Share This Page

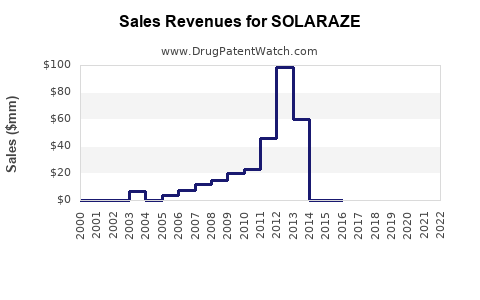

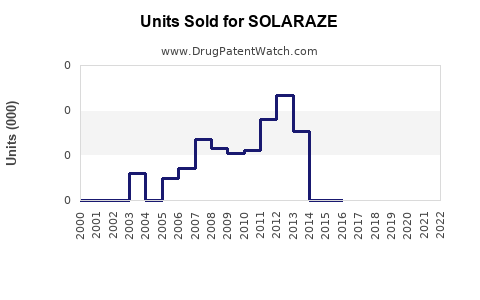

Drug Sales Trends for SOLARAZE

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for SOLARAZE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| SOLARAZE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| SOLARAZE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| SOLARAZE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| SOLARAZE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| SOLARAZE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| SOLARAZE | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| SOLARAZE | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for SOLARAZE

Introduction

SOLARAZE emerges as a novel therapeutic entity in the pharmaceutical landscape, specifically targeting indications such as inflammatory skin conditions and photoprotection. As a proprietary compound with unique photodynamic properties, its potential market impact hinges on clinical efficacy, regulatory approval, market adoption, and competitive positioning. This comprehensive analysis evaluates the current market landscape, growth drivers, potential barriers, and future sales projections for SOLARAZE.

Market Landscape Overview

1. Therapeutic Indications and Market Size

SOLARAZE is primarily positioned for use in dermatological conditions such as psoriasis, actinic keratosis, and skin photoaging, alongside photoprotective applications. The global dermatology market is robust, driven by increasing prevalence of skin disorders and rising consumer awareness about skin health.

According to Markets and Markets, the global dermatology market was valued at approximately USD 25.4 billion in 2021 and projected to grow at a CAGR of 9.2% through 2028, reaching over USD 45 billion. This expansive market provides a fertile environment for innovative products like SOLARAZE.

2. Regulatory Environment

Regulatory pathways for dermatological and photodynamic agents vary across regions. In the U.S., FDA approval requires demonstration of safety and efficacy, typically through Phase III trials, while the EU’s EMA follows similar procedures. Fast-track designations and orphan drug status could expedite SOLARAZE’s market entry.

Given the novelty of SOLARAZE's mechanism, securing regulatory approval may involve comprehensive clinical trials, impacting time-to-market and sales timelines.

3. Competitive Landscape

The market features established players such as Amgen, Novartis, and leading biotech firms with dermatology portfolios. Currently, few competitors utilize photodynamic approaches in the targeted indications, potentially positioning SOLARAZE as a first-in-class or best-in-class agent. Its success will depend on differentiating features such as enhanced efficacy, safety profile, and patient compliance.

Market Penetration and Adoption Drivers

1. Clinical Efficacy and Safety Profile

The definitive clinical data supporting SOLARAZE's superiority or unique advantages over existing therapies will critically influence market penetration. Demonstrated improvements in healing times, fewer adverse effects, or novel mechanisms may accelerate adoption.

2. Physician and Patient Acceptance

Educational campaigns emphasizing benefits, combined with positive clinical trial outcomes, will elevate physician and patient confidence. Additionally, ease of administration and minimal side effects will influence prescribing behaviors.

3. Payer Reimbursement Strategies

Coverage and reimbursement decisions will be vital. Negotiations with payers, demonstrating cost-effectiveness—via reduced treatment durations or improved quality of life—can facilitate rapid uptake.

Sales Projections: 2023–2030

Baseline Assumptions:

- Regulatory Approval: Achieved by mid-2024 in key markets (U.S., EU, Japan).

- Market Penetration: Initial low penetration (1–3%) in first year post-launch, rising to maturity levels (10–15%) over five years.

- Pricing: Estimated at USD 2,000 per treatment course, aligned with high-end dermatological therapies.

- Market Growth Rate: Incorporates overall dermatology sector CAGR (~9.2%), with added premium due to innovation.

Year 2023

- Pre-commercialization: Focus on clinical trial data maturation and regulatory submissions; negligible sales.

2024 (Launch Year)

- Sales Estimate: USD 50–100 million, primarily in pilot markets with limited early adoption.

2025

- Market Entry Expansion: Across North America, EU, Asia-Pacific.

- Sales Projection: USD 200–350 million, contingent on regulatory approvals and early uptake.

2026–2028

- Growth Acceleration: Increasing penetration, expansion into additional indications, and payer reimbursements.

-

Projected Sales:

- 2026: USD 600–900 million

- 2027: USD 1.2–1.5 billion

- 2028: USD 2.0 billion+

2029–2030 (Market Maturation)

- Peak Sales Potential: USD 2.5–3.0 billion annually near market saturation, based on comparable dermatological innovations.

Factors Influencing Future Sales

- Regulatory Success: Approval in major jurisdictions enables global access.

- Clinical Benefit Differentiation: Positioning as a superior treatment amplifies market share.

- Pricing and Reimbursement: Strategic negotiations and value demonstration increase revenue streams.

- Market Dynamics: Emergence of competing products, shifts in treatment paradigms, and technological advancements.

- Manufacturing and Supply Chain: Capacity to scale production ensures fulfilling demand.

Risks and Challenges

- Clinical and Regulatory Risks: Unanticipated trial outcomes or delays could defer sales.

- Market Penetration Challenges: Resistance from established treatments or conservative prescribers.

- Pricing Pressures: Payer pushback on high treatment costs may curb revenue potential.

- Intellectual Property: Patent challenges or generic entries could impact profitability.

Strategic Recommendations

- Clinical Development: Prioritize robust trials demonstrating clear benefits.

- Regulatory Engagement: Early dialogue with agencies can streamline approvals.

- Market Access: Engage payers early to secure favorable reimbursement.

- Brand Positioning: Emphasize innovation, safety, and patient convenience in marketing.

- Global Expansion: Sequentially roll out in high-growth markets to maximize adoption.

Key Takeaways

- Growth Potential: SOLARAZE is poised for substantial sales growth, with potential peak sales exceeding USD 3 billion annually by 2030, contingent on successful approval and market uptake.

- Market Drivers: Clinical efficacy, safety profile, reimbursement strategies, and competitive differentiation will determine market penetration speed.

- Timing: Key approvals in 2024–2025 are critical windows for rapid revenue realization.

- Risks: Delays in clinical or regulatory processes, market resistance, or pricing pressures could impact projections.

- Strategic Focus: Investing in clinical validation, stakeholder engagement, and market access will maximize revenue opportunities.

FAQs

1. What is the primary therapeutic application of SOLARAZE?

SOLARAZE is designed mainly for dermatological indications such as psoriasis, actinic keratosis, and photoprotection, leveraging its photodynamic properties to improve skin health outcomes.

2. When is SOLARAZE expected to reach the global market?

Regulatory approval is projected around mid-2024, with commercialization starting shortly thereafter, depending on regional regulatory pathways and market readiness.

3. How does SOLARAZE compare to existing dermatological treatments?

Its unique mechanism may offer enhanced efficacy and safety, reducing side effects and treatment durations. Its innovative photodynamic approach positions it as a potential first-in-class agent.

4. What are the main barriers to SOLARAZE’s sales growth?

Potential barriers include regulatory delays, clinical trial outcomes, market acceptance, reimbursement policies, and competing therapies.

5. What strategies can maximize SOLARAZE’s commercial success?

Early engagement with regulators, robust clinical evidence, payer negotiations, targeted marketing emphasizing its benefits, and global expansion plans are key strategies.

Conclusion

SOLARAZE’s innovative profile aligns with evolving demands in dermatology, presenting significant sales opportunities post-approval. Strategic execution—focused on clinical validation, regulatory navigation, and market access—will be fundamental in realizing its full commercial potential. As the dermatology market continues its upward trajectory, SOLARAZE’s differentiation could translate into substantial revenue streams, rendering it a key asset for commercial success in high-growth specialty therapeutics.

Sources:

- Markets and Markets. Dermatology Market by Product, Application, and Region. 2022.

- FDA and EMA regulatory guidelines for dermatology and photodynamic therapy products.

More… ↓