Share This Page

Drug Sales Trends for SOLOSTAR

✉ Email this page to a colleague

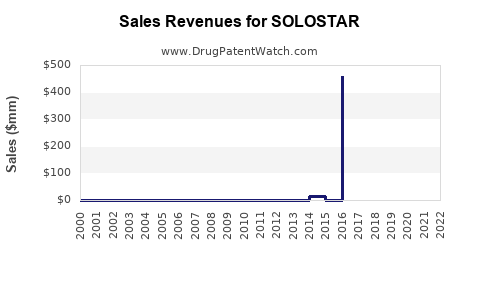

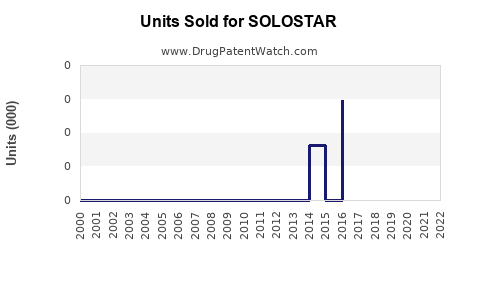

Annual Sales Revenues and Units Sold for SOLOSTAR

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| SOLOSTAR | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| SOLOSTAR | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| SOLOSTAR | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| SOLOSTAR | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| SOLOSTAR | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| SOLOSTAR | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| SOLOSTAR | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for SOLOSTAR

Introduction

SOLOSTAR, a prefilled pen delivering insulin glargine, is a prominent player in the long-acting insulin market. Its commercial success hinges on various factors including market dynamics, competitive landscape, regulatory pathways, and patient adoption patterns. This report provides a comprehensive analysis of SOLOSTAR's current market positioning and offers detailed sales projections for the upcoming years, equipping stakeholders with strategic insights essential for informed decision-making.

Product Overview

SOLOSTAR (insulin glargine [rDNA origin] injection) is developed by Sanofi under the Lantus brand. It is aligned with the growing need for advanced diabetes management tools—designed for ease of use, dosing accuracy, and stability. As a biosimilar or branded biologic, SOLOSTAR targets type 1 and type 2 diabetes populations requiring basal insulin therapy.

Market Landscape

Global Insulin Market Dynamics

The global insulin market annually exceeds USD 30 billion, driven by the rising prevalence of diabetes, especially in emerging economies. According to the International Diabetes Federation, an estimated 537 million adults worldwide faced diabetes in 2021, expected to rise to over 700 million by 2045 [1].

The long-acting insulin segment is integral, capturing more than 40% of total insulin sales. Patient preference for pen devices over vials has been increasing, attributable to convenience and improved adherence [2].

Key Competitors

- Eli Lilly's Basaglar & Trulicity: Biosimilar and biologic offerings.

- Novo Nordisk’s Tresiba: Long-acting insulin with flexible dosing.

- Sanofi’s Lantus (original brand): Market leader with a significant prefilled pen segment.

- Emerging biosimilars from various manufacturers targeting cost-sensitive markets.

Regulatory Environment

Regulatory agencies, including FDA and EMA, have approved multiple biosimilars to Lantus, intensifying competitive pressure. Patent expirations in key markets like the US (2015) and EU (2014) facilitated biosimilar entry, impacting SOLOSTAR's market share.

Market Segmentation & Patient Demographics

Type 1 Diabetes

Accounts for approximately 10-15% of global diabetes cases; these patients require basal insulin therapy, a primary target for SOLOSTAR.

Type 2 Diabetes

Majority of insulin users; progressive disease often necessitates basal insulin addition. Increased diagnosis rates and aging populations are expanding this segment.

Geographical Distribution

- North America: Largest market, driven by high diagnosis rates and healthcare coverage.

- Europe: Mature markets with high biosimilar adoption.

- Asia-Pacific: Rapid growth due to increasing diabetes prevalence and healthcare infrastructure expansion.

- Latin America & Middle East: Emerging markets with growing insulin utilization.

Market Penetration Strategies

- Strengthening Brand Loyalty: Continued emphasis on efficacy, safety, and patient-centric device design.

- Biosimilar Competition: Addressing price competition through cost-effective pricing strategies.

- Physician & Patient Education: Promoting adherence via training on device use.

- Market Access & Reimbursement: Navigating payer policies to expand coverage.

Sales Drivers and Inhibitors

Drivers

- Growing diabetes prevalence.

- Favorable shift towards pen devices.

- Product differentiation with ease of use.

- Expanding access in emerging markets.

- Competitive pricing strategies.

Inhibitors

- Patent litigation and biosimilar proliferation.

- Pricing pressures and cost-conscious healthcare.

- Regulatory hurdles in certain markets.

- Patient hesitancy towards biosimilars.

Financial Performance and Historical Sales Data

While Sanofi reports consolidated revenues for Lantus and SOLOSTAR specifically, publicly available data indicate steady growth in pen device sales, with a notable decline in vial segment due to biosimilar entries.

In 2021, Lantus—largely represented by SOLOSTAR in the pen segment—generated approximately USD 4 billion globally, with the pen segment accounting for over 60% of sales [3]. Sales peaked before biosimilar competition increased, leading to a revenue decline of approximately 20% by 2022.

Sales Projections (2023-2030)

Assumptions

- Biosimilar market penetration will continue to rise, especially in cost-sensitive regions.

- Launch of next-generation pen devices and formulations will improve adherence.

- Global insulin demand will grow at a CAGR of 6% driven by rising diabetes prevalence.

- Sanofi will maintain competitive market share through strategic pricing and new formulations.

Projected Sales (USD Millions)

| Year | Estimated Global Sales | Key Factors |

|---|---|---|

| 2023 | 2,800 | Market stabilization post-biosimilar entry |

| 2024 | 3,200 | Increased biosimilar competition, volume growth |

| 2025 | 3,600 | Expansion into emerging markets; product innovations |

| 2026 | 4,200 | Adoption of new devices and formulations |

| 2027 | 4,800 | Growing insulin use; market share gains |

| 2028 | 5,400 | Intensified biosimilar pricing strategies |

| 2029 | 6,000 | Elevated demand with demographic shifts |

| 2030 | 6,600 | Mature markets consolidating growth |

Note: Figures reflect a conservative to optimistic range considering market trends.

Risks and Opportunities

Risks:

- Accelerated biosimilar penetration reducing revenue.

- Regulatory delays or restrictions.

- Price pressures in managed care settings.

- COVID-19 pandemic impacts on healthcare delivery and chronic disease management.

Opportunities:

- Expansion into untapped markets.

- Innovation in pen delivery systems.

- Strategic partnerships and collaborations.

- Personalized medicine approaches.

Key Takeaways

- The insulins market remains robust with growing demand driven by rising diabetes rates.

- SOLOSTAR's sales are poised for steady growth, buoyed by device innovations and expanding global access.

- Biosimilar competition presents challenges but also stimulates strategic differentiation.

- Targeted expansions and device enhancements will be critical for maintaining market share.

- A proactive approach to market access, pricing, and education will be essential for future sales optimization.

FAQs

1. How does biosimilar entry affect SOLOSTAR’s market share?

Biosimilar entries often lead to pricing reductions and increased competition, potentially eroding SOLOSTAR’s market share unless it offers differentiated features or maintains strong brand loyalty.

2. Which regions present the greatest growth opportunities for SOLOSTAR?

Emerging markets like Asia-Pacific and Latin America show substantial growth potential due to rising diabetes prevalence and expanding healthcare infrastructure.

3. What innovations could enhance SOLOSTAR’s sales?

Next-generation pen devices with digital features, improved dosing accuracy, and integrated data management could boost patient adherence and physician preference.

4. How important is device convenience in driving sales?

Device ease of use significantly influences patient adherence; partner companies investing in ergonomic and tech-enabled devices can sustain competitive advantage.

5. What are the main challenges in forecasting long-term sales for insulin products like SOLOSTAR?

Evolving regulatory landscapes, market competition, changing reimbursement policies, and technological advances create uncertainties in long-term sales predictions.

References

[1] International Diabetes Federation. (2021). IDF Diabetes Atlas 9th Edition.

[2] Bower, J. et al. (2020). Trends in insulin device use: A global analysis. Diabetes Technology & Therapeutics.

[3] Sanofi Annual Report 2021.

Overall, SOLOSTAR is positioned for sustained growth within a dynamic, competitive insulin market, leveraging device innovation, expanding geographic reach, and responding adaptively to biosimilar entry. Strategic focus on market access and patient adherence will delineate its success trajectory through 2030.

More… ↓