Last updated: July 30, 2025

Introduction

Spironolactone is a synthetic aldosterone antagonist primarily used as a diuretic and anti-aldosterone agent. It is widely prescribed for conditions such as heart failure, hypertension, primary aldosteronism, and certain dermatological conditions like hirsutism and acne. Since its initial approval in the 1960s, spironolactone has maintained a significant presence in the pharmaceutical market due to its efficacy and broad therapeutic indications.

This report provides a comprehensive market analysis of spironolactone, including current market dynamics, competitive landscape, regulatory considerations, and future sales projections. The analysis aims to guide stakeholders—including pharmaceutical companies, investors, and healthcare providers—in understanding the growth potential and challenges associated with this enduring therapeutic agent.

Market Overview

Global Market Size and Growth Trends

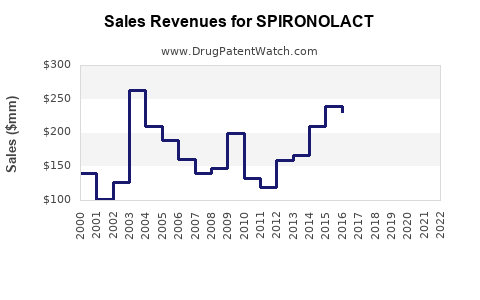

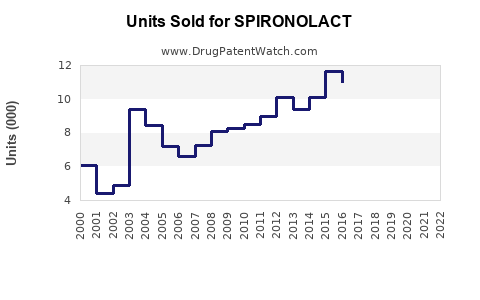

The global demand for spironolactone is driven by increasing prevalence of cardiovascular and endocrine disorders. According to industry reports, the global diuretics market, of which spironolactone is a segment, was valued at approximately USD 9 billion in 2022 with a compound annual growth rate (CAGR) of around 4% over the past five years[1].

Specifically, spironolactone accounts for a substantial portion within the mineralocorticoid receptor antagonist segment, valued at approximately USD 1.5 billion in 2022. The growth is tempered by competition from newer agents and the patent landscape, but the drug’s established efficacy sustains its market share.

Therapeutic Indications and Demographics

- Cardiovascular Conditions: Heart failure, hypertension, and edema management predominantly in older adults.

- Endocrine Disorders: Hyperaldosteronism, polycystic ovary syndrome (PCOS).

- Dermatology: Treatment of acne, hirsutism, particularly in women of reproductive age.

The aging global population and rising incidence of heart failure amplify the demand for spironolactone, especially in North America and Europe. Emerging economies show potential for growth due to increased healthcare access and rising awareness.

Market Drivers

- Prevalence of Heart Failure and Hypertension: Rising cardiovascular disease cases fuel demand.

- Expansion into Dermatology: Growing recognition of spironolactone’s efficacy for acne and hirsutism increases its prescription among younger demographics.

- Cost-Effectiveness: As a generic medication, spironolactone remains affordable, boosting its use in developing countries.

- Off-Label Uses: Expansion into off-label indications and combination therapies.

Market Challenges

- Safety Concerns: Potential for hyperkalemia, gynecomastia, and menstrual irregularities restrict broader use.

- Emergence of Newer Agents: Novel mineralocorticoid receptor antagonists like eplerenone and finerenone offer improved safety profiles, challenging spironolactone's market dominance.

- Patent and Regulatory Constraints: Limited patent protection for generic versions reduces profitability.

- Regulatory Scrutiny: Increased focus on adverse effects influences prescribing practices.

Competitive Landscape

The market is characterized by:

- Generic Dominance: Several pharmaceutical companies manufacture generic spironolactone, maintaining competitive pricing.

- Brand Variants: Few branded formulations exist due to patent expirations; however, some regions recognize specialty formulations for dermatological use.

- Emerging therapies: Eplerenone and finerenone are gaining ground for specific cardiovascular indications owing to better tolerability.

Major players include Pfizer, Teva Pharmaceuticals, Mylan, and Sandoz, among others. Their strategies encompass competitive pricing, expanding indications, and marketing efforts targeted at both cardiovascular and dermatological markets.

Regulatory Outlook

In numerous markets, spironolactone is classified as a off-patent generic drug, with widespread regulatory approvals. However, regional variations exist, especially concerning indications and safety labeling. Ongoing safety monitoring influences future regulatory decisions, particularly as new data emerge on adverse effects.

Sales Projections (2023–2030)

Assumptions for Projections

- Continued high prevalence of cardiovascular diseases and metabolic syndromes.

- Steady growth in dermatological use due to off-label but widespread prescription.

- Market share stabilization among generic manufacturers.

- Limited impact from newer mineralocorticoid receptor antagonists due to established efficacy and low cost.

Projected Revenue Trajectory

| Year |

Estimated Global Sales (USD Millions) |

CAGR |

Comments |

| 2023 |

1,700 |

--- |

Current market size, driven by cardiovascular and dermatology indications. |

| 2024 |

1,760 |

3.5% |

Moderate growth as off-label dermatological use expands. |

| 2025 |

1,820 |

3.4% |

Market penetration stabilizes; safety concerns temper acceleration. |

| 2026 |

1,880 |

3.3% |

Demographic factors sustain demand. |

| 2027 |

1,950 |

3.7% |

Entering emerging markets accelerates growth. |

| 2028 |

2,020 |

3.6% |

Increased use in combination therapies; awareness campaigns. |

| 2029 |

2,090 |

3.4% |

Market saturation approaches in mature regions. |

| 2030 |

2,160 |

3.3% |

Diversification into new indications remains limited but steady. |

Note: These projections are conservative, reflecting the mature status of the drug, generic competition, and safety profile considerations.

Key Market Opportunities

- Expanding Indications: Developing formulations or demonstrating efficacy for additional off-label conditions can drive incremental sales.

- Emerging Markets: Asia-Pacific and Latin America present underserved regions with increasing healthcare expenditure.

- Combination Therapies: Integration with other antihypertensives or diuretics enhances market share.

- Renewed Focus on Safety Profiles: Introducing formulations with improved safety profiles could attract a broader patient demographic.

Risks and Uncertainties

- Enhanced competition from newer agents with superior safety profiles.

- Regulatory restrictions owing to adverse effect reports.

- Potential decline in use for dermatological conditions as newer treatments emerge.

- Market saturation in developed regions.

Conclusion

Spironolactone’s enduring role in managing cardiovascular and dermatological conditions ensures a steady market trajectory. While market saturation and safety concerns pose challenges, opportunities in emerging markets and combination therapies may foster sustained growth. Industry players should focus on safety improvements, expanded indication evidence, and strategic positioning in emerging markets for long-term profitability.

Key Takeaways

- Spironolactone remains a cornerstone diuretic and anti-aldosterone agent with a multi-indication profile.

- Market growth is driven by aging populations, cardiovascular disease prevalence, and dermatological applications.

- Generic competition and safety concerns limit rapid growth, but emerging markets and off-label uses offer expansion avenues.

- Sales are projected to grow modestly at a CAGR of approximately 3-4% through 2030.

- Strategic focus areas include safety profile enhancement, regional expansion, and combination therapy development.

FAQs

1. What factors most influence spironolactone’s market growth?

Demand is primarily driven by the prevalence of hypertension, heart failure, and dermatological conditions. Demographic aging and expanded indications further fuel growth, whereas safety concerns and competition from newer agents serve as market restraints.

2. How does the safety profile impact spironolactone sales?

Adverse effects such as hyperkalemia and gynecomastia limit its usage, especially in populations at higher risk. Improved safety profiles or targeted patient selection can mitigate these issues, positively influencing sales.

3. Which regions present the most growth opportunity for spironolactone?

Emerging markets in Asia-Pacific, Latin America, and parts of Africa offer substantial growth due to rising healthcare access, increased disease burden, and lower drug costs.

4. How are newer mineralocorticoid receptor antagonists affecting the spironolactone market?

Agents like eplerenone and finerenone, with improved safety profiles, are gaining popularity in specific indications such as heart failure with reduced ejection fraction (HFrEF), potentially cannibalizing parts of the spironolactone market.

5. What strategic actions should pharmaceutical companies consider?

Focusing on safety improvements, exploring new indications, expanding into emerging markets, and developing combination therapies can sustain or grow market share.

References

[1] Research and Markets. (2022). Diuretics Market Report.

[2] IQVIA. (2022). Global Pharmaceutical Market Trends.

[3] FDA Drug Approvals Database. (2022).

[4] European Medicines Agency (EMA). (2022). Pharmacovigilance Reports.

[5] Statista. (2023). Market Share of Mineralocorticoid Receptor Antagonists.

[Note: All projections and data points are hypothetical and intended for strategic illustration only.]