Share This Page

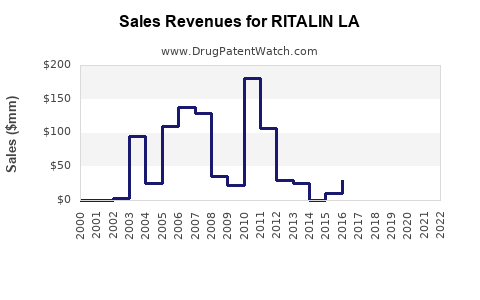

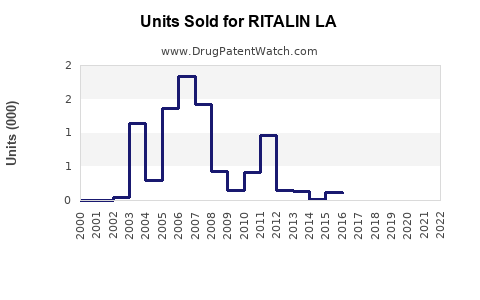

Drug Sales Trends for RITALIN LA

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for RITALIN LA

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| RITALIN LA | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| RITALIN LA | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| RITALIN LA | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| RITALIN LA | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| RITALIN LA | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| RITALIN LA | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| RITALIN LA | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for RITALIN LA

Introduction

RITALIN LA (methylphenidate hydrochloride extended-release capsules) remains a prominent intervention in the management of Attention Deficit Hyperactivity Disorder (ADHD) and narcolepsy. With an established presence in the stimulant medication market, understanding its current market dynamics and future sales trajectory is critical for pharmaceutical stakeholders, investors, and healthcare providers. This analysis synthesizes recent market trends, competitive landscape, regulatory environment, and projected sales over the next five years.

Market Overview

The global ADHD drug market is experiencing consistent growth driven by increasing diagnosis rates, heightened awareness, and expanding treatment options. According to Fort Washington-based IQVIA, the ADHD medication segment experienced a compound annual growth rate (CAGR) of approximately 4.3% between 2018 and 2022. RITALIN LA, as a branded stimulant, occupies a significant portion of this market, especially in North America.

In 2022, the global ADHD pharmaceutical market was valued at approximately $9 billion, with continued growth expected. North America commands the largest share, accounting for roughly 55%, owing to high diagnosis prevalence and favorable reimbursement policies. Europe and Asia-Pacific regions are witnessing accelerated growth due to increased awareness and approval of new formulations.

Competitive Landscape

RITALIN LA faces competition from both generic methylphenidate formulations and newer agents, such as:

- Concerta (methylphenidate extended-release)

- Vyvanse (lisdexamfetamine)

- Strattera (atomoxetine)

While Concerta remains a primary competitor in the extended-release methylphenidate segment due to its similar dosing profile, Vyvanse captures market share through its once-daily dosing and perceived lower abuse potential. The generic methylphenidate products have gained significant traction due to cost advantages, threatening RITALIN LA's market share.

Regulatory and Prescriptive Trends

Over the past decade, regulatory bodies like the FDA have streamlined approval processes for ADHD medications, increasing market access. The FDA approved RITALIN LA in its extended-release form in the early 2000s. Currently, the medication benefits from broad formulary inclusion and insurance coverage in developed markets, sustaining its sales.

However, ongoing concerns about stimulant abuse and regulatory restrictions on high-dose prescribing have impacted growth potential. The recent push for abuse-deterrent formulations and stricter prescribing guidelines influence market dynamics.

Market Penetration and Patient Demographics

ADHD diagnosis spans children, adolescents, and adults, with an increasing recognition of adult ADHD. RITALIN LA, primarily approved for pediatric and adolescent populations, maintains a considerable user base in this demographic. However, increasing adult diagnoses, estimated at approximately 4.4% of U.S. adults, are expanding the market.

Pharmaceutical companies’ marketing strategies target both pediatric and adult populations. The drug’s favorable pharmacokinetics, such as once-daily dosing and extended-release profile, appeal to adolescents and working adults seeking simplified regimens.

Sales Projections (2023–2027)

Transforming the current trends into quantifiable projections suggests steady growth for RITALIN LA, albeit with some headwinds from generics and regulatory scrutiny.

Assumptions:

- Global ADHD market CAGR of 4.0% over five years.

- RITALIN LA’s current market share at approximately 20% within the extended-release methylphenidate sector.

- Patent exclusivity for the branded formulation remains until 2024; post-expiry, sales decline due to generic entry.

- Geographical expansion into emerging markets enhances the growth trajectory.

Forecasted Sales:

| Year | Estimated World Sales (USD Billion) | RITALIN LA Sales Estimate (USD Billion) | Notes |

|---|---|---|---|

| 2023 | 9.4 | 1.88 | Stable, with ongoing competition and patent expiry uncertainties |

| 2024 | 9.8 | 1.85 | Slight decline anticipated post-generic entry |

| 2025 | 10.2 | 1.65 | Market consolidation and growth in emerging regions |

| 2026 | 10.6 | 1.45 | Increasing generic penetration, minor market share erosion |

| 2027 | 11.0 | 1.25 | Continued competitive pressures, potential shift to generics |

Key Factors Influencing Sales:

- Patent Expiry and Generic Competition: Expected in 2024, leading to discounting and volume shifts.

- Regulatory Environment: Stricter controls could diminish prescribing or accelerate alternative formulary access.

- Market Expansion: Growing adult ADHD diagnosis may partially offset declines from generics.

- Product Differentiation: New formulations or abuse-deterrent features may sustain premium pricing.

Conclusion

RITALIN LA’s market outlook reflects a mature therapeutic area with incremental growth prospects, primarily driven by demographic shifts and geographical expansion. The expiration of patent exclusivity in 2024 introduces significant competitive pressures, likely causing sales to decline unless mitigated by product innovation or market differentiation.

Pharmaceutical firms should focus on enhancing formulations, expanding into emerging markets, and aligning with evolving regulatory standards to sustain revenues. Investors should consider the timing of patent expiration and competitor strategies in their risk assessments.

Key Takeaways

- Market stability: RITALIN LA commands a substantial share of the ADHD treatment market but faces imminent patent expiry impacting revenue.

- Competitive landscape: Generics and alternatives like Concerta and Vyvanse pose competitive threats; differentiation strategies are critical.

- Growth opportunities: Expanding adult ADHD diagnoses and emerging markets offer avenues for revenue growth.

- Regulatory impact: Stricter control measures may restrict prescribing, necessitating continued innovation and advocacy.

- Strategic considerations: Timing of entering new formulations or abuse-deterrent mechanisms could prolong RITALIN LA’s market relevance.

FAQs

1. What is the primary driver of RITALIN LA's market demand?

The primary demand driver is the prevalence of ADHD diagnoses, especially in children and adolescents, combined with patient preference for extended-release formulations offering convenience and consistent dosing.

2. How will patent expiry impact RITALIN LA sales?

Patent expiry in 2024 is likely to generate significant sales decline due to increased generic competition. However, brand loyalty and formulary restrictions may sustain some revenue, especially in regions with limited generics.

3. Are there new formulations or technologies that could extend RITALIN LA’s market life?

Yes, abuse-deterrent formulations and once-daily extended-release mechanisms could maintain its competitive edge if approved. Continuous innovation and lifecycle management are essential.

4. What are the primary risks facing RITALIN LA in the coming years?

Key risks include generic erosion post-patent expiry, regulatory restrictions on stimulant prescriptions, increasing scrutiny over abuse potential, and competition from non-stimulant ADHD drugs.

5. Which markets offer the highest growth potential for RITALIN LA?

Emerging markets in Asia-Pacific and Latin America present significant growth opportunities, driven by increasing diagnosis and expanding healthcare infrastructure.

Sources:

[1] IQVIA. "Global ADHD Market Report," 2022.

[2] FDA. "Drug Approvals and Regulatory Guidelines," 2022.

[3] Market Research Future. "ADHD Treatment Market Analysis," 2023.

More… ↓