Last updated: July 27, 2025

Introduction

Rosuvastatin, marketed as Crestor by AstraZeneca, is a prominent member of the statin class of lipid-lowering agents. Approved by the FDA in 2003, it rapidly became a leading choice for managing hypercholesterolemia and preventing cardiovascular disease. As of 2023, the drug maintains a formidable market presence, driven by robust clinical data and expanding indications. This report provides a comprehensive market analysis and sales projection for rosuvastatin, considering current trends, competitive landscape, regulatory impacts, and broader healthcare dynamics.

Global Market Landscape

Market Size and Revenue Overview

The global statin market was valued at approximately $20.4 billion in 2022, with rosuvastatin accounting for a significant share, estimated at over 35%, due to its high efficacy and favorable tolerability profile [1]. North America remains the dominant region, representing nearly 45% of the revenue, followed by Europe and Asia-Pacific, where rising prevalence of hyperlipidemia augments demand.

Market Drivers

- Rising Cardiovascular Disease (CVD) Burden: The International Heart Foundation reports that approximately 19 million deaths annually are attributed to CVD, with hyperlipidemia being a key modifiable risk factor [2].

- Expanding Usage in Primary and Secondary Prevention: Clinical guidelines increasingly endorse statins, particularly rosuvastatin, for both prevention and treatment, expanding its use beyond traditional indications.

- Growing Elderly Population: Aging populations in developed and emerging markets elevate the necessity for lipid management medications.

- Enhanced Efficacy and Safety Profile: Rosuvastatin's potency allows for lower doses and fewer side effects, promoting adherence.

Competitive Dynamics

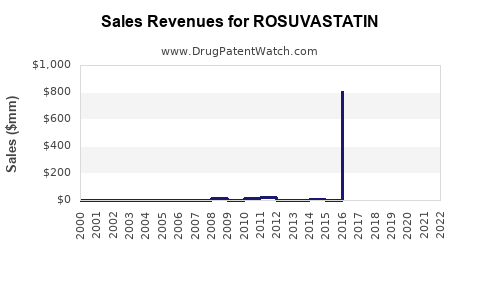

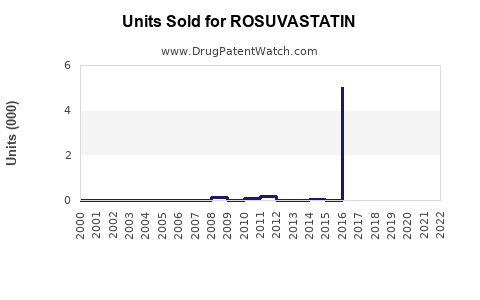

While atorvastatin holds the largest market share, rosuvastatin's newer efficacy profile and favorable pharmacokinetics position it as a preferred option in certain clinical settings. Generic versions of rosuvastatin launched in 2016 have significantly impacted pricing and accessibility, encouraging broader adoption. However, patent considerations and emerging competitors, including PCSK9 inhibitors and novel lipid modifiers, influence the competitive landscape.

Regulatory and Reimbursement Environment

Regulatory agencies worldwide regulate rosuvastatin’s indications, with approvals expanding into pediatric populations and rare indications for specific lipid disorders. Reimbursement policies favor cost-effective therapies, especially generics, which support higher volume sales.

Market Potential and Growth Opportunities

Emerging Markets

China, India, and Latin America offer substantial growth prospects due to increasing cardiovascular risk factors, urbanization, and expanding healthcare infrastructure. The surge in diagnosed hyperlipidemia cases in these regions predicts rising sales of rosuvastatin, especially as pricing barriers diminish through generics.

Innovative Formulations and Combination Therapies

Developments such as fixed-dose combinations of rosuvastatin with ezetimibe have shown to improve patient adherence, offering new revenue streams. Additionally, novel delivery methods, including oral dispersible tablets, can widen patient access.

Upcoming Clinical Trials and Indications

Ongoing research investigating rosuvastatin's role in anti-inflammatory and plaque stabilization effects could unlock new therapeutic niches, potentially extending product lifecycle and sales.

Sales Forecast (2023–2028)

Based on current trends, historical growth rates, and market expansion forecasts, rosuvastatin’s global sales are projected to grow at a CAGR of approximately 5–7% over the next five years, reaching an estimated $8.0–8.5 billion by 2028.

The primary growth drivers include:

- Continued adoption in emerging markets

- Increased use in primary cardiovascular prevention

- Expansion of approved indications and formulations

- Competitive pricing through generics

However, potential headwinds such as market saturation in mature regions and emerging competition from PCSK9 inhibitors could temper growth.

Regional Sales Projections

| Region |

2023 (Approximate) |

2028 (Projected) |

CAGR (%) |

| North America |

$3.2 billion |

$3.8 billion |

4.6 |

| Europe |

$2.2 billion |

$2.5 billion |

3.9 |

| Asia-Pacific |

$1.4 billion |

$2.5 billion |

11.5 |

| Latin America |

$0.8 billion |

$1.4 billion |

12.0 |

| Others |

$0.4 billion |

$0.5 billion |

4.0 |

Note: Figures are approximations based on market analyses, with the most significant growth in Asia-Pacific and Latin America driven by increased access and rising disease prevalence.

Competitive Outlook and Strategic Recommendations

Given the evolving landscape, AstraZeneca’s positioning for rosuvastatin should focus on:

- Accelerating expansion in emerging markets via partnerships and local manufacturing

- Innovating with fixed-dose combination products to bolster adherence

- Monitoring competitor pipelines, notably PCSK9 inhibitors, which target high-risk populations

- Engaging in clinical trials for new indications to extend product lifecycle

Key Challenges

- Price pressures from increasing generic availability

- Competition from novel lipid-lowering agents

- Regulatory hurdles in expanding indications

- Healthcare expenditure constraints in developing regions

Conclusion

Rosuvastatin remains a cornerstone in hyperlipidemia management, with strong sales momentum anticipated through geographic expansion, formulation innovation, and clinical evidence support. While competitive and regulatory challenges persist, the overall growth trajectory remains favorable, especially in underserved regions.

Key Takeaways

- The rosuvastatin market is poised for steady growth, driven by global increases in CVD risk and expanding indications.

- Emerging markets present significant opportunities, with double-digit growth expected due to increasing disease prevalence and healthcare improvements.

- Generics serve as a key growth lever, offering affordability and broad access.

- Strategic focus on combination therapies and novel formulations can enhance adherence and market share.

- Competitive threats from innovative therapies necessitate continuous clinical and commercial innovation.

FAQs

1. What factors contribute to the growing demand for rosuvastatin globally?

Rising cardiovascular disease prevalence, broader clinical guidelines endorsing statins, expanding indications, and demographic shifts toward older populations drive demand.

2. How does rosuvastatin compare to other statins in the market?

Rosuvastatin offers higher potency and fewer side effects at lower doses compared to formulations like atorvastatin and simvastatin, making it suitable for high-risk patients.

3. What regional markets are expected to generate the most sales growth?

Emerging markets in Asia-Pacific, Latin America, and parts of Africa are anticipated to experience the most substantial sales increases, fueled by improving healthcare infrastructure and rising disease burden.

4. How will generic versions impact rosuvastatin’s sales outlook?

Generics have significantly reduced prices, increasing accessibility and volume sales, particularly in mature markets, despite downward pressure on unit prices.

5. What future developments could influence rosuvastatin’s market share?

Advances in lipid management, including PCSK9 inhibitors and gene therapies, alongside new formulations and expanded indications, may reshape competitive dynamics.

References

[1] Grand View Research. "Statins Market Size, Share & Trends Analysis Report." 2022.

[2] World Health Organization. "Cardiovascular Diseases (CVDs) Fact Sheet," 2022.