific, Latin America, and the Middle East. Asia-Pacific is anticipated to witness the fastest growth, driven by increasing healthcare investments in China and India.

Competitive Landscape

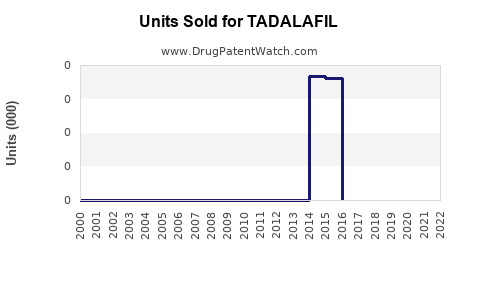

Major players include Eli Lilly and Company (Cialis), Pfizer, Bayer, Shenzhen Kangtai Biological Products Co., and several generics manufacturers. Patent expiration in 2017 spurred market entry for generics, intensifying price competition and expanding access.

Innovation & R&D

Ongoing R&D aimed at improving pharmacokinetics and reducing side effects is expected to sustain the market. Notable developments include fast-dissolving formulations and combination pills for ED and BPH.

Regulatory Environment

Stringent regulatory standards, particularly in the US (FDA), EU (EMA), and China (NMPA), influence market dynamics. Approvals for new indications or formulations often catalyze market expansion, while patent cliffs challenge exclusivity, necessitating innovation.

Sales Projections (2023–2030)

Methodology

Sales forecasts leverage historical sales data, demographic trends, pipeline developments, and competitive dynamics utilizing a bottom-up approach, cross-validated with expert insights.

Projected Growth

- 2023: $4.8 billion — steady with previous growth, driven by increased generic penetration and expanding indications.

- 2025: ~$6.4 billion — accelerated by new formulations, wider acceptance, and increased diagnosis rates.

- 2030: exceeding $8 billion — driven by emerging markets, ongoing innovation, and expanded indications, particularly in pulmonary hypertension therapies.

Regional Outlook

- North America: Dominates (~50% market share); continued growth driven by high diagnosis rates and novel therapies.

- Europe: Stable with regulatory approval of new indications.

- Asia-Pacific: Fastest CAGR (~10%), fueled by demographic shifts and increased healthcare expenditure.

- Latin America and Middle East: Growing markets with expanding access and increasing private sector engagement.

Challenges & Opportunities

Challenges

- Patent expiry leading to pricing pressures.

- Competition from alternative therapies (e.g., vacuum erection devices, other PDE5 inhibitors).

- Regulatory hurdles in emerging markets.

- Side effect profiles impacting patient adherence.

Opportunities

- Expansion into new therapeutic areas.

- Development of combination therapies and novel delivery systems.

- Penetration into underserved markets, particularly in Asia and Africa.

- Digital engagement via telehealth and online pharmacies enhances accessibility.

Key Takeaways

- The tadalafil market is poised for sustained growth through 2030, driven by demographic trends, expanding indications, and innovation.

- Generic formulations will substantially influence price competition and accessibility, especially post-patent expiration.

- Asia-Pacific is expected to become a focal point for growth, owing to increasing healthcare investments and rising disease prevalence.

- Strategic patent management and pipeline innovation are crucial to maintaining competitive advantage.

- Regulatory navigation remains vital, especially for new indications and formulations aimed at global markets.

FAQs

1. What factors are most impacting tadalafil sales growth?

The main drivers include rising prevalence of ED globally, demographic shifts toward aging populations, patent expirations fostering generic competition, and ongoing innovation in drug formulations.

2. How does patent expiration influence the tadalafil market?

Patent expirations open opportunities for generic manufacturers, significantly reducing prices, expanding access, and increasing overall sales volume. Nevertheless, they erode brand-exclusive revenue.

3. Which regions offer the highest sales potential for tadalafil?

North America remains the largest market, but Asia-Pacific is experiencing rapid growth owing to demographic trends and increased healthcare infrastructure.

4. What are key innovation trends in tadalafil development?

Focus areas include extended-release formulations, fast-dissolving tablets, combination therapies, and digital health integration to enhance adherence and patient experience.

5. How might regulatory changes affect future market projections?

Regulatory approvals for new indications can expand market size, while stringent policies or delays in approval processes, especially in emerging markets, can impede growth trajectories.

References

[1] Grand View Research. “Tadalafil Market Size, Share & Trends Analysis Report by Indication, by Distribution Channel, by Region, and Segment Forecasts, 2022-2030,” 2022.

[2] International Society for Sexual Medicine. “Epidemiology of Erectile Dysfunction,” 2021.