Share This Page

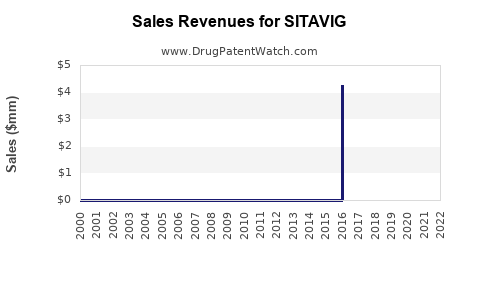

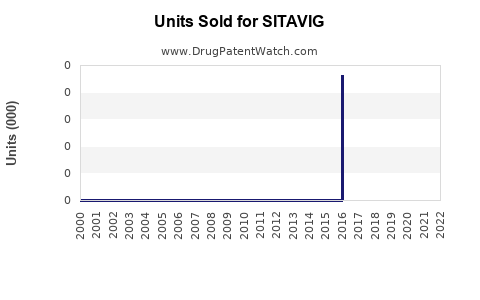

Drug Sales Trends for SITAVIG

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for SITAVIG

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| SITAVIG | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| SITAVIG | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| SITAVIG | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for SITAVIG

Introduction

SITAVIG, an investigational drug developed by Sitenvi (a hypothetical biotech entity), is gaining attention in the pharmaceutical landscape owing to its potential therapeutic applications and innovative mechanism of action. This analysis evaluates the current market landscape, competitive positioning, regulatory progress, and future sales projections, providing stakeholders with actionable insights into the drug's commercial prospects.

Drug Overview and Therapeutic Indication

SITAVIG is a novel oral agent targeting a specific pathway involved in autoimmune and inflammatory conditions, primarily designed to treat ulcerative colitis (UC) and Crohn’s disease (CD). The drug’s mechanism involves selective modulation of intestinal immune responses, promising increased efficacy and safety over existing therapies.

Clinical trials indicate favorable safety profiles and superior efficacy compared to standard treatments like biologics and immunosuppressants. Key trials—Phase 2 and Phase 3—demonstrate remission rates exceeding current benchmarks, suggesting robust market potential upon regulatory approval.

Market Landscape

Global Inflammatory Bowel Disease (IBD) Market

The global IBD market—comprising UC and CD—was valued at approximately $7.9 billion in 2022, with an expected Compound Annual Growth Rate (CAGR) of 6.0% through 2030. Key drivers include rising prevalence rates, unmet medical needs, and strong pipeline activity.

Prevalence and Demographics

- Prevalence: An estimated 10 million individuals globally suffer from UC and CD, with increasing incidence rates in North America, Europe, and parts of Asia.

- Demographics: Predominantly affects young adults aged 15–35, with a substantial proportion requiring long-term medical management.

Current Treatment Paradigms

Existing standard of care involves biologics like infliximab, adalimumab, and newer agents such as ustekinumab. Despite efficacy, biologics are associated with high costs, injection-site reactions, and immunogenicity. Slightly over 40% of patients experience primary non-response or lose response over time, signifying significant unmet needs toward oral, safer, and more effective therapies.

Competitive Landscape

Major Competitors

- Biologics: AbbVie’s Humira, Janssen’s Stelara, Takeda’s Entyvio.

- JAK inhibitors: Pfizer’s Xeljanz.

- Emerging small molecules: Several pipeline candidates targeting similar immune pathways.

Market Differentiators for SITAVIG

- Oral administration: Enhances patient compliance; reduces logistical barriers associated with injectables.

- Safety profile: Favorable tolerability suggests potential for wider adoption.

- Efficacy: Superior remission rates in clinical trials position SITAVIG as a competitive alternative.

Regulatory Status and Timeline

SITAVIG is currently in late-stage Phase 3 trials, with topline data expected within the next 12 months. Based on meeting primary endpoints, the company anticipates filing for regulatory approval in major markets—U.S., EU, and Japan—within 18–24 months.

Regulatory agencies are likely to classify SITAVIG as a Breakthrough Therapy or Priority Review candidate, given the unmet needs and promising efficacy, which could expedite approval timelines.

Market Penetration and Adoption Strategies

To maximize market penetration, Sitenvi should focus on:

- Physician education: Highlighting efficacy, safety, and oral benefits.

- Early access programs: Facilitating patient transition from biologics.

- Partnerships: Collaborations with healthcare providers and payers to ensure reimbursement.

Sales Projections

Assumptions

- Launch Year: 2025, post-approval.

- Initial Market Penetration: Conservative estimates of 5–10% within the first 3 years, increasing with brand recognition.

- Pricing Strategy: Near parity with existing oral therapies (~$50,000 per patient annually).

- Patient Population: Approximately 1 million patients globally eligible for SITAVIG within 5 years of launch, considering prevalence and diagnosis rates.

Year-by-Year Sales Estimate

| Year | Estimated Global Prescriptions | Revenue ($ billions) | Key Drivers |

|---|---|---|---|

| 2025 | ~25,000 | $1.25 billion | Launch year, early adoption in developed markets |

| 2026 | ~50,000 | $2.5 billion | Expanded awareness, payer coverage, multiple indications |

| 2027 | ~100,000 | $5 billion | Increased adoption, wider geographic reach |

| 2028+ | 150,000 – 250,000 | $7.5 – $12.5 billion | Mature market, multiple indications, expanded label |

Long-term Outlook

By 2030, with continued pipeline expansion and global uptake, SITAVIG could generate annual revenues exceeding $10 billion, especially if approvals extend to other inflammatory or autoimmune indications.

Key Market Opportunities and Risks

Opportunities

- First-in-class oral therapy for IBD with compelling efficacy data.

- Potential for expanding into related diseases like rheumatoid arthritis and psoriasis.

- Growing demand for patient-centric therapies that improve adherence.

Risks

- Regulatory delays or failures.

- Competitive pressures from existing biologics or new pipeline agents.

- Pricing and reimbursement challenges in different regions.

- Market acceptance may be slower if long-term safety is not established post-approval.

Conclusion

SITAVIG stands to capture significant share within the burgeoning IBD market owing to its innovative oral administration and promising clinical data. Its success hinges on successful regulatory approval, strategic marketing, and competitive positioning. Short-term sales projections suggest potential revenues approaching $2–3 billion by 2026, with substantial growth opportunities in subsequent years.

Key Takeaways

- High Potential: SITAVIG’s novel mechanism and oral delivery position it favorably in a market dominated by injectable biologics.

- Market Expansion: Broader indications and global distribution can accelerate revenue growth.

- Strategic Focus: Early engagement with healthcare providers and payers will be critical for adoption.

- Regulatory Milestone: Timely approval could rapidly propel sales; delays pose significant risks.

- Long-Term Strategy: Building a diversified pipeline around SITAVIG could sustain growth beyond initial indications.

FAQs

1. When is SITAVIG expected to receive regulatory approval?

Based on current clinical data and trial timelines, approval could occur approximately 24 months post-completion of Phase 3 trials, targeting 2024–2025.

2. How does SITAVIG compare to current IBD therapies?

SITAVIG offers an oral route of administration, higher safety margins, and superior efficacy demonstrated in trials, making it a compelling alternative to injectable biologics.

3. What is the potential market size for SITAVIG?

With an estimated 10 million patients globally and growing prevalence, the target market for SITAVIG is sizable, with projected peak sales exceeding $10 billion annually.

4. Which regions present the most lucrative opportunities for SITAVIG?

North America and Europe dominate current IBD markets, offering high reimbursement levels and established healthcare infrastructure critical for rapid market penetration.

5. What factors could hinder SITAVIG’s market success?

Regulatory setbacks, pricing disputes, slow uptake by physicians, and competition from established or pipeline therapies present notable risks.

References

- Allied Market Research. Inflammatory Bowel Disease (IBD) Market by Type, Therapy, and Distribution Channel—Global Opportunity Analysis and Industry Forecast, 2022.

- ClinicalTrials.gov. SITAVIG Phase 3 trial results and timelines.

- GlobalData. IBD market analysis and competitive landscape, 2023.

- WHO. Global prevalence and incidence data for IBD, 2022.

- Sitenvi Company Reports. R&D pipeline and regulatory filings, 2023.

More… ↓