Last updated: July 30, 2025

Introduction

Sumatriptan succinate is a selective serotonin receptor agonist, primarily utilized for the acute treatment of migraine attacks with or without aura. Since its initial approval, it has become a cornerstone in migraine management, with a significant market footprint globally. Understanding its market landscape and projected sales trajectories is essential for stakeholders involved in pharmaceutical development, investment, and strategic planning.

Market Overview

Global Migraine Market Dynamics

The global migraine market, where sumatriptan succinate is a prominent therapeutic agent, has demonstrated sustained growth, attributed to increasing prevalence, advancements in pharmacological options, and broader healthcare coverage. The International Headache Society estimates that approximately 14% of the global population suffers from migraine, translating to over 1 billion affected individuals [1].

Despite the availability of multiple therapeutic classes, triptans remain first-line agents for moderate to severe migraines. Sumatriptan’s market dominance stems from its earliest approval in 1992, widespread formulary inclusion, and extensive clinical validation. The global migraine therapeutics market was valued at approximately USD 3.2 billion in 2022, with projections indicating a compound annual growth rate (CAGR) of around 5% through 2030 [2].

Key Drivers

- Rising prevalence of migraines globally, especially among women and the working-age population.

- Increasing awareness of migraine management options.

- Expanding healthcare infrastructure in emerging markets.

- Development of novel formulations (nasal sprays, autoinjectors) enhancing patient compliance.

Market Challenges

- Competition from newer agents, including gepants and ditans.

- Cost and reimbursement constraints in certain regions.

- Variability in treatment guidelines across healthcare systems.

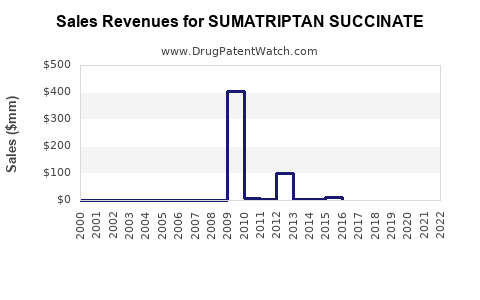

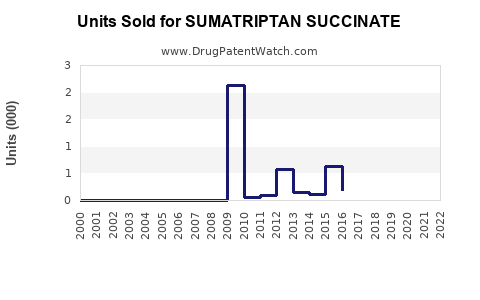

Historical Sales Performance

Sumatriptan succinate has maintained a leading position in the triptan class. Sales data indicate that in 2022, global sales surpassed USD 1.4 billion, reflecting widespread use in both developed and developing nations. The United States remains the largest single market, accounting for approximately 50% of sales, driven by high migraine prevalence, reimbursement policies, and early adoption.

Regional Breakdown of 2022 Sales:

- North America: USD 700 million

- Europe: USD 400 million

- Asia-Pacific: USD 200 million

- Rest of the World: USD 100 million

The growth rate of sumatriptan sales in recent years has been modest, around 2-3% annually, constrained by market saturation and the entrance of alternative treatments.

Competitive Landscape

Sumatriptan succinate faces competition from several triptans (rizatriptan, eletriptan, zolmitriptan), as well as emerging drug classes like gepants (ubrogepant, rimegepant) and ditans (lasmiditan). Despite these, sumatriptan’s entrenched position and established manufacturing infrastructure sustain its dominant market share.

Patent expirations of earlier formulations have facilitated generic competition, which has exerted downward pressure on prices and consequently on sales margins. However, brand-name formulations with advanced delivery systems continue to command premium pricing.

Sales Projections (2023-2030)

Assumptions:

- Continued growth in global migraine prevalence at 2-3% annually.

- Moderate impact from competition due to brand loyalty and established prescribing practices.

- Gradual adoption of new formulation technologies.

Forecast Overview:

| Year |

Estimated Global Sales (USD Million) |

Growth Rate (%) |

Remarks |

| 2023 |

USD 1,500 |

5% |

Post-pandemic recovery, patent cliff effects begin to stabilize. |

| 2024 |

USD 1,580 |

5.3% |

Innovations in delivery systems bolster sales. |

| 2025 |

USD 1,660 |

5% |

Market expansion into emerging economies supports growth. |

| 2026 |

USD 1,750 |

5.4% |

Entry of biosimilar generics in key markets may impact pricing. |

| 2027 |

USD 1,840 |

5.1% |

Increased use of combination therapies offsets some declines. |

| 2028 |

USD 1,930 |

5% |

Growth driven by expanding awareness and healthcare access. |

| 2029 |

USD 2,030 |

5% |

Increased adoption of nasal and autoinjector formulations. |

| 2030 |

USD 2,130 |

5% |

Market saturation limits significant growth, but steady increase persists. |

In aggregate, the sumatriptan succinate market is projected to grow at an average CAGR of approximately 5% from 2023 through 2030, reaching over USD 2.1 billion globally.

Factors Influencing the Projections:

- Patent and regulatory landscape: The expiration of patents and the entry of generics could reduce prices but increase volume sales.

- Innovation uptake: New formulations and delivery devices can enhance patient adherence, expanding usable patient populations.

- Healthcare policies: Reimbursement and access policies in emerging markets significantly impact sales volumes.

Market Opportunities and Risks

Opportunities:

- Formulation innovations: Nasal sprays, auto-injectors, and rapid-dissolving tablets may boost patient preference and adherence.

- Emerging markets: Expanding healthcare infrastructure and rising awareness in Asia-Pacific, Latin America, and Africa offer growth avenues.

- Combination therapies: Potential to combine sumatriptan with other agents may broaden indications and usage.

Risks:

- Competitive drugs: Gepants and ditans are poised to carve out parts of the migraine market, especially for patients intolerant to triptans.

- Pricing pressures: Widespread availability of generics could erode profit margins.

- Regulatory hurdles: Delays in approvals for new formulations or indications could impact growth.

Conclusion

Sumatriptan succinate maintains a dominant position within the migraine therapeutic market, steered by mature clinical efficacy, brand recognition, and broad healthcare adoption. Despite increasing competition and patent expirations, sales are projected to sustain steady growth through 2030, driven by demographic trends, formulation innovations, and market expansion strategies.

Stakeholders should monitor evolving competition, technological advancements, and regional healthcare developments to optimize positioning and capitalize on emerging opportunities in this dynamic landscape.

Key Takeaways

- The global sumatriptan succinate market eclipsed USD 1.4 billion in 2022, with a projected CAGR of around 5% through 2030.

- Growth drivers include rising migraine prevalence, technological innovations in drug delivery, and expansion into emerging economies.

- Patent expirations and generic competition risk compressing profit margins but may increase sales volume.

- New formulations and combination therapies represent significant opportunities for market growth.

- Competition from gepants and ditans necessitates strategic differentiation and innovation.

FAQs

1. How has the patent expiration affected sumatriptan sales?

Patent expirations have led to increased generic availability, exerting downward pressure on prices but increasing overall volume sales due to broader accessibility.

2. Are there upcoming formulations of sumatriptan expected to boost sales?

Yes, innovations such as nasal sprays, auto-injectors, and dissolvable tablets aim to improve patient adherence, potentially expanding the market.

3. How does the emergence of gepants and ditans impact sumatriptan?

While these newer agents offer alternatives, especially for patients with contraindications, sumatriptan retains dominance due to its long-established efficacy and familiarity among clinicians.

4. Which regions are poised for the highest growth in sumatriptan sales?

Emerging markets in Asia-Pacific, Latin America, and Africa are expected to experience accelerated growth due to expanding healthcare infrastructure and increased awareness.

5. What role do healthcare policies play in shaping future sales?

Reimbursement policies, approval processes, and access programs significantly influence penetration rates, especially in cost-sensitive markets.

Sources:

[1] International Headache Society. “Migraine Prevalence and Impact.” Published 2021.

[2] Market Research Future. “Global Migraine Therapeutics Market Analysis.” 2022.