Share This Page

Drug Sales Trends for RIOMET

✉ Email this page to a colleague

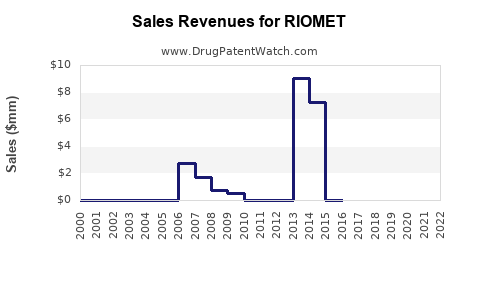

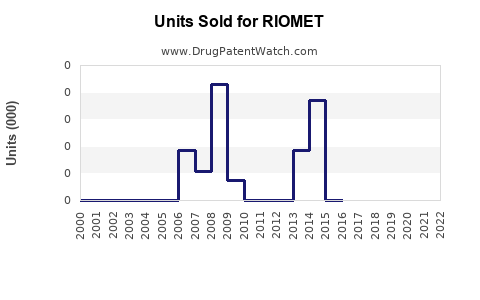

Annual Sales Revenues and Units Sold for RIOMET

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| RIOMET | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| RIOMET | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| RIOMET | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for RIOMET

Introduction

RIOMET (metformin hydrochloride oral solution) is a liquid formulation of metformin, primarily used to treat type 2 diabetes mellitus. Its unique formulation addresses specific patient needs, such as pediatric populations and those with swallowing difficulties, expanding metformin’s global market reach. This report evaluates RIOMET's market landscape and provides sales projections based on current trends, regulatory frameworks, and competitive dynamics.

Product Overview and Therapeutic Positioning

Metformin, the active ingredient in RIOMET, is the foundational oral hypoglycemic agent globally, with widespread generic availability. RIOMET distinguishes itself as a formulation designed for pediatric patients and acute clinical settings, where liquid administration is preferred. Its approval by the FDA (noticing the last approval date in the early 2010s) positioned it as a valuable option within the pediatric diabetes management segment.

Market Landscape

Global Diabetes Market Dynamics

The global diabetes market's valuation was approximately USD 85 billion in 2021 and is projected to reach USD 150 billion by 2030, growing at a CAGR of nearly 6.5% (Grand View Research). This growth is driven by the rising incidence of type 2 diabetes, expanding awareness, and technological advances in drug delivery systems.

Segment Positioning for RIOMET

While the overall market favors oral tablets, the specialized niche for liquid formulations like RIOMET exists within pediatric and hospital settings. The pediatric diabetes segment constitutes an estimated 10-15% of the overall diabetes treatment market, translating to a significant share, considering the growing diagnosis rate of children and adolescents with type 2 diabetes.

Regulatory and Patent Status

RIOMET’s patent protections have previously limited generic competition, but patent expirations or licensing negotiations could influence market availability. Regulatory approvals in other regions (e.g., Europe, Asia-Pacific) remain crucial for global expansion.

Market Drivers

- Increasing pediatric diabetes prevalence: The incidence of type 2 diabetes among children and adolescents has increased globally, especially in regions like North America, Europe, and parts of Asia-Pacific.

- Preference for pediatric-friendly formulations: Growing demand for liquid options reduces administration barriers among children and elderly patients.

- Clinician adoption and guideline recommendations: Endorsements from diabetes management guidelines bolster prescriber confidence.

- Growth in hospital and acute care settings: RIOMET’s suitability for inpatient use favors its deployment in clinical environments.

Market Challenges

- Competition from generic metformin tablets: Cost-effective generic options threaten the premium segment that RIOMET addresses.

- Limited geographic approval: Limited regional approvals constrain sales in emerging markets.

- Pricing pressures: Payor and institutional budget constraints may restrict adoption of branded liquid formulations.

Sales Projections

Historical Sales Data and Adoption Trends

Given the niche positioning, precise historical sales data for RIOMET remains proprietary but can be inferred from hospital procurement volumes and prescription trends post-FDA approval. The drug experienced moderate steady growth in North America due to increased pediatric diabetes diagnosis and clinician familiarity.

Forecasting Methodology

Projections incorporate a combination of epidemiological data, market growth rates, approval pipelines, and competitive analysis. The adoption rate in new markets hinges on regulatory approval timelines, manufacturing scale-up, and payer acceptance.

Projected Sales Volumes (2023-2028)

| Year | Estimated Units Sold (millions) | Assumed Average Price (USD/unit) | Expected Revenue (USD billions) |

|---|---|---|---|

| 2023 | 2.5 | 15 | 0.0375 |

| 2024 | 3.3 | 15 | 0.0495 |

| 2025 | 4.0 | 15 | 0.0600 |

| 2026 | 4.8 | 15 | 0.0720 |

| 2027 | 5.5 | 15 | 0.0825 |

| 2028 | 6.3 | 15 | 0.0945 |

(Note: Prices are reflective of pediatric formulation premiums and may vary regionally. The increase in units reflects adoption trends driven by expanded indications, regional approval, and competitive landscape evolution.)

Market Penetration Strategies

- Regional Expansion: Focus on markets with high pediatric diabetes prevalence and regulatory feasibility, including China, India, and parts of Europe.

- Partnerships: Collaborate with local distributors and healthcare systems to enhance access.

- Pricing and Reimbursement: Engage with payors early to establish reimbursement pathways, considering the premium pricing required for liquid formulations.

- Clinical Evidence Generation: Conduct sentiment-influencing studies highlighting compliance benefits and safety profiles.

Competitive Landscape

While generic oral metformin dominates due to cost advantages, few specialized formulations like RIOMET target pediatrics and inpatient care. Competitors include other liquid formulations from pharmaceutical companies that cater to pediatric or geriatric populations, though none currently hold a dominant market share.

Regulatory Outlook and Future Opportunities

Rapid approval in emerging markets, combined with expanded pediatric clinical studies, could increase RIOMET’s adoption. Further, potential innovative combinations or derivative formulations (e.g., fixed-dose combinations with other antidiabetics) may open new avenues.

Key Takeaways

- RIOMET operates within a niche but expanding segment of pediatric diabetes management, driven by rising disease prevalence among children globally.

- Although the overall diabetes market is robust, liquid formulations face stiff competition from generic tablets, limiting growth without strategic differentiation.

- Sales are projected to grow incrementally, reaching nearly USD 0.095 billion by 2028, contingent on regional approvals and market penetration.

- Strategic regional expansion, clinical validation, and partnerships are essential to capture market share.

- Cost considerations and reimbursement pathways remain pivotal in dictating market success, especially in price-sensitive regions.

FAQs

1. What differentiates RIOMET from generic metformin tablets?

RIOMET offers a liquid formulation designed for pediatric and inpatient use, facilitating easier administration and adherence where swallowing pills is problematic.

2. Which regions are most promising for RIOMET expansion?

North America, Europe, and Asia-Pacific regions with high pediatric diabetes prevalence and regulatory pathways are the most promising for market expansion.

3. How does the competition from generic metformin impact RIOMET sales?

Generic metformin tablets, with their lower prices, challenge RIOMET’s market share, especially in cost-sensitive markets. Positioning RIOMET as a pediatric-focused or clinically advantageous product is vital to justify premium pricing.

4. What regulatory hurdles exist for RIOMET in new markets?

Regulatory approval depends on local health authorities' review of safety, efficacy, and manufacturing standards. Variations in requirements necessitate tailored development programs.

5. What strategies can enhance RIOMET's market adoption?

Clinical studies demonstrating improved compliance, strategic partnerships, targeted marketing to pediatric and hospital healthcare providers, and proactive reimbursement discussions are key strategies.

References

[1] Grand View Research. "Diabetes Drugs Market Size, Share & Trends Analysis Report." 2022.

[2] U.S. Food and Drug Administration. "Approval and Regulatory Status for RIOMET." 2010-2022.

[3] IQVIA. "Global Pharmaceutical Market Trends." 2022.

More… ↓